INP-WealthPk

Shams ul Nisa

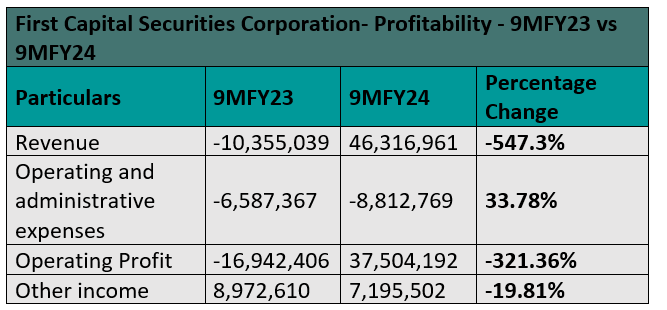

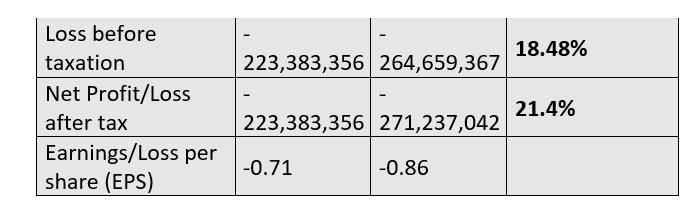

First Capital Securities Corporation sustained a net loss of Rs271.23 million in the first nine months of the current fiscal year (9MFY24), which was 21.4% higher than Rs223.38 million in 9MFY23, reports WealthPK.

However, the company reported a staggering 547.3% rise in top line, which clocked in at Rs46.3 million in 9MFY24 compared to the negative value of Rs10.35 million in the same period last year. This significant rise suggests improved strategies and favourable market conditions during the period. Likewise, the company’s operating and administrative expenses increased 33.78% to Rs8.8 million in 9MFY24.

During the period under review, a notable 321.36% surge was observed in the company’s operating profit, which stood at Rs37.5 million against an operating loss of Rs16.9 million in 9MFY23. This indicated improved efficiency in operating cost management. Despite the impressive rise in revenue and operating profit, a decline of 19.81% was observed in other income with the loss-before-tax also extending by 18.48% during the period. The company’s loss per share in 9MFY24 grew to Rs0.86 from Rs0.71 in 9MFY23.

Statement of balance sheet analysis

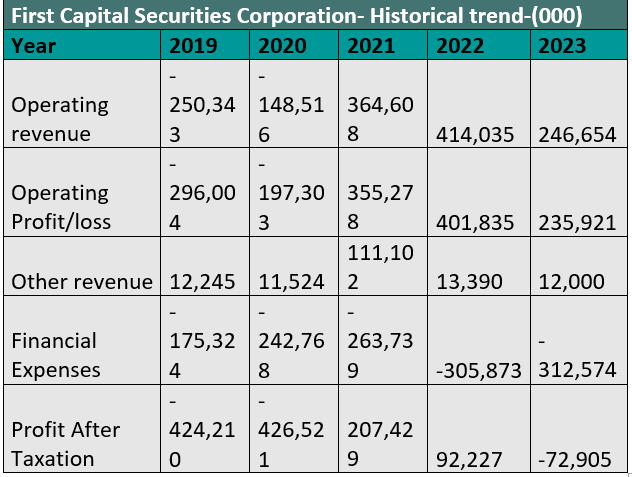

First Capital Securities Corporation Limited's operating revenue showed negative growth in 2019 and 2020 with values of Rs250.3 million and Rs148.5 million, respectively. In contrast, 2021 and 2022 appeared to be good years for the company, indicating a notable increase in operational activities with revenues of Rs364.6 million and Rs414.03 million, respectively. But in 2023, its operational revenue dropped once again to Rs246.6 million. The company sustained operating losses of Rs197.3 million in 2020 and Rs296.004 million in 2019. This suggests that the company failed to control costs effectively. Nevertheless, the company reported an operating profit of Rs355.27 million in 2021, and reached a peak of Rs401.8 million in 2022, indicating robust financial activity. But this profit dropped to Rs235.9 million in 2023.

Over the past five years, the company's other revenue declined overall from Rs12.2 million in 2019 to Rs12.00 million in 2023, while its financial expenses grew from Rs175.3 million in 2019 to Rs312.5 million in 2023. The company faced significant challenges in profit generation, with net losses in 2019 and 2020. However, it achieved a profit-after-tax of Rs207.4 million in 2021 and Rs92.2 million in 2022, but failed to sustain the profit in 2023.

Investment banks/securities sector analysis

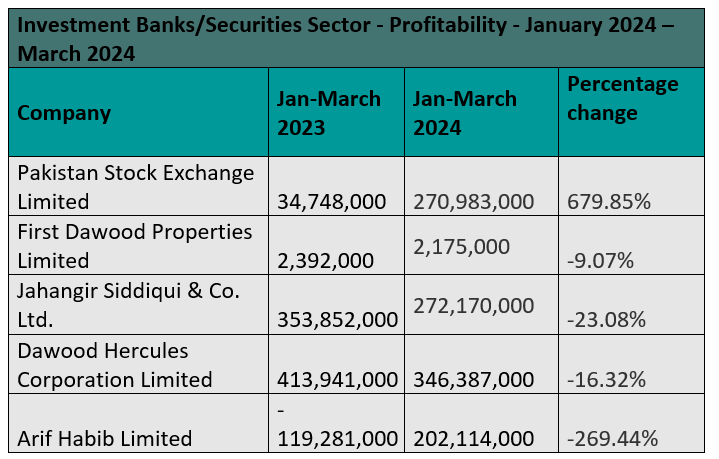

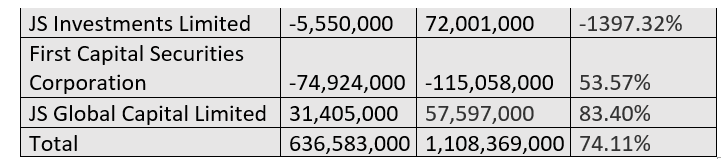

JS Investments Limited’s net profit surged 1397.32% to Rs72.0 million in the three months ending March 2024 compared to a net loss of Rs5.5 million over the same period last year. Pakistan Stock Exchange Limited achieved the second-highest growth of 679.85% in the investment banks/securities sector with a net profit of Rs270.98 million.

First Dawood Properties Limited, Jahangir Siddiqui & Co. Ltd, and Dawood Hercules Corporation Limited faced a decline of 9.07%, 23.08%, and 16.32% in net profit, respectively. Similarly, First Capital Securities Corporation suffered a net loss of Rs115.0 million during the January-March period, which was 53.57% higher than the net loss of Rs74.9 million in the same period last year. Numerous factors, including adverse market conditions, investment losses, or unique operational obstacles faced by the companies, could be responsible for these decreases.

Future outlook

First Capital Securities Corporation stayed focused on sustaining its growing pace to fortify itself. The management closely monitors its resources and works hard to maximise profits for the company's stockholders. This entails reducing costs and optimising revenue generation from core operations and treasury management.

Company profile

First Capital Securities Corporation was incorporated in Pakistan on April 11, 1994, as a public limited company enlisted on the Pakistan Stock Exchange. The company is engaged in long and short-term investments, money market operations, and financial consultancy services.

Credit: INP-WealthPk