آئی این پی ویلتھ پی کے

Ayesha Mudassar

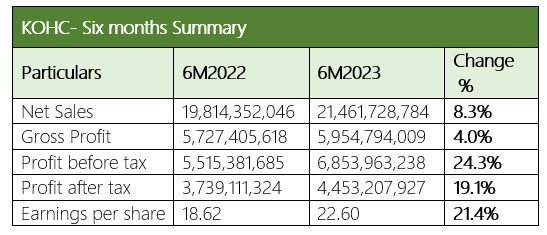

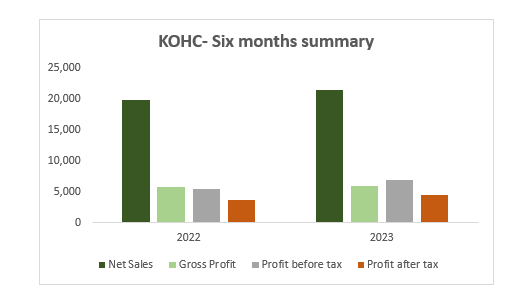

The revenue of Kohat Cement Company Limited (KOHC) grew by 8.3%, gross profit by 4%, and after-tax profit by 19.1% in the first half of the ongoing Fiscal Year (1HFY24) compared to 1HFY23, WealthPK reports. The company posted a revenue of Rs21.4 billion and gross profit of Rs5.9 billion in 1HFY24. The profit-after-tax stood at Rs4.4 billion compared to Rs3.7 billion in 1HFY23, resulting in an Earning Per Share (EPS) of Rs22.60 against Rs18.62 in 1HFY23.

The profit-before-tax increased to Rs6.8 billion in 1HFY24 from Rs5.5 billion in 1HFY23, registering a 24.3% growth. Moreover, the cost of sales increased by 10%, mainly attributable to higher fuel, power, and packing material costs. On the expense side, the finance costs for the period experienced a 12% increase, rising from Rs342.4 million to Rs383.4 million, which signifies the need for effective implementation of financial discipline to stop the escalating finance costs and to achieve efficiency across all the operations successfully.

Analysis of Quarterly Variations

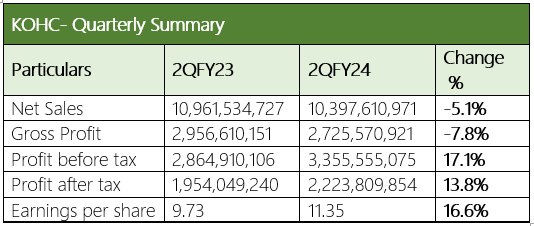

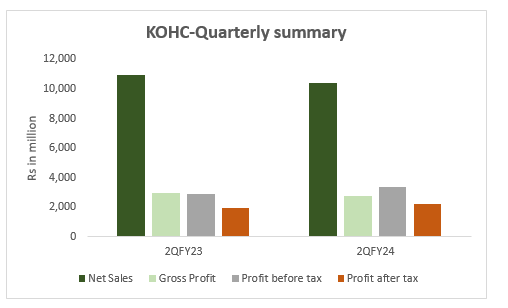

In comparison to the second quarter of FY23, the company's revenues decreased from Rs10.9 billion to Rs10.3 billion in 2QFY24, representing a decline of 5.1%. The gross profit of Rs2.9 billion in 2QFY23 decreased by 7.8% in 2QFY24. The company reported an after-tax profit of approximately Rs 1.9 billion in 2QFY23. Furthermore, in 2QFY24, it posted a net profit of Rs 2.2 billion which represents a significant improvement in profitability, with a percentage change of 13.8%. In 2QFY24, KOHC posted a quarter-based EPS of Rs11.35.

Historical Performance (2018-2022)

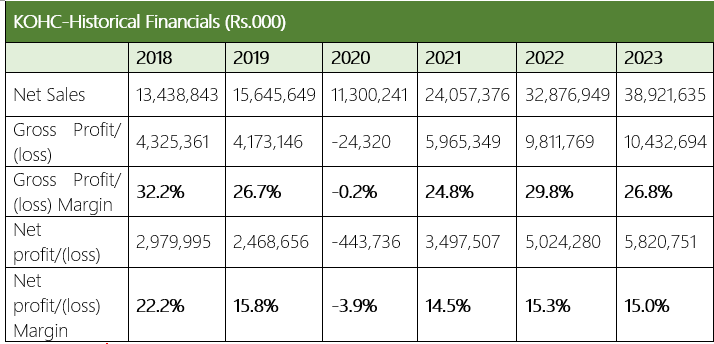

KOHC's topline has been improving since 2018, except for a dip in 2020 due to the Covid-19 pandemic. However, the profit margins considerably shrank over the years. In 2019, the company's top line grew by 16.4% Year-on-Year (YoY); however, its bottom line, on the contrary, declined by 17% YoY. During the year, tremendous increase in the cost of production resulted in a 4% dip in the gross profit. With a 17% YoY dip in the net profit, the NP margin clocked in at 15.8% in 2019 versus 22.2% in 2018.

The company witnessed an enormous 28% drop in topline, depicting a decline in volumes along with a reduction in cement prices. The finance cost increased by over 700% owing to higher long-term financing obtained for the completion of its new cement line. The company registered a net loss margin of 3.9% in 2020. During 2021, the KOHC's topline witnessed a 113% YoY growth backed by improved selling prices, CPEC-related activities, and government initiatives for the real-estate sector, including low-cost housing projects and subsidized house financing.

The profit margins rebounded after a terrible dip in 2020. The year 2022 followed the growth trajectory in terms of topline and bottom line. The company's gross profit and net profit registered a YoY growth of 64.5% and 43.7%, respectively, in FY22. In 2023, the topline of KOHC posted an 18.4% YoY growth on account of higher prices. Owing to the high cost of production, the GP margin took a dip to clock in at 26.8% in 2023 versus 29.8% last year.

Company Information and Future Prospects

Kohat Cement Company Limited is one of the leading cement manufacturing companies in Pakistan incorporated in 1980. It is registered on the Pakistan Stock Exchange (PSX) with the symbol "KOHC", with a market capitalization of Rs38.08 billion. The company witnessed a decline in demand arising from inflationary pressures and currency fluctuations. However, it is determined to work with the authorities concerned to overcome these challenges and enhance the operational activities.

Industry Overview

The cement industry of Pakistan has witnessed an overall growth of 9.73% during the half-year ending December 31, 2023, compared to the same period last year. The increase is mainly due to a 110.6% surge in cement exports due to local currency depreciation. However, in the domestic market, the demand remained flat during the six months.

Credit: INP-WealthPk