آئی این پی ویلتھ پی کے

Shams ul Nisa

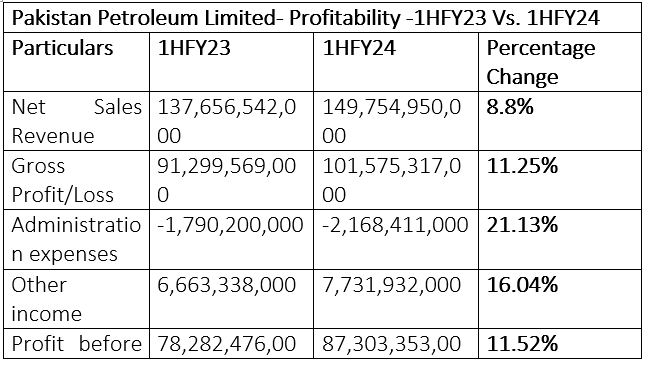

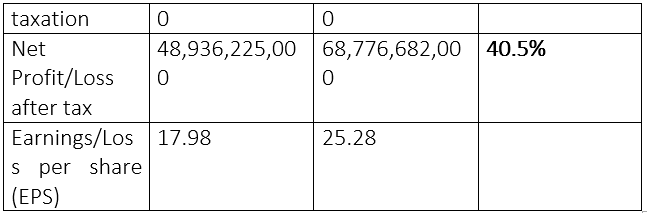

The net profit of Pakistan Petroleum Limited grew 40.5% in the first half of the ongoing fiscal year (1HFY24) compared to the corresponding period of FY23, reports WealthPK. The revenue also increased by 8.8% during the period under review as the company posted net sales of Rs149.7 billion in 1HFY24. This impressive growth is attributed to the higher positive price variance compared to the negative sales variance due to currency devaluation. Increased sales and lower tax charges drove up the net profit to Rs68.77 billion during the period under review.

The company’s gross profit surged to Rs101.5 billion in 1HFY24 from Rs91.29 billion in 1HFY23. On the expense front, administrative expenses expanded by 21.13% to Rs2.16 billion. Likewise, the company’s other income increased by 16.04% in 1HFY24 to Rs7.73 billion. Thus, profit-before-tax stood at Rs87.3 billion against Rs78.28 billion in 1HFY23, representing an increase of 11.52%. The impressive financial performance translated into the higher earnings per share of Rs25.28 in 1HFY24 against Rs17.98 in 1HFY23.

Quarterly analysis

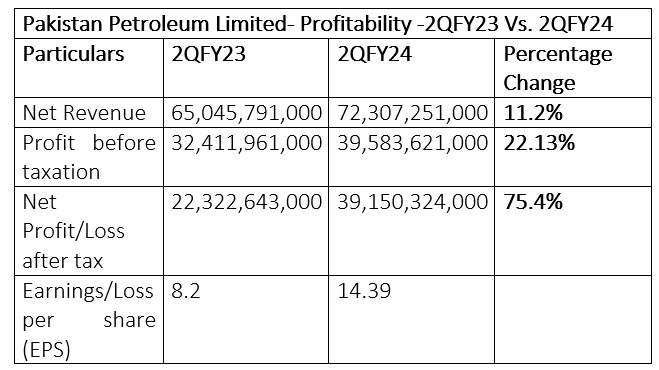

The company posted a 11.2% growth in revenue, 22.13% in before-tax profit and 75.4% in net profit in 2QFY24. The company posted net revenue of Rs72.3 billion, profit-before-tax of Rs39.58 billion and net profit of Rs39.15 billion in 2QFY24. The earnings per share stood at Rs14.39 in 2QFY24 compared to Rs8.2 in 2QFY23.

