INP-WealthPk

Qudsia Bano

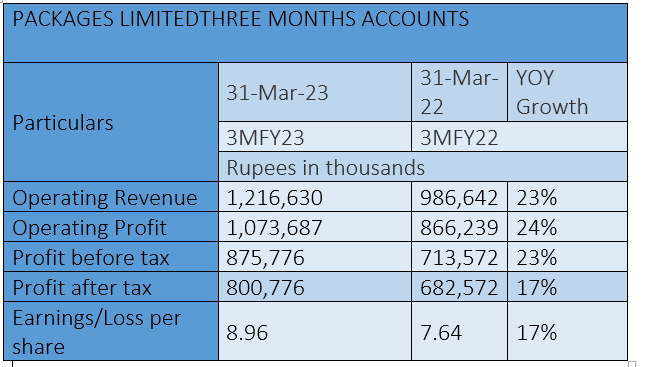

Packages Limited, a leading packaging and paperboard manufacturing company in Pakistan, has reported impressive financial results for the three months ending March 31, 2023 (FY23). The company showcased robust growth across key financial metrics, reaffirming its position as a market leader in the industry. During the three months, Packages Limited's operating revenue reached Rs1.22 billion, exhibiting a significant year-on-year growth of 23% compared to the corresponding period in the earlier fiscal (FY22). The substantial increase in operating revenue is a testament to the company's effective sales strategies, successful product offerings, and strong customer demand. The company's operating profit for the three months amounted to Rs1.07 billion, demonstrating a remarkable growth rate of 24% compared to the same period last year.

This noteworthy increase in operating profit highlights the company's operational efficiency and cost management practices. Packages Limited's profit-before-tax for the three months stood at Rs875.78 million, indicating a substantial year-on-year growth of 23%. The increase in the before-tax profit reflects the company's ability to generate strong operating profits, despite prevailing market challenges and economic conditions. The post-tax profit for the three months reached Rs800.78 million, representing an impressive growth of 17% compared to the corresponding period of the previous fiscal year. The rise in the post-tax profit underscores the company's consistent profitability and effective tax management strategies. Earnings per share (EPS) for the three months stood at Rs8.96, showcasing a notable growth rate of 17% compared to the same period of the previous year.

The higher EPS indicates enhanced profitability on a per-share basis and reflects the company's commitment to creating value for its shareholders. Packages Limited's strong performance in the three months accounts reaffirms its position as a market leader in the packaging and paperboard industry. The company's ability to achieve remarkable revenue and profit growth, despite challenging market conditions, is a testament to its sound financial management and customer-centric approach.

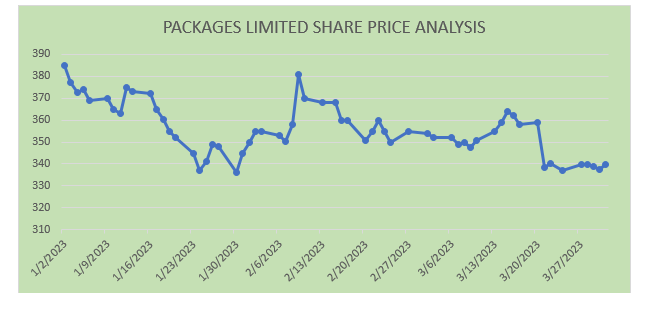

Share price analysis

Over the three-month period from January 2 to March 31, 2023, the share prices of the company exhibited a mix of both upward and downward movements, reflecting the typical fluctuations witnessed in the stock market. The initial period of January and early February saw a gradual uptrend, with the share prices rising from Rs380.98 to Rs385. This upward movement may have been influenced by positive market sentiment, favourable company news, or strong financial performance. However, a notable price correction occurred in late February, with the share prices declining from Rs385 to around Rs350.

This correction could be attributed to profit-taking by investors, changes in market conditions, or macroeconomic factors impacting investor sentiment. Subsequently, from late February to mid-March, the share prices staged a recovery, climbing back up from Rs350 to Rs364. This recovery might have been influenced by positive company developments or renewed interest from investors. Following the recovery, the share prices entered a phase of sideways movement from mid to late March, fluctuating within a relatively narrow range between Rs350 and Rs365. This period of sideways movement indicated a certain degree of indecision in the market, with limited new information driving significant price changes.

Towards the end of March, the share prices experienced increased volatility, oscillating between Rs337 and Rs339.99. Such volatility might have been related to broader market conditions, macroeconomic uncertainties, or company-specific factors impacting investor sentiment. Throughout the three-month period, the share prices responded to a variety of factors, including company performance, industry trends, economic conditions, and overall market sentiment. Additionally, share prices can be influenced by news, rumours, geopolitical events, and changes in the overall market environment.

About the company

Packages Limited is a public-limited company engaged in the manufacture and sale of packaging materials and tissue products. The company also holds investments in other companies.

Credit: INP-WealthPk