آئی این پی ویلتھ پی کے

Ayesha Mudassar

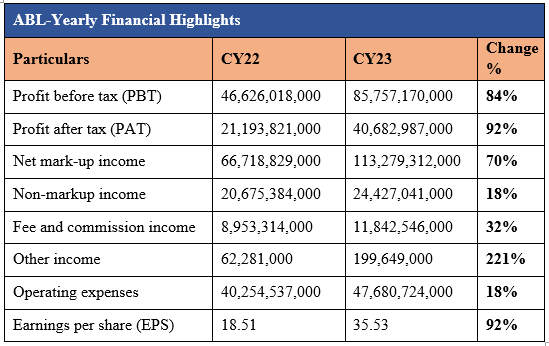

Allied Bank Limited (ABL), one of Pakistan's prominent banks, has declared an unconsolidated profit-after-tax (PAT) of Rs 40.6 billion for the year ending December 31, 2023, with an impressive growth of 92% over the previous calendar year, reports WealthPK. The volumetric expansion in asset base, improved deposit mix, higher interest rate, and enormous revenue growth- all contributed to the aforementioned increase in after-tax profit.

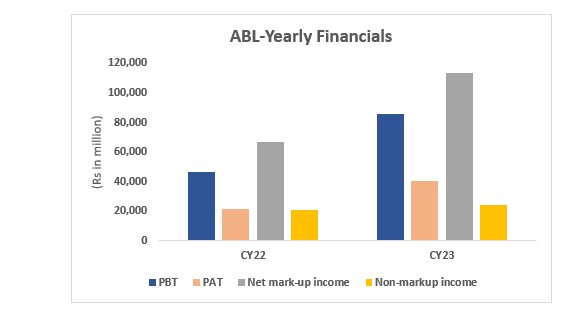

According to the financial results submitted to the Pakistan Stock Exchange (PSX), the bank recorded a profit before-tax (PAT) of Rs 85.7 billion for CY23 versus a PBT of Rs 46.6 billion in CY22. Moreover, the ABL announced an Earnings per share (EPS) of Rs 35.53 for the year under review. The bank's net markup income posted massive growth, reaching Rs 113.2 billion for CY23, compared to Rs 66.7 billion in CY22. This was supported by positive growth in average earning assets, improved spreads, and effective investment duration management. Furthermore, the non-markup interest income for the year reached Rs 24.4 billion, representing an 18% year-on-year (YoY) increase. The enormous rise in other income and higher fee and commission income were the key contributors to this positive variance.

The ABL upgraded its digital as well as conventional products, which complemented a 32% increase in fee and commission income and recorded Rs 11.8 billion during the year 2023, compared to Rs 8.9 billion in year 2022. The bank's other income enhanced by 221% to reach Rs 199.6 million for the year ended December 31, 2023, as compared to Rs 62.2 million for the year ended December 31, 2022. In addition, the bank managed to limit the increase in operating expenses to 18% by continuously automating processes and enforcing internal controls. Operating expenses were recorded at Rs. 46,985 million for the year ended December 31, 2023, compared to Rs. 39,699 million for the previous year.

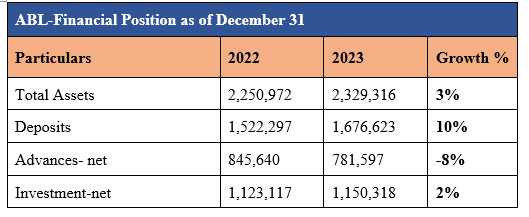

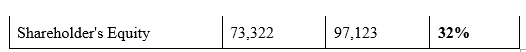

ABL-Financial Position

The prudent investing and transactional banking have helped the asset base of Allied Bank to cross Rs 2.3 trillion as of December 31, 2023. The growth in assets was primarily driven by increases in investments. The net investment rose by 2% to Rs 1.1 trillion during the year under review.

Driven by marketing campaigns and customer acquisition drives, the deposit base of the bank increased by 10% and was recorded at Rs 1.6 trillion as of December 31, 2023. Amidst challenging operating conditions, the ABL has demonstrated resilience and achieved significant growth in both its balance sheet and net profits.

Future Outlook

Despite the country's challenges, the bank continues its endeavors to achieve its vision through growth, efficiency, and diversity and creating sustainable value for all stakeholders. The ABL is focused on promoting the advancement of the digital ecosystem in the financial sector.

Banking Sector Performance

Pakistan's banking industry was resilient against multiple headwinds, including pandemic aftershocks, high inflation, economic slowdown, and political unrest. As of December 31, 2023, the total assets of the industry increased by 31% and recorded at Rs 45,183 billion, compared to Rs 34,530 billion as of December 31, 2022. This growth was mainly driven by an 84% appreciation in Cash and Balances, a 56% increase in other assets, and a 41% improvement in investments.

On the liability side, total deposits improved by 24% to reach Rs 27,841 billion as of December 31, 2023, as compared to Rs 22,467 billion as of December 31, 2022. The initiatives introduced by the State Bank of Pakistan (SBP), including digital onboarding, Raast, and Real-Time Gross Settlement are playing a noteworthy role in promoting innovation, advancing financial inclusion, and offering digital financial services.

Credit: INP-WealthPk