INP-WealthPk

Qudsia Bano

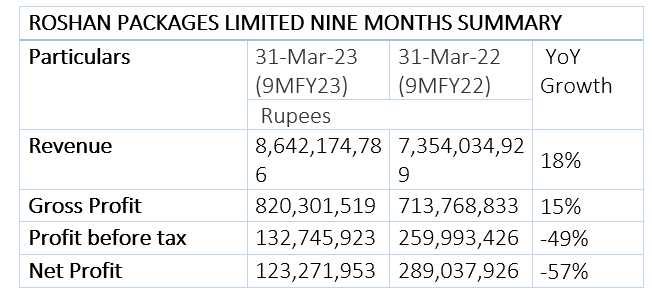

Roshan Packages Limited’s performance during the first nine months of the ongoing financial year 2022-23 was marked by growth in revenue and gross profit and a dip in net profit compared to the same period a year ago, reports WealthPK. According to the packaging solution provider’s nine-month financial report, it posted a revenue of Rs8.64 billion in 9MFY23, registering an 18% growth from the previous year, highlighting the company's ability to meet market demand and generate higher sales. Gross profit for the period stood at Rs820 million, showing a growth 15% over the previous year's nine-month period. This growth demonstrates the company’s effective cost management and operational efficiency in delivering its packaging solutions.

However, the company's profitability indicators present a different picture. The profit-before-tax for the nine months of FY23 stood at Rs132.7 million, down 49% from the same period of FY22. Similarly, the net profit witnessed a substantial drop of 57% to Rs123.3 million, highlighting the challenges faced by the company in maintaining its profitability amid various factors such as increased costs or changes in market dynamics.

Third-quarter analysis of share price returns

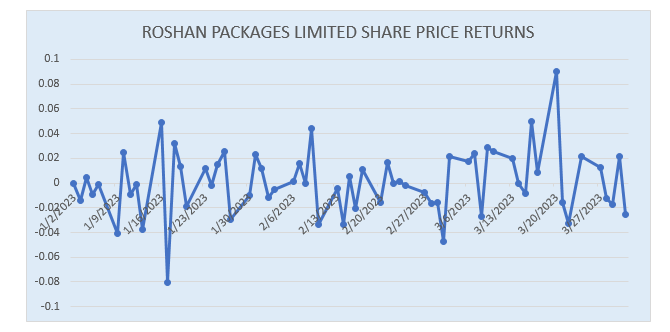

The share prices of Roshan Packages Limited exhibited fluctuations during the first quarter of FY23. Starting the year at 10.9, the share price experienced some minor fluctuations before stabilising around the 10-10.5 range. However, towards the end of January, a downward trend was observed, with the share price reaching a low of 9.65 on January 17.

In February, the share price showed some recovery, briefly touching 10.81 on February 9. However, the price remained volatile, with fluctuations between 9.89 and 10.45 throughout the month. March witnessed more significant movements in the share price. It started with a decline to 9.15 on March 2, followed by a gradual recovery and subsequent increase to 11.67 on March 20. This upward trend can be attributed to various factors, including positive market sentiment and favourable company-specific developments. Overall, the share price of Roshan Packages Limited displayed a mixed performance in 1QFY23, with periods of stability, fluctuations and occasional recovery.

About the company

Roshan Packages was incorporated in Pakistan as a private company limited by shares on August 13, 2002 under the Companies Act, 2017. It was converted into a public limited company on September 23, 2016 and got listed on Pakistan Stock Exchange on February 28, 2017. It is principally engaged in the manufacture and sale of corrugated and flexible packaging materials.

Credit: Independent News Pakistan-WealthPk