INP-WealthPk

Ayesha Mudassar

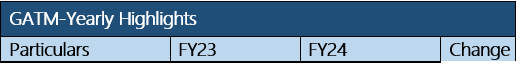

Gul Ahmed Textile Mills Limited (GATM) recorded a 10% increase in pre-tax profit and a 19% rise in post-tax profit during the Fiscal Year 2024 compared to the earlier year, reports WealthPK.

The company posted a pre-tax profit of Rs6.5 billion and a post-tax profit of Rs4.7 billion in FY24. The profit translates into earnings per share (EPS) of Rs6.39, compared to an EPS of Rs5.39 recorded in FY23.

Additionally, the company reported sales of Rs143.1 billion in FY24 compared to Rs111.9 billion in FY23, representing a 28% growth. This increase in sales underscores the effectiveness of the management’s strategic initiatives, including timely investments and leveraging both export and domestic market opportunities. The cost of sales also rose by 32%, driven primarily by the higher material costs, increased energy expenses, and an upward adjustment in minimum wages.

Pattern of Shareholding

As of June 30, 2024, Gul Ahmad Textile Mills Limited has 740 million shares distributed among 7,693 shareholders. Joint stock companies hold a majority stake of 69.2% of the shares followed by individuals who possess 16.3% of the company's ownership. Around 7.9% of the company's shares are owned by the financial institutions while investment companies & mutual funds hold a 5.1% stake. The insurance companies account for 1.2% of GATM’s shares. The remaining ownership is held by other categories of shareholders, including charitable institutions and government departments.

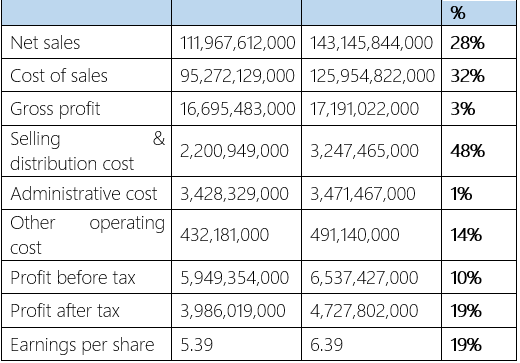

Performance over the last six years (2018-23)

The company has demonstrated a consistent upward trend in its topline, except in 2020. However, its bottom line experienced declines in two years —2020 and 2023. In 2019, the company's top line grew by 26% year-on-year (YoY) on account of a strong demand in both local and export markets. The year concluded with a 25% increase in gross profit and a 74% rise in net profit, reaching Rs11.9 billion and Rs3.6 billion, respectively. The profit before tax also grew from Rs2.3 billion in 2018 to Rs4 billion in 2019. The onset of the Covid-19 pandemic in 2020 led to a 6% YoY decline in sales, attributed to a weak demand and epidemic-related restrictions. As a result, the company’s gross profit dropped by 24%, and reported a net loss of Rs479 million for the year. In 2021, GATM experienced a recovery, with sales increasing by 46% YoY due to a rebound in both local and export markets. The gross profit grew to Rs12.8 billion, while the net profit rose to Rs4.4 billion.

Despite macroeconomic challenges and political uncertainty in 2022, the company benefited from a substantial devaluation of the rupee, which bolstered its export sales. This led to a 27% increase in topline growth, along with a 100% rise in net profit, which reached Rs8.8 billion. In 2023, the company’s topline registered a modest 10% increase. However, the rising raw material costs, local currency depreciation, and higher utility expenses contributed to a 4% decline in gross profit. Additionally, the net profit fell by 55%, closing the year at Rs3.9 billion.

About the company

Gul Ahmed Textile Mills Limited was incorporated on April 1, 1953 in Pakistan as a private limited company and was subsequently converted into a public limited company on January 7, 1955. The company is a composite textile mill engaged in the manufacture and sale of textile products.

Textile Sector

The textile sector has exhibited a weak performance during the Fiscal Year 2024, primarily due to a reduced demand in key markets such as the USA and Europe. Additionally, the industry is grappling with several challenges, including elevated raw material costs, expensive energy, high bank financing rates, and delays in sales tax refunds. These factors have collectively eroded profitability and adversely affected sectoral performance.

Credit: INP-WealthPk