INP-WealthPk

Shams ul Nisa

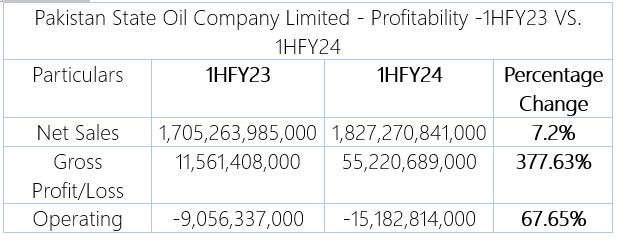

The Pakistan State Oil Company Limited (PSO) witnessed a robust growth of 330.6% in net profit at the end of the first half of the Fiscal Year 2024, reports WealthPK. As per the unconsolidated report of the company for 1HFY24, it earned a net profit of Rs7.74 billion compared to a net loss of Rs3.36 billion compared to the corresponding period last year. The company earned a whopping amount of Rs1.82 trillion in net sales in 1HFY24 compared to Rs1.7 trillion in 1HFY23, representing a 7.2% growth.

Likewise, an exponential surge of 377.63% in gross profit was registered during the review period. The operating costs expanded to Rs15.18 billion in 1HFY24, showcasing an increase of 67.65%. Thus, the company earned a hefty amount of Rs51.14 billion as operating profit, 322.28% higher than the Rs12.11 billion in 1HFY23.

The high profitability lifted the earnings per share to Rs16.51 in 1HFY24 from a loss per share of 7.16% in 1HFY23. This significant performance during the period resulted from increased gasoline sales and higher market share in both the white oil and diesel markets. Additionally, to improve capacity and reliability, the company works on infrastructure development by establishing new storage in different cities in the country.

Quarterly analysis

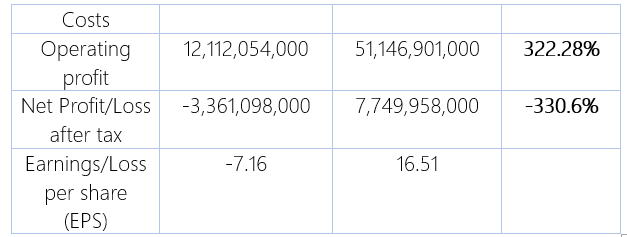

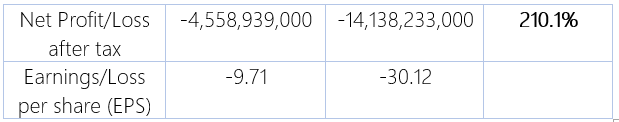

The quarterly analysis of the company provides concerning financial results, with the global economic downturn putting pressure to reduce the oil prices. During the period, the addition of 210.1% in net loss was observed, constituting a net loss of Rs14.13 billion compared to a net loss of Rs4.55 billion in 2QFY23.

However, the net revenue climbed from Rs842.99 in 2QFY23 to Rs907.18 billion in 2QFY24. The company witnessed an operating loss of Rs1.55 billion in 2QFY24 compared to an operating profit of Rs3.54 billion in 2QFY23. The loss per share further worsened to Rs30.12 during the review period against a loss per share of Rs9.71 in 2QFY23.

Profitability ratios analysis

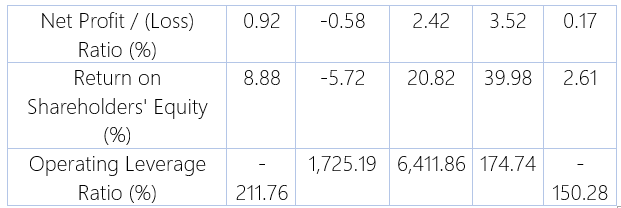

The company's gross profit remained volatile over the years, starting from 3.12% in 2019. It reduced to 1.10% in 2020 before reaching a peak of 6.57% in 2022. However, in 2023, it slipped to 2.21% due to an unfavourable price regime and a decrease in the sales volumes of the overall sector. The net profit fluctuated over the period, as the company witnessed a net loss ratio of 0.58% in 2020, resulting from the economic implications of COVID-19, and the highest net profit of 3.52% in 2022. A similar trend was followed by the returns of shareholders equity ratio as it ranged between negative returns of shareholders equity of 5.72% in 2020, and the maximum return of 39.98% in 2022.

