INP-WealthPk

Jawad Ahmed

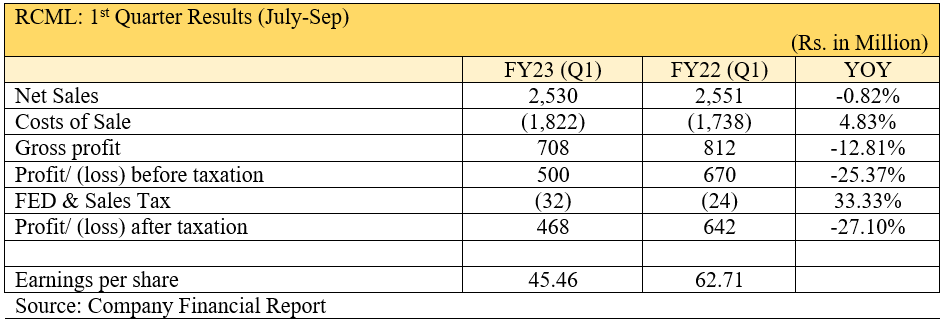

Reliance Cotton Spinning Mills Limited's net sales for the first quarter (July-Sept) of the current fiscal year 2022-23 stood nearly unchanged at Rs2.53 billion compared to the same period of the previous fiscal.The company saw a significant decline in sales growth and profitability in this quarter as a result of economic downturn and escalating costs, WealthPK reports, quoting the company's financial statistics. Reliance Cotton Spinning Mills was incorporated in Pakistan on June 13, 1990 as a public limited company under the Companies Ordinance, 1984 (now the Companies Act, 2017). The principal activity of the company is manufacturing and sale of yarn.

In the first quarter of FY23, the company reported a gross profit of Rs708 million, 25.3% lower than Rs812 million achieved during the same quarter of FY22. The company's net profitability also decreased by 27.1%, from Rs642 million in 1QFY22 to Rs468 million this year. Due to this loss, the company’s EPS decreased from Rs62.71 the prior year to Rs45.46 this year.

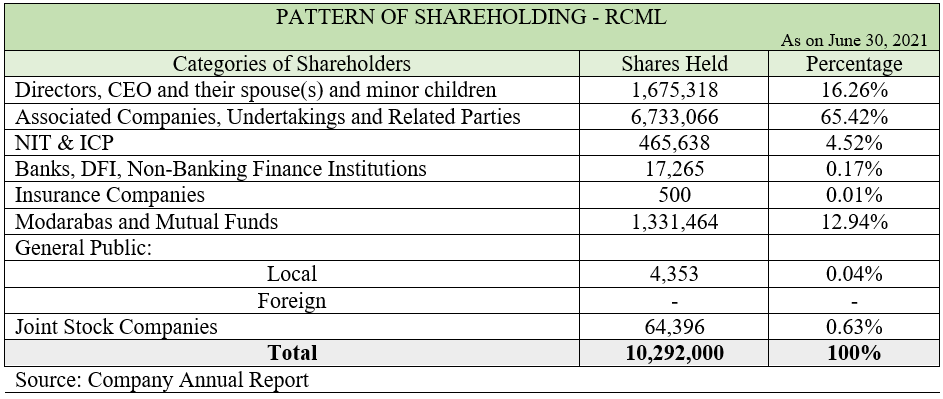

Shareholding pattern

As of June 30, 2021, the company’s directors, the chief executive officer, their spouses and minor children owned 16.26% of its shares. Associated companies held 65.42% of shares, while NIT and ICP owned 4.52%. Modarabas and mutual funds possessed 12.94% of the shares. Banks, development financial institutions, insurance companies and joint stock companies held the rest of the shares.

