INP-WealthPk

Shams ul Nisa

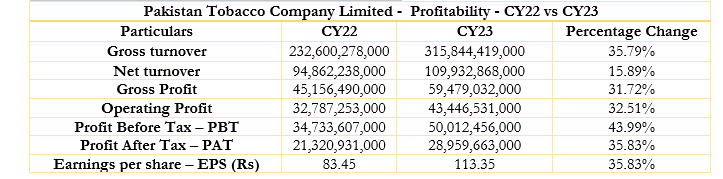

Pakistan Tobacco Company Limited's annual report for the calendar year 2023 showed a growth of 35.79% in gross profit, 15.89% in net turnover, and 35.83% in net profit, compared to the calendar year 2022. This was made possible by the company’s consistent efforts to improve production efficiencies, such as updating the machinery footprint and implementing best practices from around the world. In addition, the company focused on increasing the yield of leaf crops, efficiently allocating resources for trade and distribution, and maximizing customer retention.

During the period, the company registered a gross profit of Rs59.47 billion, up 31.72%. The company's efficient forex liability management assists in mitigating the impact of devaluation during the calendar year 2023. The tobacco company exported products worth $48 million during the period. Furthermore, its operating profit rose 32.51% to Rs43.44 million in CY23. The company’s effective cost management and efficient business operation added to a higher profit after tax, which was translated into an EPS of Rs113.35 in CY23 compared to Rs83.45 in CY22.

Profitability ratios analysis

Over the years, the company’s gross profit continued to widen with a slight dip in 2021 and 2022. From 44% in 2018 to a peak of 54.1% in 2023, the company managed to improve its costs. Additionally, the net profit followed a similar track, moving from 20% in 2018. The company’s net profit slipped to 25.2% in 2021 and 22.2% in 2022, due to a decline in overall sales volume coupled with a high cost of sales and increased inflation. The company came back with an upward swing to 26.3% in 2023.

The EBITDA margin-to-sales ratio showed a significant improvement from 2018 to the highest of 41.5% in 2023, with a single dip to 36.3% in 2021. The upward trajectory of the ratio reflects higher profit generations from the company's core operations. The company's operating leverage ratio remained concerning in 2019, 2020, and 2022, with a value above 1. This implies that the company had lower operating income and sales volume to cover it costs. However, in 2023 the company recorded a stable operating leverage ratio of 0.9%. During the period under review, the return on equity ratio remained stable overall with an initial increasing track from 2018 to a peak of 100.6% in 2021. The return on equity ratio witnessed a decreasing path from 95.6% in 2022 to 74.2% in 2023.

Analysis of liquidity ratios and capital structure ratios

The company’s current ratio has remained stable over the years, reflecting ample assets owned by the company to cover its liabilities. The company witnessed a significant improvement in the current ratio from 1.40 in 2018 to a peak of 1.60 in 2023. The quick ratio measures the ability to pay short-term debts with current assets excluding inventory. The ratio has been less than 1 over the years, but improved in the recent year 2023, reaching a high of 0.70 compared to the lowest of 0.30 in 2019.

![]()

The interest cover ratio is the earnings before interest and taxes (EBIT)to the interest rate on the company's outstanding debts. The ratio has shown a stable pattern over the years. However, it decreased overall from the highest ratio of 452.70 in 2018 to the lowest of 81.90 in 2023.

Tobacco Sector

Regarding market capitalization, Pakistan Tobacco Company had the highest outstanding share worth Rs271.84 billion in the tobacco sector. The Khyber tobacco company has a total of Rs1.83 billion outstanding shares. Similarly, the net profit for PAKT stood at Rs28.9 billion and KHTC at Rs1.99 billion. However, the EPS for KHTC led the sector with a value of Rs288.68, followed by PAKT with an EPS of Rs113.25 in 2023.

![]()

Company’s profile

Pakistan Tobacco Company Limited was established in Pakistan in 1947. The company’s core activities include the manufacturing and sales of cigarettes or tobacco.

Credit: INP-WealthPk