Historical trend analysis

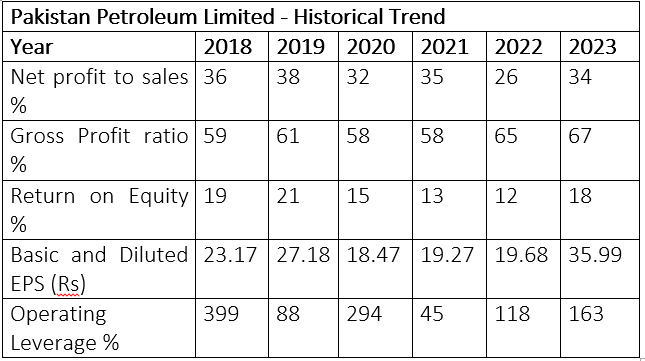

The net profit-to-sales ratio fluctuated between 2018 and 2023, peaking at 38% in 2019 and falling to 26% in 2022. The oil and gas exploration company reported a 34% net profit-to-sales ratio in 2023. The gross profit ratio stayed over 50%, indicating a steady profit creation by the company over the years. With variations between the years, the gross profit ratio increased from 59% in 2018 to 67% in 2023. Return on equity demonstrates the company's capacity to earn a profit while effectively employing shareholder's equity. Return on equity dropped from 19% in 2018 to 18% in 2023. In 2019, the firm reported a maximum return on equity ratio of 21% and a minimum of 12% in 2022.

The earnings per share declined to Rs18.47 in 2020 from Rs23.17 in 2018. However, they rebounded in subsequent years, peaking at Rs35.99 in 2023. The degree to which a company increases sales and produces operational income is measured by its operating leverage. Operating leverage for the company decreased from 399% in 2018 to 163% in 2023. In 2021, the company had its lowest 45% operating leverage.

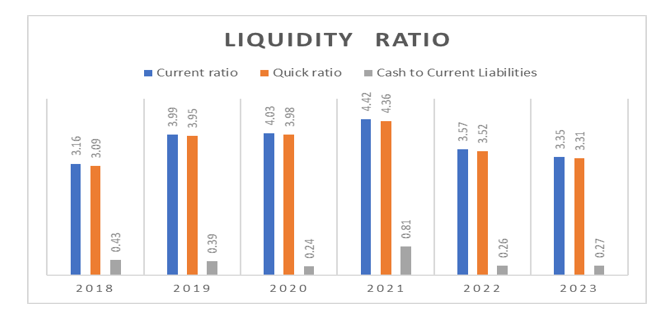

Liquidity ratio analysis

The current ratio showed remarkable performance throughout the years, staying above 1, indicating a reduced risk to pay the liabilities. It reached its maximum of 4.42 in 2021 and its minimum of 3.16 in 2018. Likewise, the quick ratio shows the ability of the company to pay its debts since it has consistently remained over 1, indicating a higher level of ability to cover liabilities. However, the cash-to-current liability ratio stayed below 1 from 2018 to 2023, indicating that the company had sufficient cash to meet its current liabilities. In 2021, the firm had its highest cash-to-current liability value of 0.81.

Oil & gas exploration sector

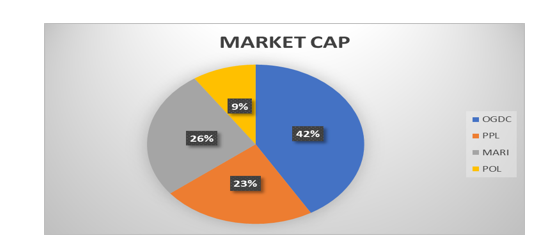

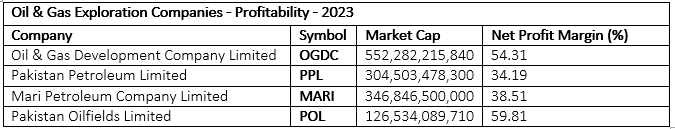

A thorough comparison of the companies in the oil & gas exploration sector for 2023 is analysed using market capitalisation and net profit margin. Oil & Gas Development Company Limited leads the sector with 42% of total outstanding shares, followed by 26% market capitalisation of Mari Petroleum Company Limited, 23% of Pakistan Petroleum Limited and 9% of Pakistan Oilfields Limited.

However, Pakistan Oilfields Limited leads the sector with a net profit margin of 59.81% in 2023. Oil & Gas Development Company Limited secured the second position, with a 54.31% net profit margin. Mari Petroleum Company achieved a net profit margin of 38.51%, while Pakistan Petroleum recorded a net profit margin of 34.19% during the same period.

Company profile

Founded in 1950, Pakistan Petroleum Limited embarked on its journey with the mission to explore, prospect, develop, and produce oil and natural gas resources within the nation.

Credit: INP-WealthPk