INP-WealthPk

Amir Khan

Pakistan’s current account deficit (CAD) witnessed a significant reduction of over 78% in the first month of FY25, signalling a positive economic momentum for the country. According to the State Bank of Pakistan (SBP), the CAD stood at $162 million in July 2024 – a sharp decline from $741 million recorded during the same period in the previous fiscal year. This remarkable contraction is attributed to an 188% decrease in the trade deficit, a key indicator of the nation’s economic health.

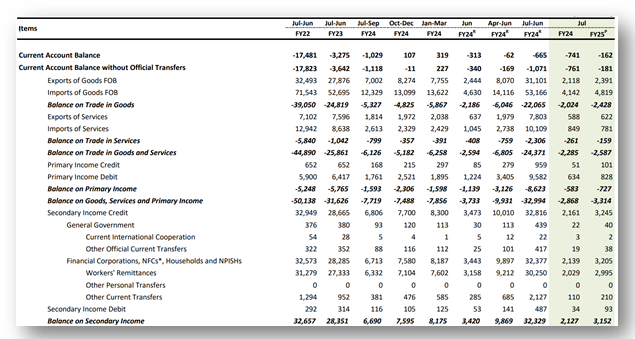

Pakistan’s Current Account Data. Source: State Bank of Pakistan (Values are in $ millions)

The decline in the CAD continues a trend that began in the latter half of FY24. During the first half of the previous fiscal year, Pakistan struggled with a high CAD, but focused efforts by the government and the SBP to curb imports and stabilize the foreign exchange reserves led to a reduction. Moreover, by the end of FY24, the CAD had narrowed to just over half a billion dollars – a considerable achievement given the challenging global economic environment. The SBP’s data also highlights the dynamics of exports and imports in July. Exports of goods rose to $2.391 billion, compared to $2.118 billion in July 2023, marking a notable improvement. The export of services also showed a slight increase, reaching $622 million, up from $588 million in the previous year. On the import side, the figures presented a mixed picture. The import of goods increased to $4.689 billion, up from $4.142 billion in July 2023, indicating a rise in demand. However, the import of services declined to $761 million from $849 million, reflecting some relief on the services trade front. Overall, Pakistan’s exports in July totalled $3.013 billion, while imports amounted to $5.470 billion, resulting in a trade gap of $2.457 billion.

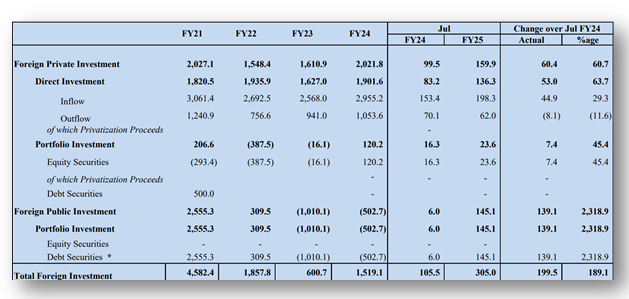

Pakistan’s Foreign Direct Investment Data. Source: State Bank of Pakistan (Values are in $ millions)

In addition to the improvement in the CAD, the foreign direct investment (FDI) increased in July. The SBP reported an increase of 64% in FDI, which amounted to $136.3 million compared to $83.2 million in July 2023. While this increase is encouraging, it is important to note that the overall FDI figures remain relatively modest, especially when compared to the other regional countries. The rise in FDI in July was driven primarily by inflows from China. China accounted for $45.1 million of the FDI, up from $21.2 million the previous year. In contrast, other countries showed less enthusiasm for investing in Pakistan. Additionally, the United Kingdom and the United States contributed $22 million and $13.2 million, respectively. A sectoral breakdown of the FDI reveals that the power sector was the largest beneficiary, attracting $62 million in July, up from $50.2 million in the same month last year. The oil and gas exploration sector followed, with $30 million in FDI, compared to $17 million in July 2023. The financial business sector also saw a notable increase, securing $20.4 million in investments – a significant jump from just $4.6 million in the previous year.

Credit: INP-WealthPk