INP-WealthPk

Ayesha Mudassar

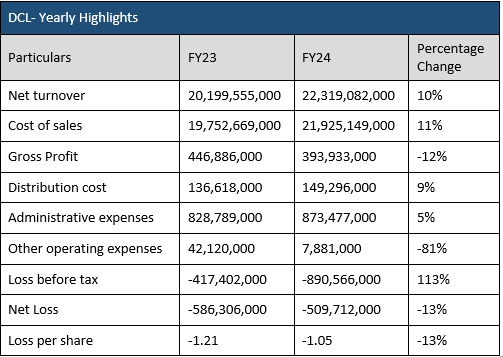

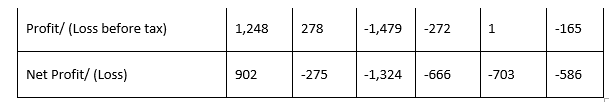

Dewan Cement Limited (DCL) managed to bring its net loss to Rs509.7 million in the last fiscal year (FY24) from Rs586.3 million recorded in FY23, reports WealthPK. However, the company’s loss-before-tax also jumped to Rs890.5 million in FY24 from Rs417.4 million in FY23. Additionally, the gross profit for the year declined by 12%.

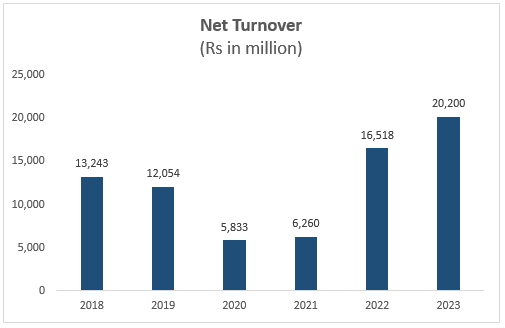

DCL, however, posted a 10% rise in net sales for FY24, reaching Rs22.3 billion from Rs20.1 billion in FY23. This revenue growth was primarily attributed to a modest increase in sales volume coupled with a rise in the average selling price. On the expense side, administrative costs rose by 5% year-on-year (YoY). In comparison, other operating expenses were significantly reduced by 81% YoY during the period under review. The company’s management has actively pursued cost-saving initiatives to mitigate losses. However, certain factors, including exorbitant input prices, escalating energy charges, currency exchange rate fluctuations, and economic uncertainty, have adversely impacted the company’s overall performance.

Financial position highlights

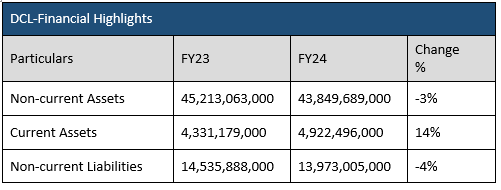

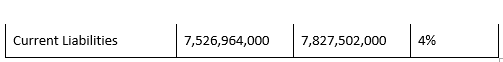

The financial analysis of DCL for the fiscal year ended June 30, 2024, revealed a 3% decline in non-current assets compared to FY23. This reduction was primarily driven by lower investments in intangible assets and decreased long-term deposits. On the other hand, a 14% rise in current assets was mainly due to an increase in stores and spare parts. Additionally, loans, advances and other receivables significantly increased during the period under review.

On the liabilities side, the non-current liabilities declined by 4% compared to the previous year, while current liabilities rose by 4%, mainly due to an increase in trade and other payables.

Operational performance (2018-2023)

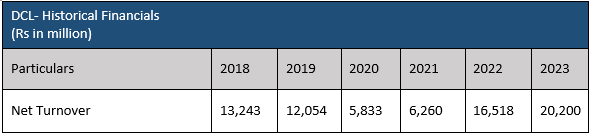

DCL revenue growth has been inconsistent from FY18 to FY23, with the top line increasing only three times. Profit margins have generally declined, except for some improvement in FY21. In FY20, the company experienced a sharp revenue drop of nearly 52%, with net turnover hitting a record low of Rs5.8 billion. This decline was primarily driven by a slowdown in construction activities and reduced selling prices. As production costs exceeded net revenue, the company recorded a gross loss of Rs516 million, with the net loss surging to an all-time high of Rs1.3 billion during the year. In FY21, the company’s revenue increased by 22%, supported by a rise in the average selling price. However, the cost of sales per ton escalated by 48% due to persistently rising input costs. Despite the revenue growth, high production and operating expenses continued to erode profitability, leading to compressed profit margins.

In FY23, the company’s revenue grew to Rs20.2 billion, largely driven by an increase in the average selling price. However, the cost of sales again rose by 48%, driven by soaring input costs, including coal, power, raw materials, and imported consumables.

Industry overview

In FY24, the local cement sector saw a modest decline in domestic dispatches, decreasing by 5% compared to the previous year. This reduction equates to a drop of 1.8 million tonnes, from 40 million tonnes to 38.2 million tonnes. However, exports experienced a substantial increase of 55%, reaching 7.1 million tonnes, up from 4.6 million tonnes in the prior year. As a result, the industry’s total dispatches rose by 1.6%, totalling 45.3 million tonnes compared to 44.6 million tonnes the previous year.

About the company

DCL was established as a public limited company in 1980. It is part of the Yusuf Dewan Group of Companies. DCL manufactures and sells cement. It has two manufacturing units, Parkland Cement Limited and Saadi Cement Limited.

Credit: INP-WealthPk