INP-WealthPk

Ayesha Mudassar

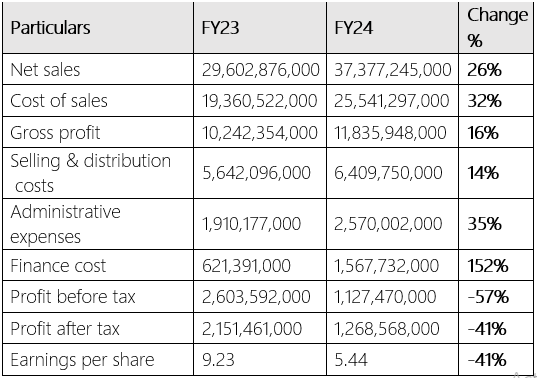

National Foods Limited (NATF) – a prominent food manufacturer – experienced a significant decline in profitability during the Fiscal Year 2024. The company reported a 57% decrease in the profit before tax and a 41% reduction in the profit after tax compared to the previous fiscal year, reports WealthPK.

In FY24, the company recorded a pre-tax profit of Rs1.1 billion and a post-tax profit of Rs1.2 billion. The decline in profit can be primarily attributed to the elevated interest rates associated with financing for the Faisalabad manufacturing facility and investments made abroad to establish a foundation for international business growth.

The net sales increased to Rs37.3 billion, up from Rs29.6 billion in FY23, representing a rise of 26%. Additionally, the cost of sales witnessed a 32% increase during the year. On the expense side, the distribution costs rose by 14%, while the administrative expenses grew by 35%. These trends highlight the impacts of high inflation and rising freight charges.

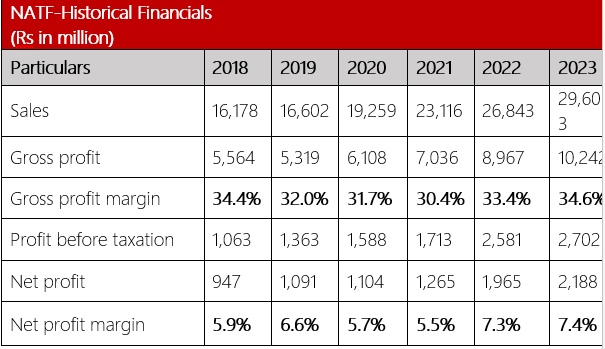

Performance over the six years (2018-2023)

National Foods has consistently improved its financial performance since 2018, as evidenced by the constant rise in its sales and net profit. However, the company’s margins have followed a cyclical pattern. After a three-year decline, the gross margin rebounded in 2022 and peaked in 2023. Conversely, the net profit margins initially increased in 2019 but declined in 2020 and 2021.

In 2019, the company recorded a modest increase of 3% in its topline. However, the rising inflation and currency depreciation resulted in 4% smaller gross profit with the GP margin falling from 34.4% in 2018 to 32.0% in 2019. The net profit stood at Rs1.09 billion with an NP margin of 6.6%. In 2020, the company continued to sustain and posted a moderate 16% YoY growth in its net sales. The gross profit grew by 15% YoY in 2020; however, the GP margin witnessed a decline and was reported at 31.7%. The company’s net profit was Rs1.1 billion with an NP margin of 5.7%. The year 2021 fetched a 20% YoY improvement in the NATF’s sales. This growth was mainly due to the resumption of business activities after Covid-19. This translated into a 15% YoY increase in gross profit, which stood at Rs7.03 billion in 2021 with a GP margin of 30.4%. In 2022, the company achieved a 16% YoY increase in its topline.

This rise was primarily driven by portfolio rationalization, price revisions, and exchange gains on export sales. The company's cost transformation measures along with strategic buying decisions led to a 27% rise in gross profit. The bottom line posted a 55% YoY growth to Rs1.9 billion with an NP margin of 7.3%. In 2023, the company registered a 10% YoY growth in net sales. This rise was mainly led by price revisions to counter high inflation, increased borrowing costs, depreciation of the rupee, and significant rises in energy costs. Furthermore, the company's gross profit grew by 14% with a GP margin of 34.6%. The net profit increased by 11% YoY, totalling Rs2.1 billion in 2023 with an NP margin of 7.4%

About the company

National Foods was incorporated in Pakistan on February 19, 1970 as a private limited company under the Companies Act 1913. It was subsequently converted into a public limited company under the Companies Ordinance, 1984 (now Companies Act 2017). The company is principally engaged in the manufacture and sale of a wide range of food products including pickles, ketchups, and desserts.

Future Outlook

Despite challenging economic conditions, the company is committed to innovation, efficiency, and strategic planning for maintaining a leading position in all major categories and ensuring a sustainable growth.

Credit: INP-WealthPk