INP-WealthPk

Shams ul Nisa

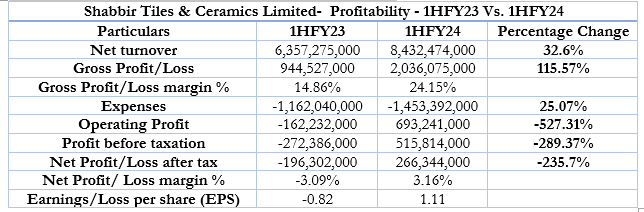

The Shabbir Tiles & Ceramics Limited reported an outstanding growth of 235.7% in net profit in the first half of the ongoing fiscal year 2024, compared to a net loss of Rs196.3 million in 1HFY23, reports WealthPK. The net turnover reached Rs8.43 billion in 1HFY24, 32.6% higher than Rs6.35 billion in 1HFY23. The company's gross profit grew significantly by 115.57%, resulting in a higher gross profit margin of 24.15% in 1HFY24 compared to 14.86% in 1HFY23. The factors that pushed this rise in net margins include the better product mix and the repricing of products.

Persistent inflationary pressures have amplified input costs, squeezing overall profitability. Moreover, the hike in gas and electricity tariffs has driven up expenses, encompassing selling and distribution costs, administrative outlays, and provisions for expected credit losses, which have climbed to Rs1.45 billion in the first half of FY24. This represents a 25.07% increase from Rs1.16 billion in the corresponding period of FY23.During 1HFY24, the company witnessed an exponential surge of 527.31% in operating profit, securing an operating profit of Rs693.24 million compared to an operating loss in the same period last year. As a result, the profit before taxes climbed to Rs515.8 million in 1HFY24, 289.37% more than a loss before tax of Rs272.38 million in 1HFY23. At the end of 1HFY24, the company improved its net profit margin to 3.16% and earnings per share to Rs1.11 compared to a net loss margin of 3.09% and loss per share of Rs0.82 in 1HFY23.

Assets Analysis

![]()

Shabbir Tiles & Ceramics Limited's non-current assets were reduced by 6.25% to Rs3.5 billion at the end of December 2023, due to decreased property, plant and equipment, investment property, and right-of-use assets by the company. However, the company's current assets grew by 9.23%, which offsets the decline in non-current assets, resulting in a growth of 2.68% in total assets to Rs9.08 billion in December 2023. This was because of an increase in stores and spare parts, stock in trade, trade debts, loans, and advances.

Equity and Liabilities Analysis

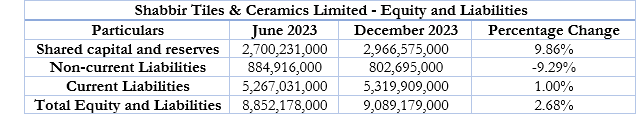

The company's reserves and shared capital for December 2023 were Rs2.966 billion, marking a 9.86% increase from Rs2.7 billion in June 2023. Nonetheless, non-current liabilities fell by 9.29% to Rs802.6 million in December 2023, because the company offset its lease liability against right-of-use assets and deferred income. Gas infrastructure development cess (GIDC) payables were also settled during the review period. However, the company's current liabilities increased slightly to Rs5.3 billion in December 2023, a 1.0% increase. Thus, the overall equity and liabilities of the corporation increased by 2.68%.

Historical Analysis

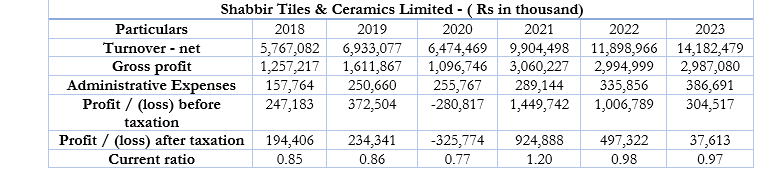

The company’s historical financial trend reveals a trajectory of growth over the years. The net turnover saw a steady rise from Rs5.7 billion in 2018 to Rs6.9 billion in 2019, followed by a slight dip to Rs6.4 billion in 2020. Notably, a strategic shift towards higher-margin products and cost-efficiency propelled the revenue to an all-time high of Rs14.1 billion in 2023.Although the gross profit varies over the years, it increased from Rs1.25 billion in 2018 to Rs2.98 billion in 2023. In contrast, administrative expenses continue to grow with time, reaching a maximum of Rs386.6 million in 2023, due to the restrictions on imported raw materials and the persistent rise in inflation.

Between 2018 and 2023, the company's profit before tax climbed from Rs247.1 million to Rs304.5 million. Nonetheless, a loss of Rs280.8 million was reported in 2020, and the largest profit before taxes of Rs1.44 billion was observed in 2021. The net profit declined substantially from Rs194.4 million in 2018 to Rs37.6 million in 2023, with a net loss of Rs325.7 million in 2020. The current ratio remained below 1 over the years, except for a current ratio of 1.20 in 2021.

Future outlook

The company urged the government to realize the crucial role of the construction sector in economic growth and employment generation. Additional pledge to re-consider the cross-subsidy of gas tariffs to help smooth working.

Company Profile

Shabbir Tiles and Ceramics Limited was established in Pakistan in 1978. The Company is primarily engaged in the manufacture and sale of tiles and trading of allied building products.

Credit: INP-WealthPk