INP-WealthPk

Shams ul Nisa

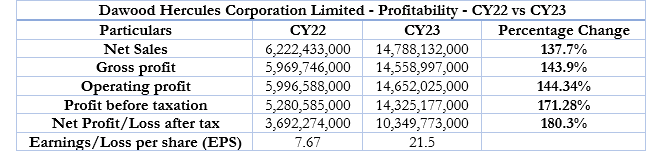

The Dawood Hercules Corporation Limited ended the calendar year 2023 with a remarkable surge of 137.7% in net sales to Rs14.78 billion, compared to Rs6.22 billion in CY22, reports WealthPK. During the same period, the company posted 143.9% growth in gross profit and 144.34% in operating profit year-on-year. In CY23, Dawood Hercules Corporation Limited earned a total net sale of Rs114.55 billion and an operating profit of Rs14.65 billion.

The profit before tax stood at Rs14.32 billion in CY23, up by 171.28% from Rs5.28 billion in the same period last year. At the end of CY23, the company managed to earn a hefty amount of Rs10.34 billion as net profit compared to Rs3.69 billion in CY22, representing a massive spike of 180.3%. Thus, the high-profit generation in CY23 pushed the earnings per share of the company to Rs21.5 from Rs7.67 in CY22.

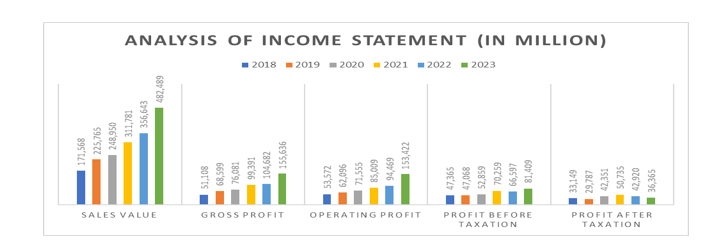

Analysis of income statement

From 2018 to 2023, the company's sales value, gross profit, and operating profit followed an increasing trend. The sales value stood at Rs171.5 billion in 2018 and rose over the years, reaching the highest of Rs482.48 billion in 2023. Likewise, the company's gross profit expanded to Rs155.6 billion in 2023 from Rs51.1 billion in 2018. Furthermore, its operating profit was registered at Rs53.57 billion in 2018, and moved up massively to Rs153.42 billion in 2023.

However, the profit before tax grew overall but witnessed two dips over the years. Starting from Rs47.36 billion in 2018, the profit before tax contracted marginally to Rs47.06 billion in 2019, but increased hereafter to Rs70.25 billion in 2021. It again then fell to Rs66.59 billion in 2022 before reaching the highest at 81.4 billion in 2023. The profit after tax demonstrated a marginal overall growth from 2018 to 2023. The company posted the highest value of Rs50.7 billion in 2021, which kept on declining in 2022 and 2023 with values of Rs42.9 billion and Rs36.36 billion.

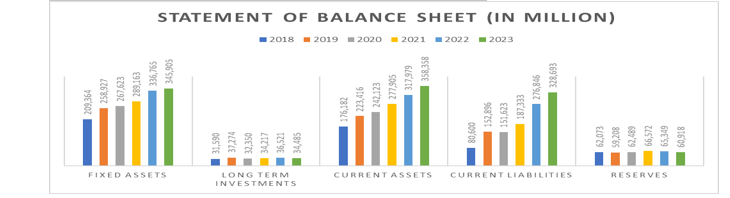

Analysis of the balance sheet

The company’s fixed assets kept on growing to Rs345.9 billion in 2023, from Rs209.36 billion in 2018. However, its long-term investments fluctuate over the years, with two dips in 2020 and 2023 leading to values of Rs32.35 billion and Rs34.48 billion. This indicates that in 2023 the company’s long-term investments such as stocks, bonds, real estate, and cash have declined compared to the previous year. The company observed the highest long-term investment of Rs37.27 billion in 2019. Its current assets, such as cash, accounts receivable, and inventories climbed to Rs358.35 billion in 2023, from Rs176.18 billion in 2018, reflecting the stable liquidity position of the company.

The current liabilities of the company increased overall from the lowest value of Rs80.6 billion in 2018 to the highest obligation of Rs328.69 billion in 2023. However, in 2020 the company witnessed a slight dip to Rs151.6 billion. Dawood Hercules Corporation Limited’s reserves fluctuate slightly over time, with the highest reserves of Rs66.57 billion recorded in 2021, and the lowest value of Rs59.2 billion in 2019.

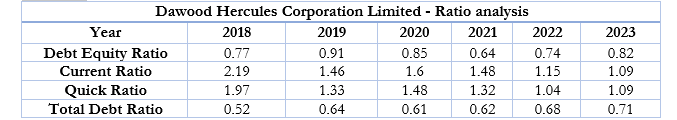

Ratio analysis

The company’s debt-equity ratio remained below 1 from 2018 to 2023, indicating lower financial risk as the company possesses more shareholder's equity than liabilities. During the six years, the ratio peaked at 0.91 in 2019 and the minimum ratio of 0.64 in 2021. The current ratio measures a company’s ability to use its current assets to cover its short-term obligations. The Dawood Hercules Corporation Limited's current ratio remained above 1 during the review period, showcasing a stable liquidity position.

Similarly, the quick ratio followed the same pattern as the current ratio, indicating the stability of the company to cover its liabilities, remained above 1 over the years. The total debt ratio measures the total liabilities to total assets. A ratio greater than 1 shows a high risk of covering liabilities and more lesser value than 1 shows low leverage and risk. The company's quick ratio reflects a stable debt ratio over the years 2018 to 2023 as it lies below 1.

Future Outlook

The company is optimistic to perform better regardless of macroeconomic challenges in the country. Pakistan's economy is under constant strain, most likely as a result of high taxes, high interest rates, and inflation. Although the government's efforts are praiseworthy, restoring investor confidence will need long-term structural changes such as widening the tax net and discouraging capital flight to unproductive sectors.

Company Profile

Dawood Hercules Corporation Limited was established in1968 as a public limited company. The principal activity of the company is to manage investments including in its subsidiaries and associated companies.

Credit: INP-WealthPk