INP-WealthPk

Shams ul Nisa

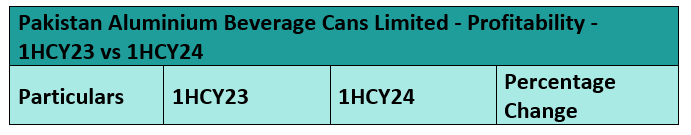

The total sales of Pakistan Aluminium Beverage Cans Limited (PABC) grew by 5.5% in the first half of the ongoing calendar year 2024 compared to the corresponding period of 2023, reports WealthPK. The increase was attributed to higher export sales despite an 11.1% drop in domestic sales caused by high energy costs.

Furthermore, the cost of sales increased by 9.8% in1HCY24, which resulted in a modest 1.06% decrease in gross profit during the period under review. However, the other income saw an impressive 140.46% jump, reflecting the successful diversification of income sources.

Despite the drop in gross profit, operating profit grew significantly by 26.48%, suggesting effective control of operating expenses and enhanced operational efficiency. Profit-before-tax rose by 22.38%, and net profit saw a modest gain of 1.9% in 1HCY24. Earnings per share increased slightly to Rs7.66 in 1HCY24 from Rs7.52 in 1HCY23, offering shareholders slightly better returns and potentially boosting investor confidence.

Assets, equity and liabilities

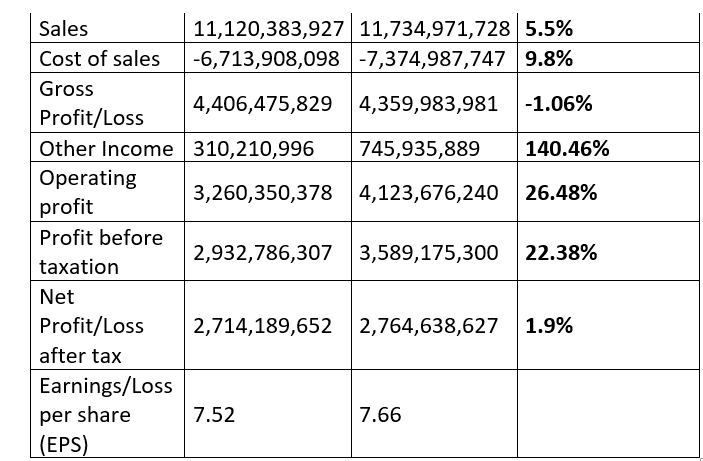

The company's non-current assets saw a slight decline of 0.32% in June 2024 compared to December 2023, reflecting stability in long-term investments and fixed assets. Meanwhile, current assets grew by 40.48% during this period, signalling improved liquidity. This increase is attributed to higher trade debts, advances, deposits, prepayments, other receivables, income tax refunds, accrued income, short-term investments, and cash and bank balances during the period. Non-current liabilities grew by 31.67%, mainly due to a rise in deferred tax liabilities, raising concerns about the company's long-term financial leverage and its capacity to manage these obligations effectively. Furthermore, current liabilities also increased by 24.23% in June 2024, driven by higher trade and other payables, short-term borrowings, accrued finance costs, and the current portion of long-term financing.

Total equity and liabilities rose by 25.86%, indicating overall growth in the company's financial structure and a positive trend in attracting investments.

Ratio analysis

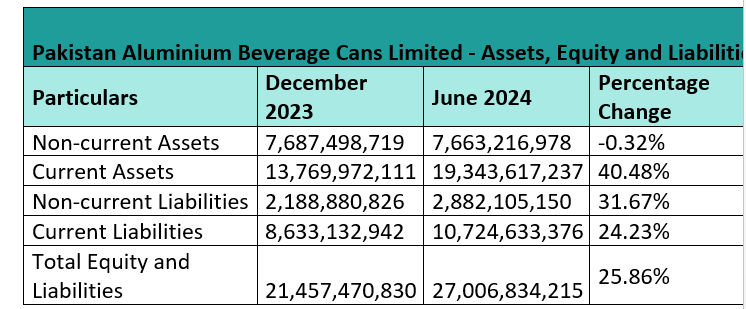

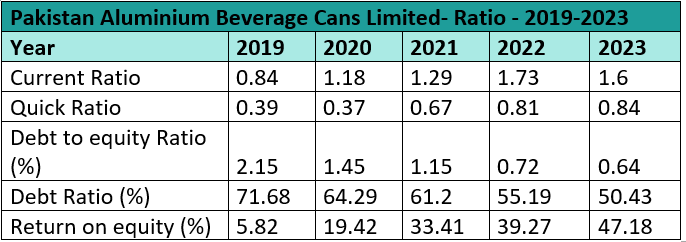

The company's current ratio rose from 0.84 in 2019 to 1.60 in 2023, reflecting improved working capital management and a stronger ability to cover current liabilities. Similarly, the quick ratio, which assesses the company's capacity to meet short-term obligations without depending on inventory sales, increased from 0.39 in 2019 to 0.84 in 2023. Additionally, the debt-to-equity ratio saw a substantial decline from 2.15% in 2019 to 0.64% in 2023, indicating that the company has been actively lowering its debt levels relative to equity, enhancing financial stability and minimising risk for shareholders.

The debt ratio fell from 71.68% in 2019 to 50.43% in 2023, signifying an improved capital structure and reduced financial risk. Meanwhile, the return on equity experienced significant growth, increasing from 5.82% in 2019 to 47.18% in 2023. This suggests that the company has successfully leveraged shareholders' equity to generate profits.

Future outlook

The company's performance is impacted by the uncertain economic environment in Pakistan due to sluggish domestic demand, strained consumer income, and unrest in the Middle East. Additionally, high fuel and energy costs, and logistical disruptions at the Afghan border impact the company's exports to Afghanistan and Central Asia. Despite these difficulties, new local brands and international investments offer hope for increased domestic demand. The company is also expanding export markets to offset local demand shortfalls.

Company profile

PABC was incorporated in Pakistan on December 4, 2014. It was listed on the Pakistan Stock Exchange on July 16, 2021. The company specialises in manufacturing and selling aluminium cans. It began commercial operations in September 2017 after completing its manufacturing facility at the Faisalabad Special Economic Zone.

Credit: INP-WealthPk