INP-WealthPk

Shams ul Nisa

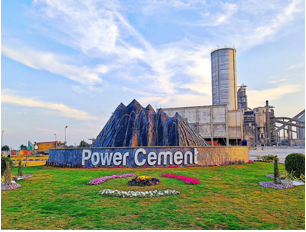

The Power Cement Limited (PCL) is tapping rising global clinker prices and regional demand to accelerate export growth, positioning itself as a key driver of industrial resilience and economic momentum, reports WealthPK.

PCL posted a 28% year-on-year rise in cement and clinker exports, driven by a 33.3% export surge from the southern region, despite a slight overall decline of 2.3% in domestic sales. This performance reflects the company’s strategic focus on regional markets, offering competitively priced products that meet international quality standards.

PCL’s growing export focus is generating wider economic gains. Moreover, higher foreign exchange inflows help bolster Pakistan’s external account and offset import pressures. Steady production, supported by export revenue, ensures continued employment within the company and across its supply chain, offering economic stability amid subdued domestic demand.

Additionally, export-driven earnings enable further investment in energy-efficient technologies and industrial upgrades, strengthening the long-term competitiveness of Pakistan’s manufacturing sector. Despite an overall decline in capacity utilization to 61% from 76% last year due to domestic demand challenges, PCL has successfully improved its profit margins.

This was driven by operational efficiencies, effective use of alternative fuels to cut energy expenses, and disciplined cost management. Additionally, rising international clinker and cement prices also support a positive outlook for higher margins and export volumes. The company’s efforts to reduce finance costs and streamline working capital have further strengthened its financial position, paving the way for sustained export-led growth and profitability despite volatile commodity markets.

Looking ahead, PCL’s export strategy aligns with broader economic forecasts that anticipate Pakistan’s GDP growth to rise to 4% in FY26. Inflation is expected to ease to a range of 5.5% to 7.5%, offering a more stable cost environment. Furthermore, government efforts to boost housing and infrastructure development, including a federal task force on housing and provincial initiatives in Sindh, are expected to drive domestic demand for cement.

Anticipated energy cost reductions and a more accommodative monetary policy may further improve cost efficiency, strengthening the company’s competitiveness in export markets. Despite persistent global economic uncertainty and uneven domestic demand, PCL remains well-positioned to manage challenges thanks to its strong export focus and favorable policy environment.

The company has benefited from a Rs15 billion capital injection by its sponsors, which has significantly enhanced its financial foundation and enabled continued investment in expanding export capacity and modernizing operations. PCL’s targeted export growth strategy, spurred by higher clinker prices, has proven to be both commercially effective and economically significant.

The company is playing a vital role in boosting foreign exchange earnings, sustaining employment, and reinforcing Pakistan’s long-term growth path by capitalizing on favorable global trends and aligning with national development goals. The company’s efforts are helping position Pakistan as a competitive force in the regional construction materials industry.

Credit: INP-WealthPk