INP-WealthPk

Ayesha Mudassar

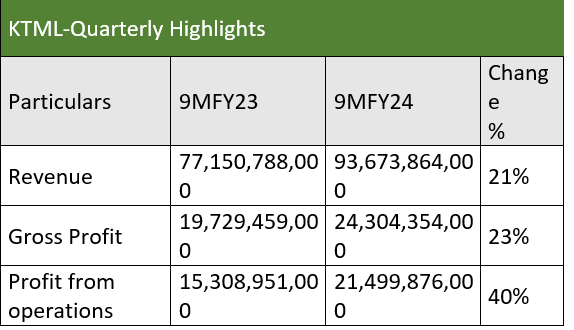

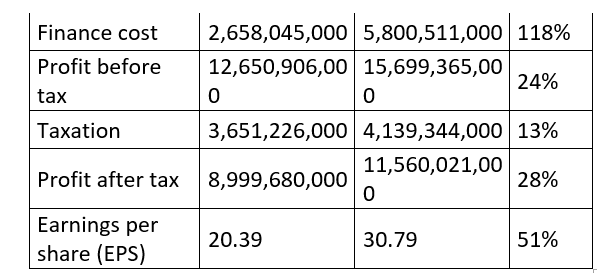

Kohinoor Textile Mills Limited (KTML) witnessed an increase of 24% and 28% in before-and-after-tax profits, respectively, during the nine months of the fiscal year 2023-24 compared to the corresponding period of the earlier year, reports WealthPK.

The company reported a pre-tax profit of Rs15.6 billion and an after-tax profit of Rs11.5 billion in 9MFY24. The profit translated into earnings per share (EPS) of Rs30.79 versus an EPS of Rs20.39 recorded in the same period of FY23.

Furthermore, KTML observed a 23% and 40% rise in gross and operating profits, respectively, during the period under review. The company’s revenue increased 21% year on year to Rs93.6 billion. The company's performance improved over the previous period, driven by an increase in exports, a one-off positive impact from rapid devaluation, and savings from the company's self-generation of power. Despite prevailing economic challenges, the company continues to invest with a focus on quality, capacity increase, and diversification of its product lines. Further, KTML continues to rapidly expand solar energy generation to become a 'green company'.

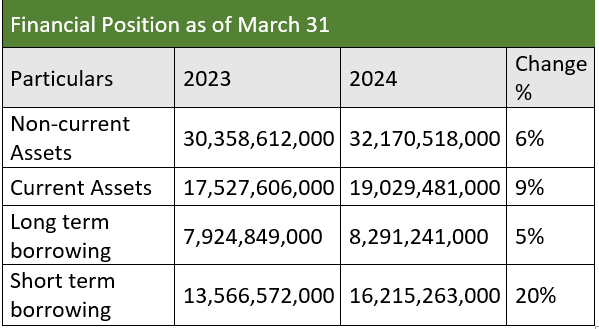

Financial position as of March 31, 2024

The analysis of the company’s financial position shows a growth of 6% in its non-current assets during the nine months ended March 31, 2024, compared to the same period last year. This rise indicates the company’s investment in the modernisation of production facilities.

Moreover, the rise in current assets is primarily attributed to an increase in trade debts, advances, and short-term prepayments. This increase aligns with the company’s regular business expansion requirements. The company’s long-term borrowing witnessed a growth of 5% compared to 9MFY23. This growth shows that the company took additional long-term liabilities or debt for the expansion and modernisation of production facilities and solar-based power generation plants. Furthermore, the rise in short-term borrowing in the current year is in line with the growing business operations and high working capital demands of the company.

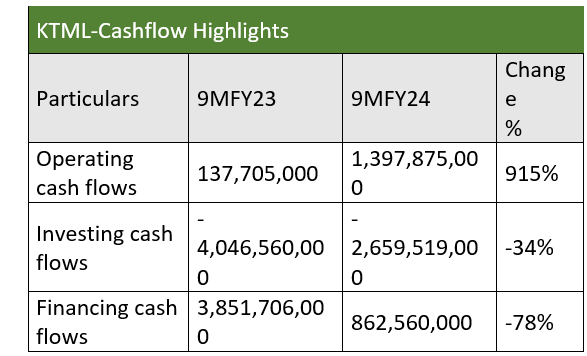

Cashflow highlights

The company’s operating cash flows observed a substantial increase of 915% during the period under review. This remarkable growth is largely attributed to a significant improvement in the company’s core operational efficiency and cash generation capabilities. The reduction in cash outflows from investing activities is primarily due to a notable decrease in capital expenditure on fixed assets and greater proceeds from the disposal of property, plant, and equipment. Moreover, financing cash flows decreased by 78% in 9MFY24, reflecting the repayment of long-term financing.

Overall, the table illustrates a shift towards enhanced operational efficiency, a more restrained investment strategy, and a decrease in reliance on external financing.

About the company

Kohinoor Textile Mills is a public limited company incorporated in Pakistan under the Companies Act, 1913 (now the Companies Act, 2017), and listed on the Pakistan Stock Exchange Limited. In pursuit of sustainable growth, the company has strategically embraced a policy of horizontal integration encompassing weaving, processing and home textiles activities to address the dynamic challenges posed by the market.

Credit: INP-WealthPk