INP-WealthPk

Ayesha Mudassar

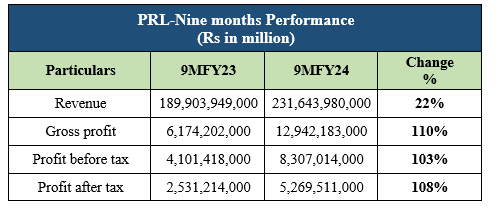

Pakistan Refinery Limited (PRL) unveiled its profit and loss statement for the nine months ending March 2024, wherein the profit after tax clocked in at Rs5.2 billion, compared to a profit of Rs2.5 billion in the same period last year, according to WealthPK. Going by the results, the net sales revenue increased to Rs231.6 billion in 9MFY24 compared to Rs189.9 billion in 9MFY23, thus posting a 22% growth. The rise in the company’s revenue was primarily due to high petroleum product prices and greater production of high-speed diesel and motor gasoline.

The company’s gross profit ballooned to Rs12.9 billion from Rs6.1 billion in 9MFY23. Furthermore, the profit-before-tax skyrocketed to Rs8.3 billion in 9MFY24 from Rs4.1 billion in 9MFY23, registering a whopping 103% growth.

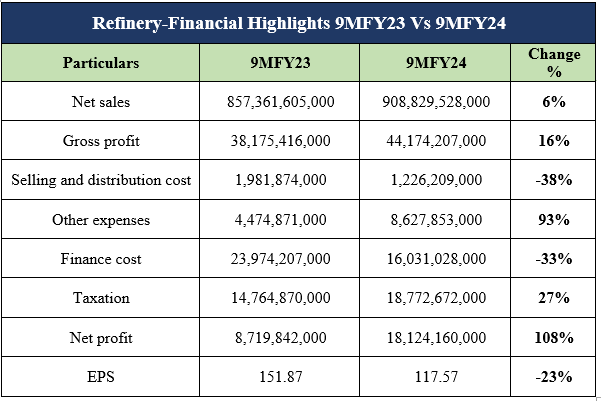

Refinery Sector- 9MFY23 vs 9MFY24

Pakistan's refinery sector recorded a notable 108% year-on-year (YoY) surge in net profit during the 9MFY24, clocking in at Rs18.1 billion compared to a profit of Rs8.7 billion in 9MFY23. The refinery sector includes; Cnergyico PK Limited (CNERGY), Attock Refinery Limited (ATRL), National Refinery Limited (NRL), and Pakistan Refinery Limited (PRL).

As per the results compiled by WealthPk of the income statements of the four refinery companies, the sector saw a slight increase of 6% YoY in its sales, worth Rs908.8 billion as compared to Rs857.3 billion in 9MFY23. On the expense side, the sector observed a decrease in selling and distribution expenses by 38% YoY while other expenses rose by 93% YoY to clock in at Rs8.6 billion during the review period. In addition, the industry’s finance cost dipped by 33% YoY and stood at Rs16.03 billion as compared to Rs23.9 billion in 9MFY23. On the tax front, the sector paid a significantly larger tax worth Rs18.7 billion against Rs14.7 billion paid in the corresponding period of last year, depicting a rise of 108% YoY.

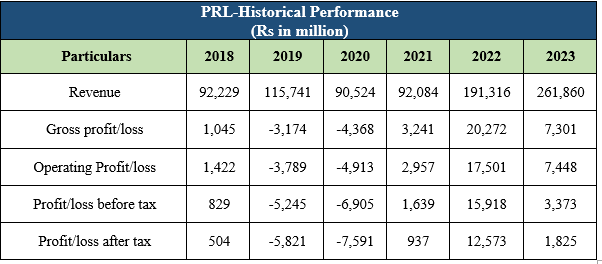

Company’s performance over the last six years (2018-2023)

Refineries have had a tough time in Pakistan mainly due to outdated technology, depressed refining margins, and a credit crunch in the country’s energy sector. During 2019, the refinery posted a shocking decline in earnings due to a fall in petrol prices, steep devaluation of the currency, and depressed refining margins. As a result, the company incurred a loss of Rs5.8 billion in 2019 as compared to a profit of Rs504 million in 2018. Owing to the Covid-19 pandemic, the PRL's earnings were again adversely affected in the year 2020. During the year, the company's loss after tax extended to Rs7.5 billion from Rs5.8 billion in 2019. The fiscal year 2021 was a recovery year. Better product mix, exchange gains, and changes in pricing policy helped the PRL turn losses into profits. The company earned a net profit of Rs937 million during the year.

In 2022, PRL witnessed a record profit owing to healthy gross refinery margins, better inventory management, and optimal product mix. The company's revenue growth doubled in 2022 on the back of higher volume and prices. This was a memorable year for PRL as it recorded not only the highest revenues for the company but also the highest ever gross profits and net profit for the company. During 2023, the refinery experienced a significant fall of 85.5% Year-on-Year (YoY) in its profitability, clocking in its profit after tax of Rs1.8 billion in the fiscal year 2022-23, as compared to a profit of Rs12.5 billion in the earlier fiscal year. The lower profit was mainly due to challenging and adverse economic conditions that included depletion of the country's foreign exchange reserves, depreciation of local currency, and highest-ever inflation.

Company Profile

PRL is a hydro-skimming refinery incorporated in Pakistan as a public limited company in May 1960. PRL is engaged in the production and sale of petroleum products. PRL operates as a subsidiary of Pakistan State Oil Company Limited (PSO), which is the largest oil marketing company in Pakistan.

Credit: INP-WealthPk