INP-WealthPk

Shams ul Nisa

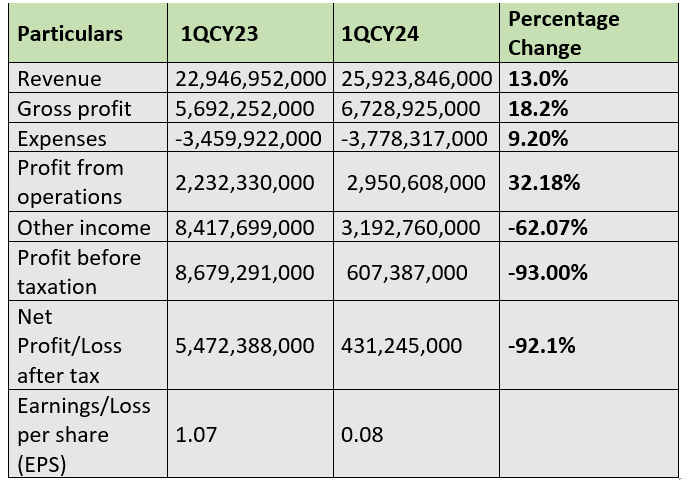

Pakistan Telecommunication Company Limited (PTCL) suffered a significant downturn with net profit plunging by 92.1% to Rs431.2 million in the first quarter of the ongoing calendar year 2024 compared to Rs5.4 billion in the corresponding period of CY23, reports WealthPK.

However, the company witnessed a 13% increase in net sales, which rose from Rs22.94 billion in 1QCY23 to Rs25.92 billion in 1QCY24, indicating effective sales strategies or market expansion. The company attributed the revenue growth to Flash Fiber, Pakistan's leading Fiber-To-The-Home (FTTH) service provider, which has experienced significant growth, achieving the highest net additions in the market since December 2023. This growth is attributed to aggressive expansion and dedicated customer experience throughout the country.

Similarly, the gross profit rose to Rs6.72 billion, up 18.2% from Rs5.69 billion in 1QCY23, indicating better cost management and improved sales revenue. The company experienced a 9.20% hike in expenses in 1QCY24. During the period, a 32.18% surge in profit from operations was offset by a decline of 62.07% in other income, which dropped from Rs8.42 billion in 1QCY23 to Rs3.19 billion in 1QCY24, significantly impacting the company’s bottom line. Thus, the profit-before-taxation contracted by 93% to Rs607.3 million in 1QCY24. The earnings per share dropped to Rs0.08 in 1QCY24 from Rs1.07 in 1QCY23.

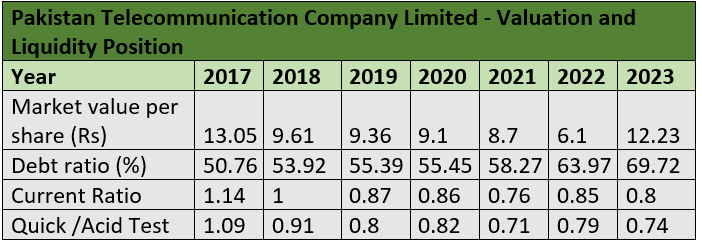

Valuation and liquidity position

PTCL's valuation and liquidity position showed significant fluctuations from 2017 to 2023, reflecting various challenges and changes in the company's financial position. Over the years, the market value per share of the company has consistently declined, reaching a low of Rs6.1 in 2022, indicating investor concerns due to declining profitability, increased competition, and broader economic factors affecting the telecom sector. However, in 2023, the share price recovered, jumping to Rs12.23, suggesting improved market sentiment or expectations of better future performance.

The debt ratio steadily increased from 50.76% in 2017 to 69.72% in 2023, indicating growing reliance on debt financing to fund operations and capital expenditures amid declining liquidity. Liquidity ratios, including the current and quick ratios, have generally declined over the years, reflecting increasing liquidity pressures. A current ratio below 1 indicates the company faces challenges in meeting its short-term liabilities. The company reported the highest current ratio of 1.14 in 2017 and the lowest of 0.76 in 2021. Similarly, the quick ratio stood at a maximum of 1.09 in 2017 and a minimum of 0.71 in 2021. This suggests that liquid assets might not have been sufficient to cover the immediate liabilities of the company in recent years.

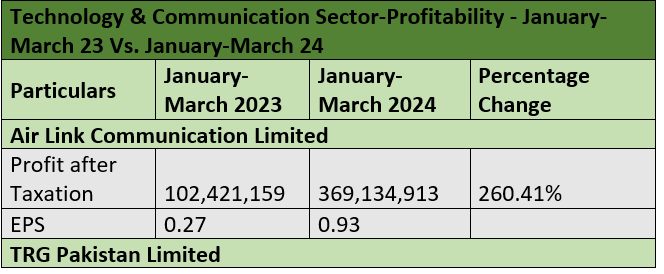

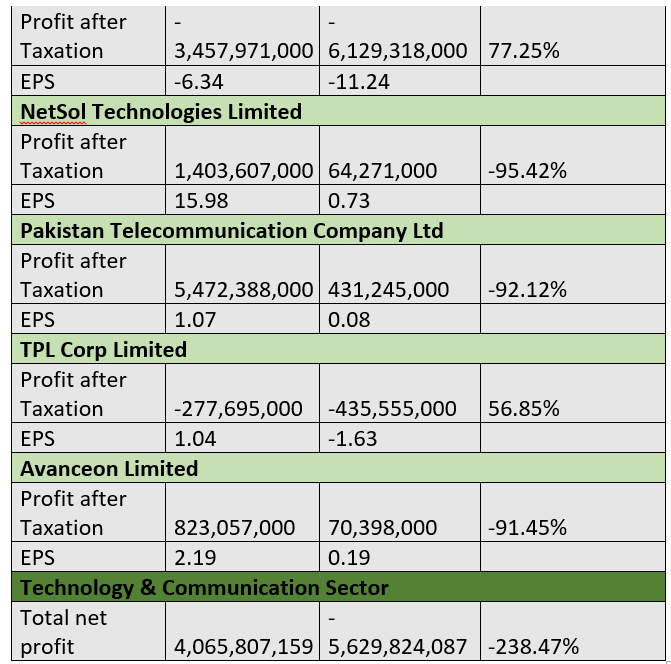

Technology and communication sector

The technology and communication sector in Pakistan experienced a massive 238.47% decline in net profit in the January-March 2024 period compared to the same period of 2023. During January-March 2024, the sector suffered a total net loss of Rs5.63 billion compared to a net profit of Rs4.06 billion in January-March 2023. Air Link Communication Limited was the only company with a significant surge of 260.41% in net profit. The company’s earnings per share improved from Rs0.27 in January-March 2023 to Rs0.93 in January-March 2024.

NetSol Technologies Limited, Pakistan Telecommunication Company Ltd, and Avanceon Limited experienced significant reductions in net profit by 95.42%, 92.12%, and 91.45%, respectively, during the period under review. TRG Pakistan Limited and TPL Corp Limited witnessed worsening financial positions, as their net losses increased by 77.25% and 56.85%, respectively, during the period under review.

Company Profile

Pakistan Telecommunication Company Limited was established on December 31, 1995, and opened for business on January 1, 1996. The company offers telecom services. It is the owner and operator of communication facilities used for local and international phone calls. Additionally, the company is authorised to offer its services in Gilgit-Baltistan and Azad Jammu and Kashmir.

Credit: INP-WealthPk