INP-WealthPk

Shams ul Nisa

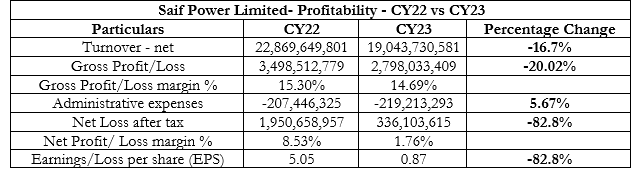

According to Saif Power Limited’s annual report for the year 2023, the company posted a net turnover of Rs19.04 billion, shrinking by 16.7% from Rs22.86 billion in CY22, reports WealthPK. Likewise, a decline of 20.02% was observed in gross profit to Rs2.79 billion in CY23, causing a slight contraction to 14.69% in gross profit margin from 15.30% in CY22.

On the expenses front, administrative expenses jumped to Rs219.2 million in CY23, up by 5.67%. Furthermore, the company continues the downward trajectory, with a contraction of 82.8% in its net profit. The company recorded a net profit of Rs336.1 million in CY23 compared to Rs1.95 billion a year earlier. This was because additional expense charged in the previous years was reversed and was incurred in the current year. This resulted in a significant hike in operation and maintenance costs as compared to the previous year. Furthermore, in CY23, the company transferred Rs213 million from unappropriated profit to maintenance reserves through the statement of changes in equity for the next overhaul. Thus, the net profit margin slipped to 1.76% in CY23 from 8.53% in CY22. The company’s earnings per share stood at Rs0.87 during the review period against an EPS of Rs5.05 in CY22.

Assets Analysis

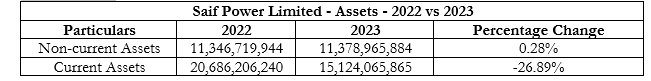

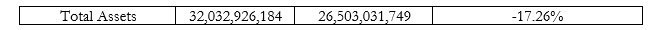

At the end of the calendar year 2022, the company's non-current assets were Rs11.34 billion, which rose by 0.28% to Rs11.37 billion in 2023. This slight reduction is due to a surge in long-term loans. Whereas, the company’s property, plant, and equipment and right of use assets contracted during the review period.

The power company experienced a significant decline in current assets by 26.89%, to Rs15.12 billion in 2023, from Rs20.68 billion in 2022. This was mainly due to the reduction in short-term investment, bank balances, and stocks in trade during this period. The decrease in current leads to an overall downfall of 17.26% in total assets, to Rs26.5 billion in 2023, from Rs32.03 billion in 2022. During the review period, the company approved the proposal for the sale of land and other assets of Saif Cement Limited (SCL).

Equity and Liabilities Analysis

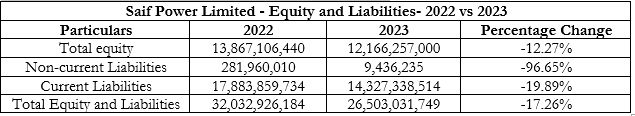

The company’s total equity stood at Rs12.16 billion in 2023 compared to Rs13.86 billion in 2022, constituting a decline of 12.27%. This decline was a result of the reduction in the company’s maintenance reserve and revenue reserves during this period.

Similarly, the current and non-current liabilities showed a notable reduction of 19.89% and 96.65%. The power company has completely paid its subordinate loan, and along with that, it has witnessed a decline in lease liabilities, short-term borrowings, current portion of non-current liabilities, and unclaimed and unpaid dividends. This in turn amplifies liquidity position and lowers the financial risk of the company. Overall, total equity and liabilities compressed by 17.26% to Rs26.5 billion in 2023, from Rs32.03 billion in 2022.

Historical Analysis

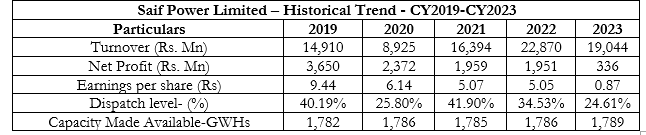

The company’s turnover faced two dips to Rs8.9 billion in 2020 and Rs19.04 billion in 2023. During the five years, the highest turnover of Rs22.87 billion was registered in 2022 by the power company. Profit after taxation exhibits a gradually decreasing trend from Rs3.65 billion in 2019 to the lowest of Rs336.0 billion in 2023, representing decreasing efficiency of the company. Thus, the declining trend contracted the earnings per share of the company gradually from a peaked value of Rs9.44 in 2019 to a minimum of Rs0.87 in 2023.

In 2023, the company’s dispatch level saw a significant decrease, falling to 24.61%, almost half of the 40.19% recorded in 2019. The peak dispatch level was 41.90% in 2021. However, there was a slight improvement in capacity availability, with the company reaching 1789 gigawatt-hours (GWh) in 2023.

Company’s profile

Saif Power Limited is an independent Power Producer (IIP) incorporated in 2004. The company is a subsidiary of Saif Holdings Limited. The Company's primary activities include owning, running, and maintaining a combined cycle power plant with a capacity of 225 MW (ISO) and selling the electricity to Central Power.

Credit: INP-WealthPk