i NEWS PAK-CHINA

Pakistan’s local mobile phone manufacturing and assembling sector continued its rapid expansion in 2025, while commercially imported handsets dropped sharply, Gwadar Pro reported quoting new data released by the Pakistan Telecommunication Authority (PTA). The regulator’s latest Mobile Device Manufacturing indicators show that local assembly and manufacturing reached 30.21 million units in 2025, compared with just 2.37 million commercially imported phones, underscoring a decisive shift toward domestic production.

The PTA’s data suggests that Pakistan’s handset ecosystem has undergone a structural transformation over the past decade. Local manufacturing rose from just 0.29 million units in 2016 to 1.72 million in 2017, 5.2 million in 2018, and 11.74 million in 2019, before accelerating to 13.05 million in 2020 and 24.66 million in 2021.

Output remained above 21 million units in both 2022 and 2023, surged to a record 31.38 million in 2024, and eased slightly to 30.21 million in 2025, while commercial imports collapsed from more than 21 million units in 2016 to near historic lows in recent years The figures mark another milestone for Pakistan’s import-substitution drive. As recently as 2020, commercial imports stood at more than 24 million units, while local manufacturing was limited to about 13 million.

By 2021, domestic output had overtaken imports, and the gap has widened steadily since then. The trend reflects the combined impact of PTA’s Mobile Device Manufacturing (MDM) regulations, tighter controls under the Device Identification Registration and Blocking System (DIRBS), and incentives aimed at encouraging global brands to assemble devices locally.

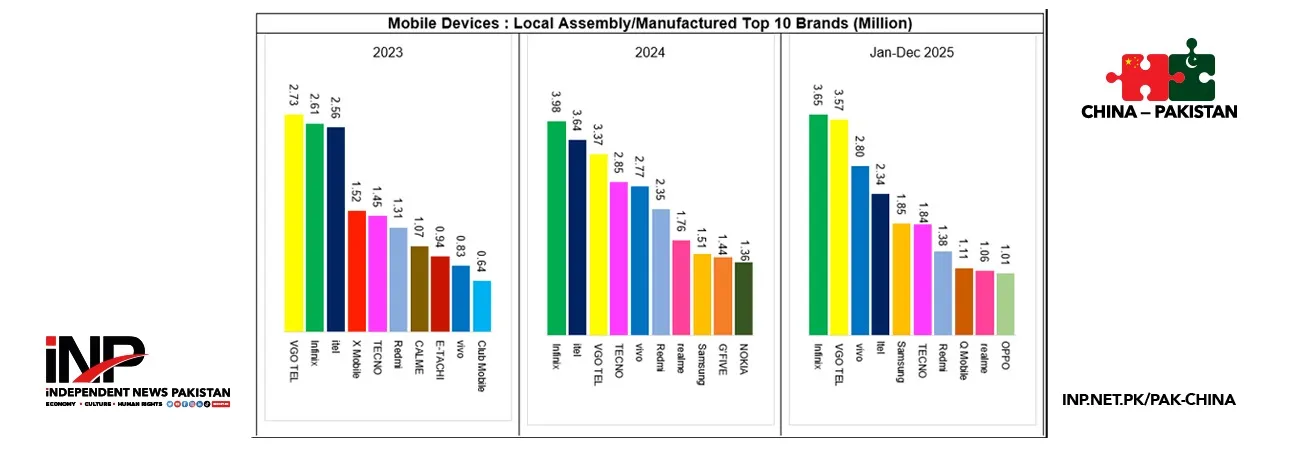

Chinese brands dominate Pakistan’s locally manufactured handset market. PTA’s latest “Top 10 Brands” charts show Transsion Holdings’ Infinix leading local production in 2025 with about 3.65 million units, followed closely by Vivo at roughly 2.8 million units, while other Chinese-backed brands such as itel, Tecno and Xiaomi’s Redmi line also feature prominently among the top assembled devices.

Collectively, Chinese manufacturers account for a substantial share of Pakistan’s locally produced smartphones, highlighting their central role in the country’s handset value chain, PTA data shows The growing presence of Chinese brands has helped expand affordable smartphone access while strengthening Pakistan’s industrial base.

The momentum is also reflected in PTA’s Annual Report, which is based on data available up to June, notes that by 2025 more than 95% of mobile devices used on Pakistani networks were locally manufactured, including 68% of all smartphones, a dramatic shift from reliance on imports just a few years ago.

The report adds that dozens of manufacturing authorizations have been issued to domestic and international players, positioning Pakistan as an emerging regional hub for handset assembly. Beyond reducing pressure on foreign exchange reserves, the transition has supported job creation and technology transfer, while helping formalize the mobile market through tighter compliance and registration frameworks, according to Gwadar Pro.

Credit: Independent News Pakistan (INP) — Pak-China