آئی این پی ویلتھ پی کے

Shams ul Nisa

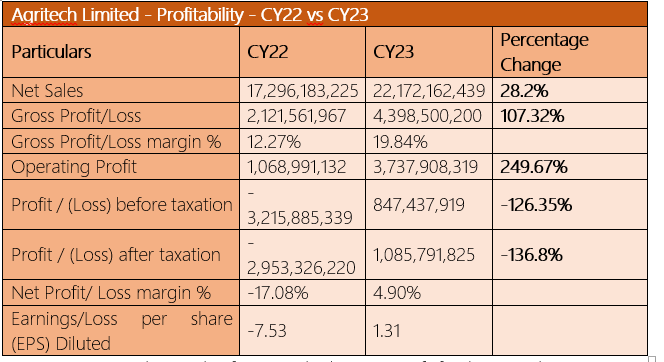

Agritech Limited posted a net profit of Rs1.08 billion at the end of the Calendar Year 2023, compared to a net loss of Rs2.95 billion in CY22, representing a surge of 136.8%, report WealthPK.

At the end of CY23, high prices of fertilizer and continuous operation of the plant due to the availability of raw materials pushed the net sales to expand by 28.2% to stand at Rs22.17 billion. This demonstrates that the company effectively navigated inflationary and cost challenges during the period. Thus, the gross profit margin rose to 19.84% in CY23 from 12.27% in CY22. The company attributed this increase to process optimization, efficient resource management, cost control measures, and a favorable trend in the fertilizer prices.

The increase in sales and economies in production and selling expenses caused an increase of 249.67% in the operating profit to Rs3.73 billion in CY23 against 1.06 billion in CY22. The company secured a profit before tax of Rs847.43 million compared to a loss before tax of Rs3.21 billion in CY22, up 126.35% yearly. Furthermore, a net profit margin of 4.90% was recorded in CY23 against a net loss margin of 17.08% in CY22, mainly driven by a hike in the fertilizer selling prices, gain on restructuring, and higher returns on investments. During CY23, the company managed to generate a profit of Rs1.31 for its shareholders compared to a loss per share of Rs7.53 in CY22.

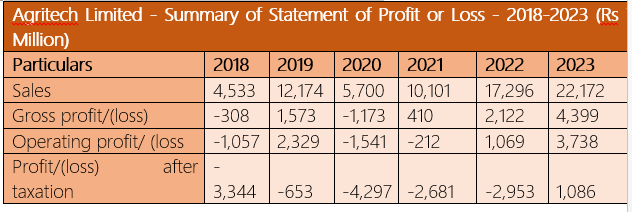

Summary of statement of profit or loss

The company posted Rs22.17 billion as revenue in 2023 – the highest in six years. The company expanded from Rs4.53 billion in 2018, primarily attributed to increased sales and successful absorption of inflationary and cost-related impacts. Starting from a gross loss of Rs308 million in 2018, the company demonstrated a steadfast ability to improve its gross profitability to a notable Rs4.3 billion in 2023. The driving factors include a favorable trajectory of fertilizer prices, optimization of processes, and cost economization throughout the period.

During the six years, the company suffered an operating loss of Rs1.05 billion in 2018, Rs1.54 billion in 2020, and Rs212 million in 2021. However, its profit increased to an impressive Rs3.73 billion in 2023 mainly due to the adjustments made in respect of a scheme worth Rs3.2 billion in 2023. In the Financial Year 2023, the company posted a net profit of Rs1.08 billion for the first time in the last six years. This notable achievement was attributed to an improvement in the operating profit margin. The company incurred a net loss of Rs3.3 billion in 2018 compared to a net profit of Rs1.08 billion in 2023.

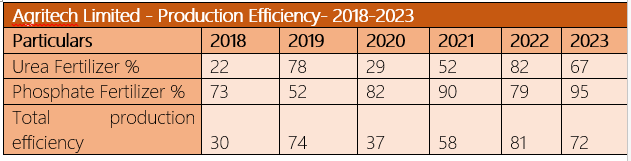

Production Efficiency

The company's urea fertilizer production efficiency increased from 22% in 2018 to 67% in 2023. During 2023, the company produced 292K tons of urea compared to 353K tons in 2022. However, the urea segment performed better in 2023 due to the efficient utilization of resources, energy efficiency initiatives, and better urea prices despite lower production from the last year due to the lower gas supply. The company’s highest urea production efficiency of 78% over the previous six years was recorded in 2019.

The phosphate fertilizer production efficiency over the six years grew significantly from 73% in 2018 to the highest of 95% in 2023. Production of phosphate fertilizer increased from Rs1,359 million in 2022 to Rs1,891 million in 2023. This was largely attributed to better sales volumes and cost-control measures. In 2019, the company witnessed the lowest production efficiency of 52%. Overall, the company’s total production efficiency expanded from 30% in 2018 to 72% in 2023.

Future outlook

Economic challenges such as the persistently high inflation rates and currency devaluation, alongside the absence of coherent fiscal strategies, need government intervention to initiate remedial actions. Additionally, the gas supply to the fertilizer plant is likely to be challenging, requiring the government’s intervention to tackle any gas supply shortage. As the urea demand will likely keep rising in the foreseeable future, there will be a strong need for fertilizers including both urea and phosphate.

Company’s profile

Agritech Limited was established in Pakistan on 15 December 1959. Its primary activity is the production, sale, and marketing of fertilizers, mainly including urea and granulated single super phosphate fertilizers.

Credit: INP-WealthPk