INP-WealthPk

Shams ul Nisa

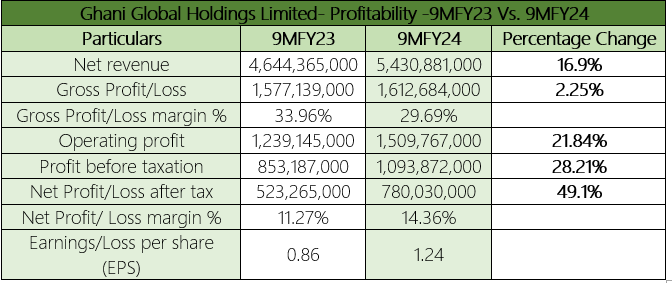

Ghani Global Holdings Limited posted a net profit of Rs780.03 million for 9MFY24, which was 49.1% higher than Rs523.26 million in the same period last year, reports WealthPK. Despite economic uncertainties during the period, the consolidated net revenue ballooned by 16.9% and gross profit by 2.25% in 9MCY24. However, the gross profit margin contracted to 29.69% in 9MCY24 from 33.96% in 9MFY23 due to the rise in other expenses.

Likewise, at the end of 9MFY24, the company earned an operating profit of Rs1.5 billion, up by 21.84% from Rs1.2 billion in 9MFY23. The profit before tax clocked in at Rs1.09 billion during the review period compared to Rs853.1 million. Furthermore, the net margin and earnings per share climbed to 14.36% and Rs1.24, respectively in 9MFY24.

Chemical sector sales trend

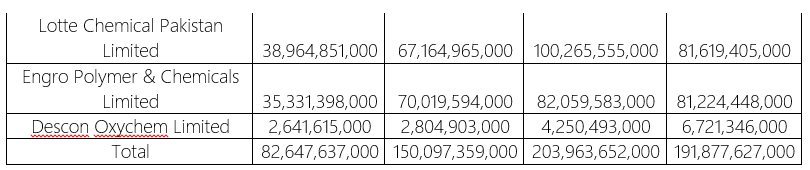

The chemical sector sales have grown in the last four years with significant changes across the companies yearly. Comparatively, Ghani Global Holdings Limited observed a dominant growth variation of around 1295.68% from 2020 to 2023 in the sector and the least growth of 109.47% by Lotte Chemical Pakistan Limited. However, in terms of absolute sales value, Lotte Chemical Pakistan Limited has registered the highest sales each year and Ghani Global Holdings Limited the lowest. The sales of Ghani Global Holdings Limited witnessed a sharp decline of 30.62% to Rs6.97 million in 2021 from Rs10.05 million in 2020.

However, a remarkable spike of around 1217.05% was registered, making the sales reach Rs91.8 million in 2022. Furthermore, the sales expanded with a moderate rate of 52.73% to the highest of Rs140.26 million in 2023. Starting from Rs5.69 billion in 2020, the sales of Agritech Limited consistently grew to Rs22.17 billion in 2023, registering a surge of 289.0%. Compared to Rs17.29 billion in 2022, the company posted the lowest yearly growth of 28.19% to Rs22.17 billion in 2023.

Over the four years, Lotte Chemical Pakistan Limited held the top spot in sales in the sector, climbing from Rs38.94 billion in 2020 to the highest of Rs100.26 billion in 2022. However, its sales slid by 18.60% to Rs81.6 billion in 2023. The sales of Engro Polymer & Chemicals Limited has been rising over the years, reaching Rs82.05 billion in 2022 and decreasing marginally by 1.02% to Rs81.22 billion in 2023. Descon Oxychem Limited reflects steady growth in the four years, reporting the highest sales of Rs6.7 billion in 2023. The sector’s cumulative sales expanded by 132.16% from Rs82.6 billion in 2020 to Rs203.9 billion in 2022 before slipping to Rs191.8 billion in 2023.

Net profit

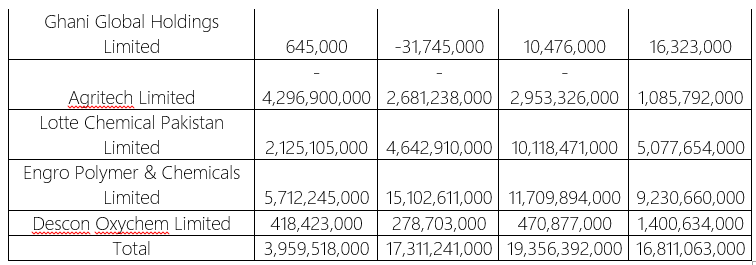

The net profit remained volatile in the last four years in the sector. Ghani Global Holdings Limited incurred a major hit in 2021, reporting a net loss of Rs31.7 million. However, with efficient policy implementation and cost strategies, it managed to earn its highest-ever net profit of Rs16.23 million in 2023.

On the other hand, Agritech Limited faced a persistent net loss in the first three years, before securing its first-ever net profit in the four years of Rs1.08 billion in 2023. Lotte Chemical Pakistan Limited, Engro Polymer & Chemicals Limited, and Descon Oxychem Limited posted net profits throughout the years. The chemical sector's total net profit surged from Rs3.95 billion in 2020 to the peak of Rs19.35 billion in 2022 before contracting slightly to Rs16.81 billion in 2023.

Company profile

Ghani Global Holdings Limited was established in Pakistan on November 19, 2007. The company's primary activity is to oversee its trading activities and investments in affiliated and subsidiary companies.

Credit: INP-WealthPk