INP-WealthPk

Shams ul Nisa

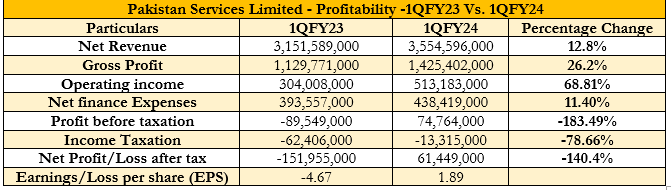

The Pakistan Services Limited achieved a net revenue of Rs3.55 billion in the first quarter of the ongoing fiscal year 2024, showcasing a considerable increase of 12.8% compared to Rs3.15 billion in 1QFY23, report WealthPK. The company ended the first quarter with a gross profit of Rs1.42 billion, as opposed to Rs1.12 billion in the same period last year, reflecting an increase of 26.2%. Additionally, the operating profit expanded by 68.81%, clocking in at Rs513.18 million in 1QFY24 compared to Rs304.0 million in 1QFY23.

On the expenses front, the increase in finance cost added to the hike in net finance expenses to Rs438.4 million in 1QFY24, from Rs393.5 million in the same period last year, indicating a growth of 11.40%. The factors that fueled this hike include the rise in worldwide fuel prices, high markup cost coupled with depreciation in currency. However, at the end of the review period, the company earned a profit after tax of Rs74.7 million against a loss after tax of Rs89.5 million in 1QFY23, posting a surge of nearly 183.49% year-over-year. During the period, the company bore an income tax of Rs13.3 million, 78.66% lower than Rs62.4 million in 1QFY23. As a result, the net profit rose 140.4% to Rs61.44 million in 1QFY24 from a net loss of Rs151.9 million in 1QFY23. The higher revenue gain coupled with a decrease in finance cost lifted the earnings per share of the company to Rs1.89 in 1QFY24 from a loss per share of Rs4.65 in the same quarter last year.

Historical Trend

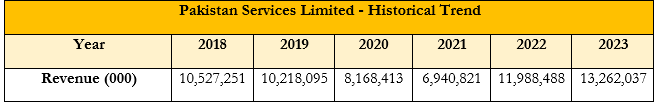

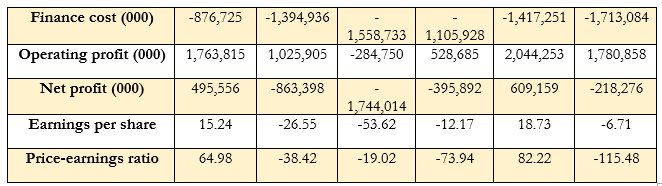

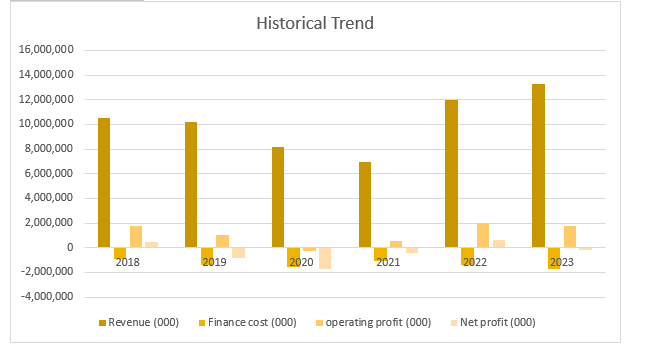

The historical trend analysis of the past six months of Pakistan Services Limited portrays a declining trend, from Rs10.5 billion in 2018 to Rs6.9 billion in 2021. This is because the COVID-19 pandemic resulted in a slowdown of operational activities such as the room division and the food and beverage division. Additionally, the inflationary pressure added to the cost hike, pushing revenue downwards. However, it regained its momentum in 2022 and 2023, clocking in at Rs11.98 billion and Rs13.26 billion respectively.

Finance costs remained volatile over the six years, ranging between the lowest of Rs876.7 million in 2018 and the highest of Rs1.78 billion in 2023. Following a downward trajectory, the company reported an operating profit of Rs1.76 billion in 2018. In 2020, it incurred an operating loss of Rs284.7 million, before registering the highest operating profit of Rs2.04 billion in 2022. Furthermore, the operating profit stood at Rs1.78 billion in 2023. Starting with a net profit of Rs495.5 million in 2018, the company witnessed a net loss for the next period of three years from 2019 to 2021. In 2022, the company was able to generate a net profit of Rs609.1 million but registered a net loss of Rs218.27 million in 2023. The Pakistan Service Limited posted the highest earnings per share of Rs18.73 in 2022 and the highest loss per share of Rs53.62 in 2020. The price-earnings ratio remained negative in 2019, 2020, 2021, and 2023 with the value of 38.42, 29.02, 73.94 and 115.48 respectively. The company recorded a positive price-earnings ratio of 64.98 in 2018 and 82.22 in 2022.

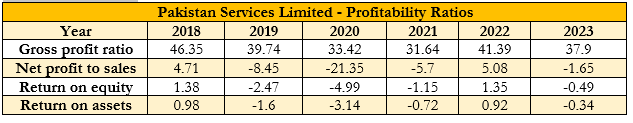

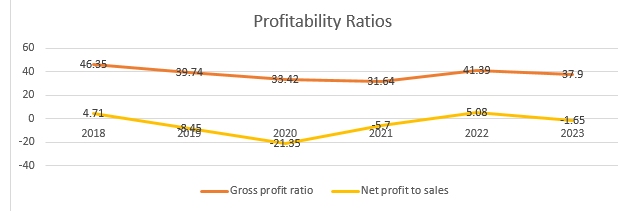

Profitability Ratios

The company has witnessed a declining gross profit ratio over the last six years, while the net profit to sales suffered between 2019 and 2021, before rising again in 2022 and declining in 2023. Similarly, the return on equity and assets dwindled, showcasing declining profitability by efficient utilization of assets and equity.

Over the last six years, the highest gross profit ratio of 46.35% was registered in 2018, and the lowest of 31.64% in 2021. The company observed a net loss-to-sales ratio in 2019, 2020, 2021, and 2023, with only net profit to sales in 2018 and 2022. In 2018, the company achieved a maximum return on equity and assets ratio with values of 1.38% and 0.98% respectively.

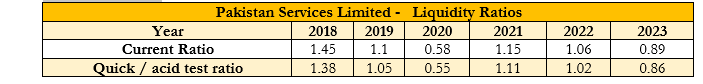

Liquidity Ratios

The current ratio remained under pressure during the six years, with a value lower than 1.2, except for the year 2018 with a current ratio of 1.45. The quick ratio declined from 1.38 in 2018 to 0.86 in 2023, reflecting increasing risk to cover short-term obligations. However, it remained stable in the last six years except in 2020, as it reached a value of 0.55.

Company profile

The Pakistan Services Limited was established as a public limited company on December 6, 1958. The company owns and operates the network of Pearl Continental Hotels, and its primary activity is hotel management. Additionally, the company has a single modestly sized Lahore property that operates as a low-cost hotel. Furthermore, the company offers franchises for the use of its brand and trademark, Pearl Continental.

INP:Credit: INP-WealthPk