INP-WealthPk

Qudsia Bano

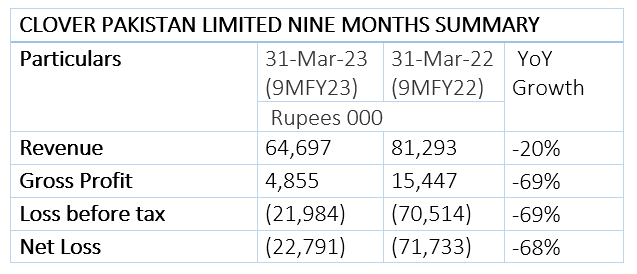

Clover Pakistan Limited experienced a significant decline in sales revenue, but managed to bring down its losses year-on-year in the first nine months of the ongoing fiscal year 2022-23 (9MFY23). According to the company’s performance report for the nine months ending on March 31, 2023, its revenue dipped 20% to Rs64.7 million from Rs81.3 million reported over the same period a year ago, reports WealthPK.

The gross profit also experienced a substantial downturn, reaching Rs4.9 million in 9MFY23, down 69% from Rs15.4 million reported over the same period last year. The decrease in gross profit highlights the challenges faced by the company in managing its cost structure and maintaining profitability. Furthermore, the company reported a loss-before-tax of Rs21.98 million in 9MFY23, showing a significant decline from the before-tax loss of Rs70.51 million in the corresponding period of FY22.

The net loss also witnessed a substantial decrease and stood at Rs22.79 million in 9MFY23 compared to a net loss of Rs71.73 million the previous year, indicating a decline of 68%. The decline in financial performance reflects the challenging market conditions and the impact of various internal and external factors on the company's operations.

Most recent events

Clover Pakistan Limited's Board of Directors met on April 27 to review and approve the financial statements for the nine-month period ending on March 31, 2023. The board examined the company's financial performance, assessing various key indicators and metrics. After thorough deliberations and analysis, the meeting unanimously approved the nine-month accounts, affirming their confidence in the financial soundness and integrity of the company.

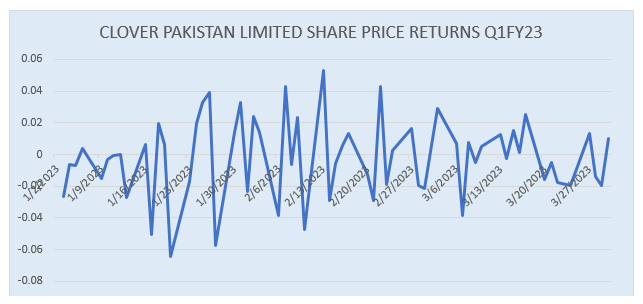

Third-quarter analysis of share price returns

Clover Pakistan witnessed relatively stable share prices during the first quarter of 2023, exhibiting minimal fluctuations. Starting from January 2, the share price stood at Rs17.15. The price experienced slight variations, reaching its lowest point on January 20 at Rs14.5 and its highest on February 9 at Rs15.9. Overall, the share price stayed relatively steady, demonstrating resilience in the face of adverse market conditions.

The company’s stock maintained its value despite minor fluctuations, suggesting market sentiment towards Clover Limited remained steady during the quarter. This stability can be attributed to various factors, including the company's consistent performance, positive industry outlook, and overall market stability. The average share price for the quarter settled at Rs15.4, with investors closely monitoring the stock's performance for potential growth opportunities. The stable share prices indicate confidence among shareholders and the potential for future growth in the company's market value.

About the company

Clover Pakistan was incorporated in Pakistan on September 30, 1986, as a publicly listed company under the now repealed Companies Ordinance, 1984. The principal business of the company includes the sale of food products, consumer durables, chemicals and lubricants. It also makes the import and trade of gantry equipment's air/oil filters and other car care products. The company also makes office automation products, fuel dispensers, vending machines and digital screens.

Credit: Independent News Pakistan-WealthPk