INP-WealthPk

Shams ul Nisa

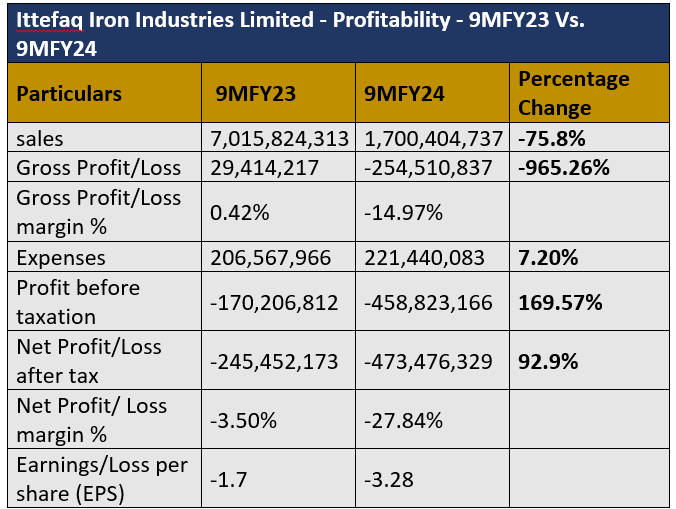

The sales of Ittefaq Iron Industries Limited plummeted by 75.8% in the first nine months of the fiscal year 2023-24 compared to the same period of the earlier fiscal, reflecting significant challenges in revenue generation, reports WealthPK.

The gross profit margin deteriorated drastically from a profit margin of 0.42% in 9MFY23 to a negative margin of 14.97% in 9MFY24, highlighting that the cost of goods sold significantly exceeded revenue. The company’s operating expenses also rose 7.2% in 9MFY24, worsening its financial situation. Furthermore, the loss-before-taxation surged by 169.57% from Rs170.21 million in 9MFY23 to Rs458.82 million in 9MFY24. The loss-after-tax also increased a substantial 92.9%, leading to a notable increase in the net loss margin to 27.84% in 9MFY24 from a loss margin of 3.50% in 9MFY23. This loss was because of unfavourable market conditions, increased competition and operational problems. Additionally, the loss per share increased to Rs3.28 in 9MFY24 from Rs1.7 in 9MFY23, indicating a significant erosion of shareholders’ value.

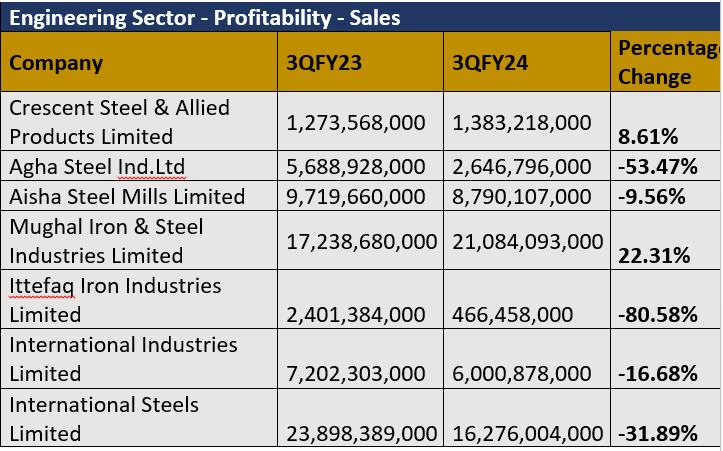

Engineering sector sales

Pakistan's engineering sector displayed mixed sales performance in 3QFY24 compared to the same period of the previous year. Mughal Iron & Steel Industries Limited saw a 22.31% sales increase in 3QFY24, reflecting a strong market position and effective strategies. Crescent Steel & Allied Products Limited achieved a modest sales increase of 8.61%, suggesting successful market strategies and rising demand. Ittefaq Iron Industries Limited experienced a steep decline of 80.58% in 3QFY24, highlighting rising concerns about its operational viability and competitiveness. Furthermore, Agha Steel Industries faced a significant sales decline of 53.47%, likely due to operational difficulties, intensified competition, or a shrinking market share. Aisha Steel Mills Limited, International Industries and International Steels Limited also reported drop in sales, possibly due to broader market difficulties, decreased demand and pricing challenges.

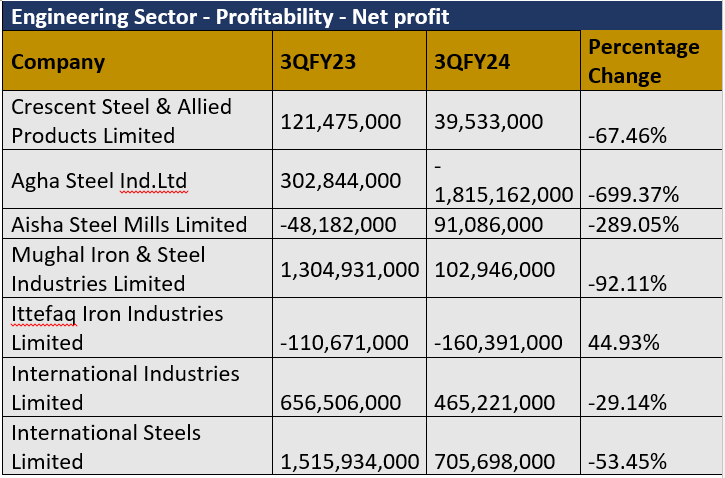

Net profit

In 3QFY24, Pakistan's engineering sector showed varied net profit performance compared to 3QFY23. Agha Steel Industries Limited and Ittefaq Iron Industries Limited incurred net losses of Rs1.81 billion and Rs160.3 million in 3QFY24. Crescent Steel & Allied Products Limited, Mughal Iron & Steel Industries Limited, International Industries Limited, and International Steels Limited also faced declines in profitability. However, Aisha Steel Mills Limited earned a net profit of Rs91.08 million, up by a substantial 289.05% from a net loss of Rs48.1 million in 3QFY23. To enhance competitiveness and profitability, companies should adopt strategic measures to optimise operations, control costs, and explore new markets.

Profitability ratios (2019-23)

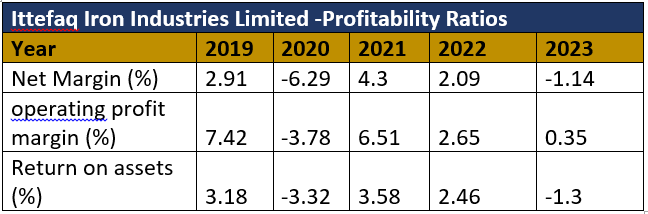

Ittefaq Iron Industries Limited’s net profit margin has been highly unstable over the years as it suffered negative ratios of 6.29% in 2020 and 1.14% in 2023. The company posted the highest net profit ratio of 4.3% in 2021. This reflects ongoing challenges in maintaining profitability, with fluctuations between profit and loss indicating difficulties in managing costs and generating revenue.

The operating profit margin followed a similar trend, decreasing from 7.42% in 2019 to -3.78% in 2020, and varying between 6.51% in 2021 and 0.35% in 2023. The company’s return on assets, which measures profit generated from assets, remained negative at 3.32% in 2020 and 1.3% in 2023, with the highest value of 3.58% in 2021. The negative return on assets in 2020 and 2023 indicates the company's inefficiency in utilising its assets to generate profits, likely due to declining sales or an expanding asset base without corresponding revenue growth.

Company profile

Ittefaq Iron Industries Limited was established on February 20, 2004, and later became a public unquoted company on January 5, 2017. The company's primary business is the manufacturing of iron bars and girders.

Credit: INP-WealthPk