![]()

The operating leverage ratio measures the ratio between fixed and variable costs. A company with a higher operating leverage ratio is capital-intensive. The company's operating leverage remained negative in 2019 but turned positive in the subsequent years before turning negative again in 2023.

Liquidity ratios analysis

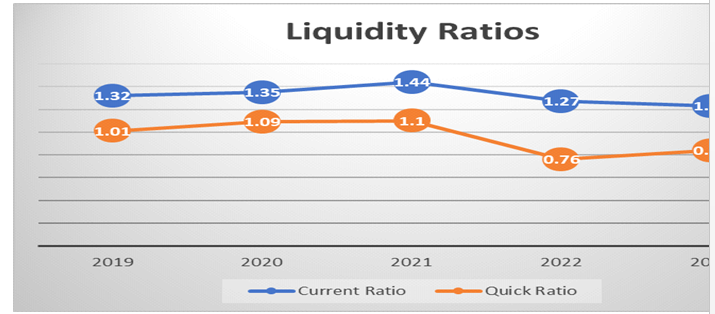

The current ratio remained above 1.2 over the years, indicating a positive liquidity position. This means the company can easily cover its current liabilities using the current assets. The quick ratio was quite stable over the period, ranging from 0.76 to 1.1, but reduced overall from 1.01 in 2019 to 0.84 in 2023.

Oil and Gas Marketing Companies Sector Analysis

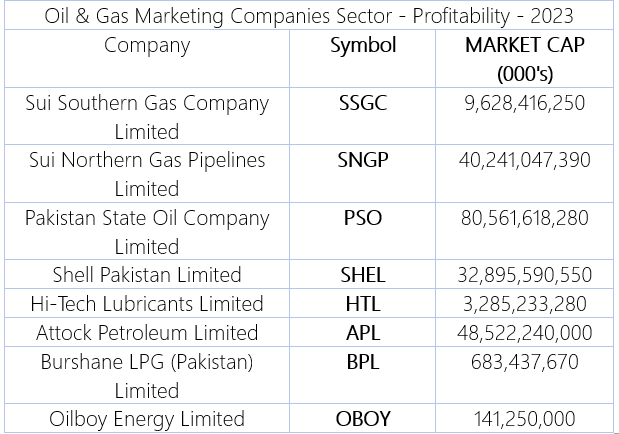

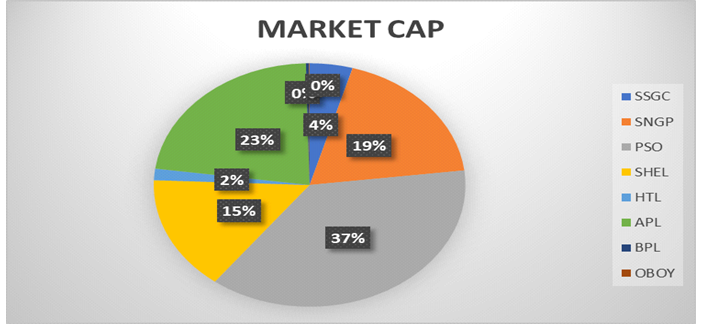

We have taken the market capitalization of the companies to analyze the oil & gas marketing companies sector. The market capitalization measures the worth of a company by the total market value of all outstanding shares. In the oil & gas marketing companies sector, the Pakistan State Oil Company Limited is leading the sector with 37% of the total outstanding shares followed by 23% of the market capitalization by the Attock Petroleum Limited and 19% by the Sui Northern Gas Pipelines Limited.

Company profile

The PSO is a public company established in Pakistan in 1976. The principal activities of the company are procurement, storage and marketing of petroleum and related products. Additionally, it operates various kinds of lubricating oils.

Credit: INP-WealthPk