INP-WealthPk

Ayesha Mudassar

Murree Brewery

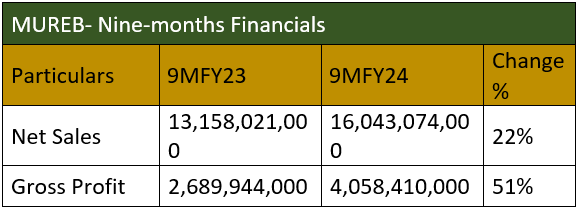

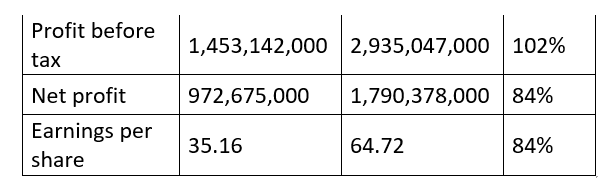

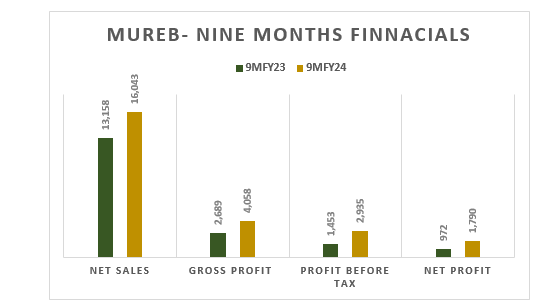

Company Limited (MUREB) witnessed its profitability surge by 84% to Rs1.7 billion during the first nine months (July-March) of the fiscal year 2023-24 from Rs972.6 million in 9MFY23, reports WealthPK. The gross profit rose by 51% to Rs4.05 billion in 9MFY24. Additionally, the profit-before-tax saw a significant increase of 102%, totalling Rs2.9 billion during the period under review.

Moreover, the net revenue posted a reasonable growth of 22%, reaching Rs16.04 billion. This increase in sales is attributed to heightened consumer demand and the company’s strategic marketing efforts. The earnings per share (EPS) for the nine months of FY24 stood at Rs64.72, reflecting an 84% rise compared to the same period last year. The rising EPS suggests an increase in the company’s earnings available to shareholders per share.

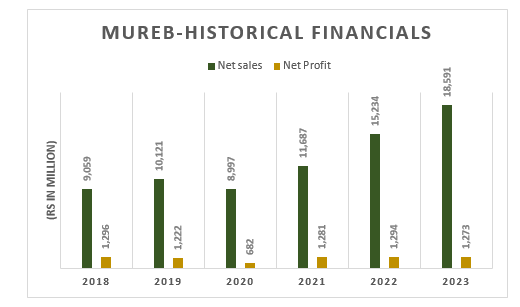

Operational performance (2018-23)

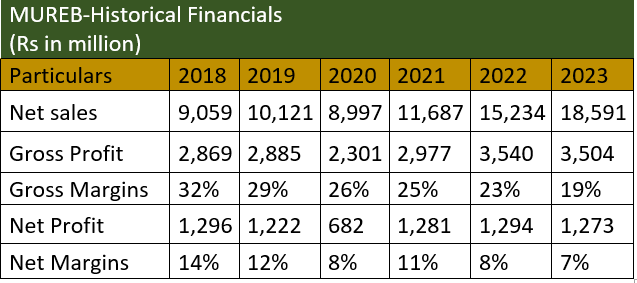

MUREB has demonstrated consistent top-line growth over the years, except in 2020. Conversely, the bottom line only showed growth in 2021 and 2022. The gross profit of the company descended until 2020 before rebounding in subsequent years, while net profit, which kept declining until 2020, rebounded in 2021 and 2022 before falling in 2023. In 2019, MUREB’s net sales posted a reasonable year-on-year (YoY) growth of 12%, reaching Rs10.1 billion. The company’s sales mix is predominantly driven by Pakistan-made Foreign Liquor (PMFL) and non-alcoholic beverages. However, the net profit slid by 6% YoY to Rs1.2 billion, with a net profit margin of 12% versus 14% in 2018. In 2020, the company’s top line experienced an 11% YoY decline. All categories, excluding tetra-pack juices, bottled drinking water, and glass products, posted a decrease in sales revenue. Owing to curtailed production, the gross profit fell by 20%, with this margin nosediving to 26% in 2020 from 29% in 2019. The net profit of MUREB plunged by 44% to clock in at Rs682 million, with the net profit margin dropping to 8% in 2020 from 12% in 2019.

In 2021, MUREB’s top line posted the highest-ever sales growth of 30% on account of high exports. Robust sales and contained expenses drove the net profit up by a stunning 88%, with the net profit margin climbing up to 11%. MUREB’s top line grew by another 30% in 2022 backed by both local and export sales. Record high inflation, rupee depreciation, as well as high energy charges, pushed the cost of sales up by 34% in 2022, culminating in a drop in gross profit margin to 23% from 25% in 2021. Furthermore, the imposition of super tax almost nullified the bottom-line growth, which grew by only 1% to clock in at Rs1,294 million. The year 2023 didn’t prove to be encouraging for MUREB. Rupee depreciation, commodity super cycle in the global market, and high fuel and power charges drove the gross profit down by 1% YoY in 2023. Gross profit margin also nosedived from 23% in 2022 to 19% in 2023. Moreover, the bottom line slumped by 2% YoY to clock in at Rs1,273 million with a net profit margin of 7% against 8% during 2022.

The company and its operations

Murree Brewery Company was incorporated as a public limited company in February 1861. The principal activity of the company is the manufacturing and sale of alcoholic beer, non-alcoholic beer, PMFL, aerated water, mineral water, food products as well as glass bottles and jars. The company presently operates three divisions, namely liquor, tops and glass.

Future outlook

The coming months present challenges and uncertainties with continuing political instability and high inflation. Given the unpredictable economic environment, the company’s management remains alert in its endeavour to continue to bring the best possible value to its shareholders.

Credit: INP-WealthPk