INP-WealthPk

Ayesha Mudassar

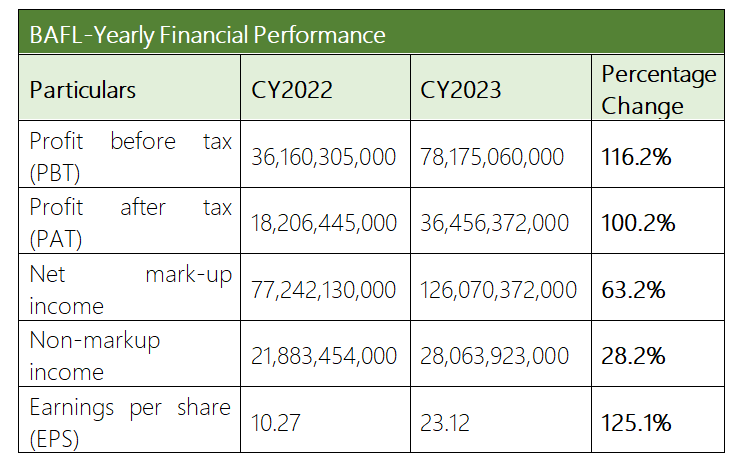

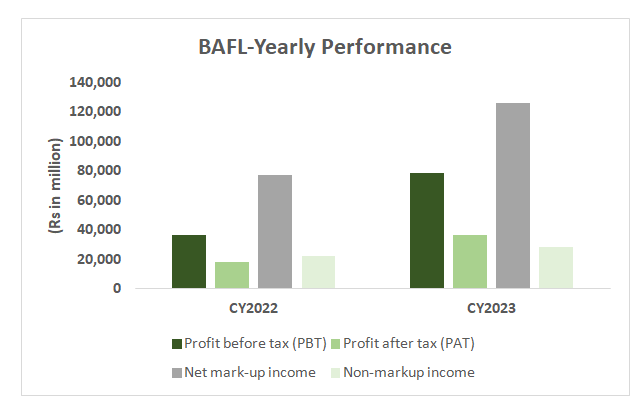

Bank Alfalah Limited (BAFL), one of the country’s largest commercial banks, recorded an unconsolidated profit-before-tax (PBT) of Rs78 billion for the year ending December 31, 2023, with an impressive growth of 116% over the earlier calendar year, reports WealthPK. According to the financial results submitted to the Pakistan Stock Exchange (PSX), the bank registered a profit-after-tax (PAT) of Rs36 billion for CY23 as against the profit-after-tax of Rs18 billion in CY22. Moreover, the bank announced an earnings per share (EPS) of Rs23.12 for the year under consideration.

The net markup income posted a colossal growth, reaching Rs126 billion for CY23, compared to Rs77 billion in CY22. The combination of net earning assets growth and re-pricing of the asset book at higher rates led to an increase in markup income. Furthermore, the non-markup interest income for the year reached Rs28 billion, representing a 28% year-on-year (YoY) increase. Higher fee and commission income and gains from derivatives were the key contributing factors to the positive variance. The bank’s continuous focus on expediting the digital transformation journey, combined with delivering unparalleled services to the customers facilitated a robust fee income growth of 37% to reach Rs14.8 billion during the CY2023 as compared to Rs10.8 billion over the last year.

Going by the income statement, the foreign exchange income increased by 4% to reach Rs9.5 billion for the year ending December 31, 2023 as compared to Rs9.2 billion for the year ending December 31, 2022. Furthermore, the operating expenses increased 30% to Rs64.5 billion in line with the bank's strategy to open new branches and invest in digital technology platforms alongside inflation, rupee depreciation, marketing, and flood relief efforts. The deposits were reported at Rs2.08 trillion at the end of December 2023 with year-on-year (YoY) growth of 40%. This reflects the bank’s exceptional efforts for the diverse product suite and successful execution of its strategic plan. Overall, the bank pursued its approach of consistent growth through a robust risk management framework and improved customer experience through technologically driven automation and digitization.

Significant milestones during 2023

- Inauguration of 1000th branch and

- Surpassing of Rs2 trillion in deposits.

The aforementioned milestones indicate a strong commitment toward growing presence and providing excellent services in virtually all areas across the country.

Ratio analysis (2020-2023)

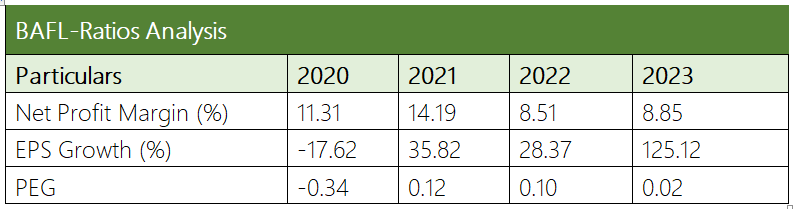

The net profit margin for the calendar years 2020, 2021, 2022, and 2023 stood at 11.31%, 14.19%, 8.51% and 8.85%, respectively. The net profit margin represents the percentage of revenue that translates into net profit. The declining trend from CY21 to CY22 indicates a decrease in profitability, primarily due to the increased operating expenses and worker welfare funds.

The earnings per share (EPS) growth rate for CY20, CY21, CY22, and CY23 was 17.62%, 35.82%, 28.37, and 125.12%, respectively. The positive EPS growth in the last three years signifies an increase in earnings per share, indicating improved profitability. However, the negative EPS growth rate in CY20 suggests a decline in EPS, indicating reduced profitability during that period. The price/earnings to growth (PEG) ratio for CY20, CY21, CY22, and CY23 was 0.34, 0.12, 0.10, and 0.02, respectively. The PEG ratio evaluates the relationship between a company's price-to-earnings (P/E) ratio and its EPS growth rate. A PEG ratio below 1 is generally considered favorable, as it indicates that the stock may be undervalued relative to its growth potential. In this case, the PEG ratio suggests a positive outlook, with the bank's earnings growth aligning with its valuation.

Forward-looking statement

Bank Alfalah is determined to advance its deposit base, enhance its local presence, and deliver unparalleled services to the customers. The bank's strategic pillars include a heightened focus on the consumer sector, robust support for SME growth, broadened cash management capabilities, and adept use of technology to cater to the customers' banking needs. Additionally, the bank remains steadfast in its commitment to invest in human capital and nurture a culture characterized by care, collaboration, and creativity.

Credit: INP-WealthPk