Performance over the years

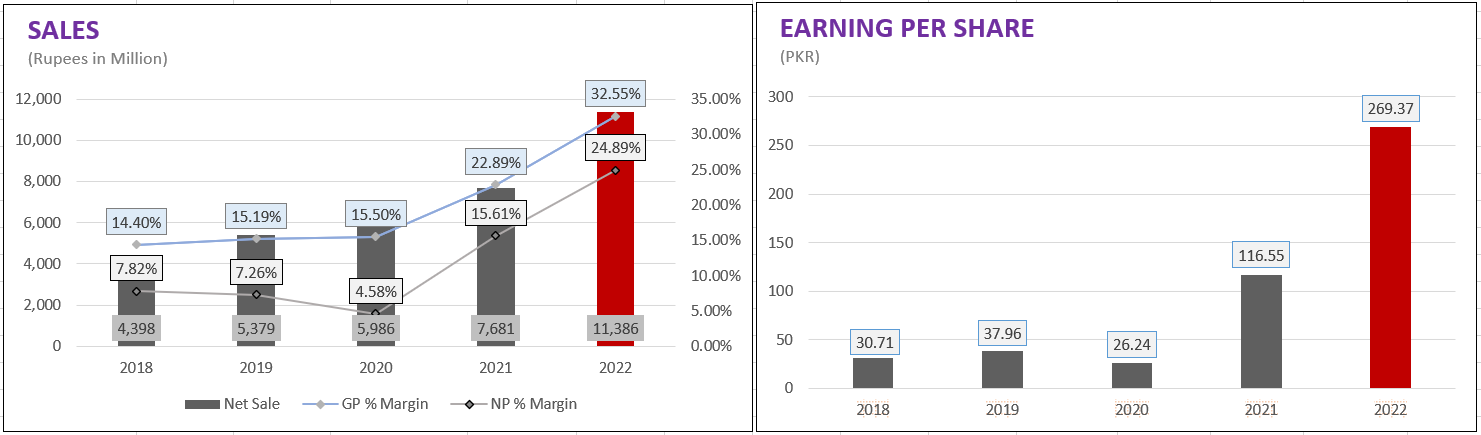

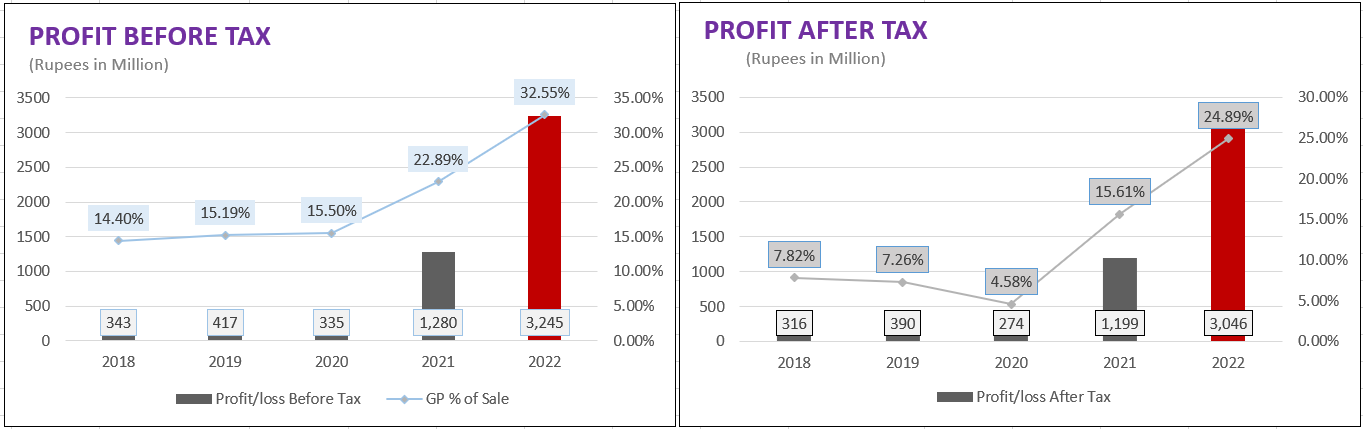

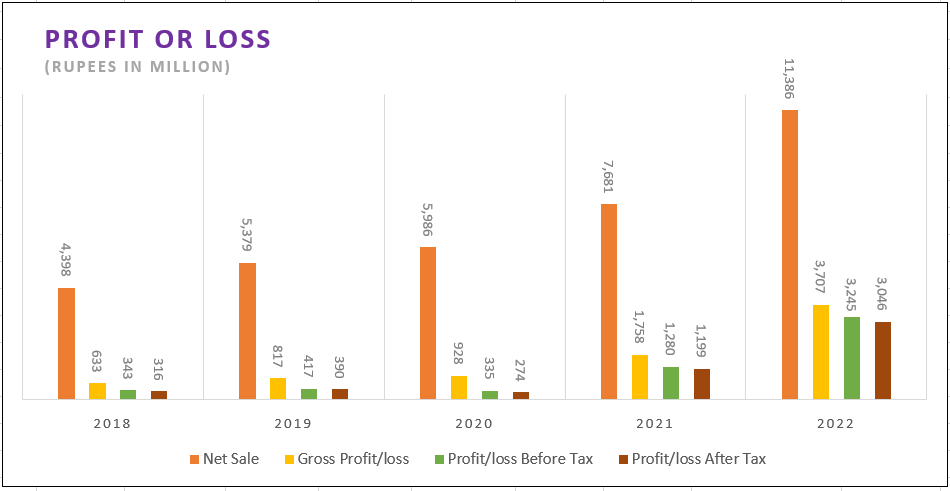

In 2020, the Covid-19 epidemic and the ensuing challenging economic environment allowed the company to slightly recover its sales. The sales income climbed 11.3% to Rs5.98 billion from Rs5.37 billion in 2019. As a result, the company’s gross profit in 2020 was Rs928 million as opposed to Rs817 million in 2019. The company posted a net profit of Rs274 million for the year, down 30% from Rs390 million in 2019. The EPS decreased to Rs26.24 in 2020 from Rs37.96 the year before.

In 2021, the company's top line climbed to Rs7.68 billion from Rs5.98 billion in 2020 due to an increase in product demand. The increase in gross profit to Rs1.75 billion from Rs928 million the previous year was mostly attributable to growing demand and the economy's recovery following the lifting of the Covid-19-induced limitations. The net profit increased dramatically from Rs274 million to Rs1.19 billion. As a result, the EPS jumped from Rs26.24 to Rs116.55.

In 2022, the company's sales revenue climbed to Rs11.38 billion from Rs7.68 billion the previous year. The company's gross profit soared 111% to Rs3.70 billion from Rs1.75 billion the previous year. The profit-after-tax for the year increased to Rs3 billion, a 152% increase over Rs1.19 billion the year before. The EPS consequently climbed significantly to Rs269.37from Rs116.55 the prior year.

Credit : Independent News Pakistan-WealthPk