INP-WealthPk

Shams ul Nisa

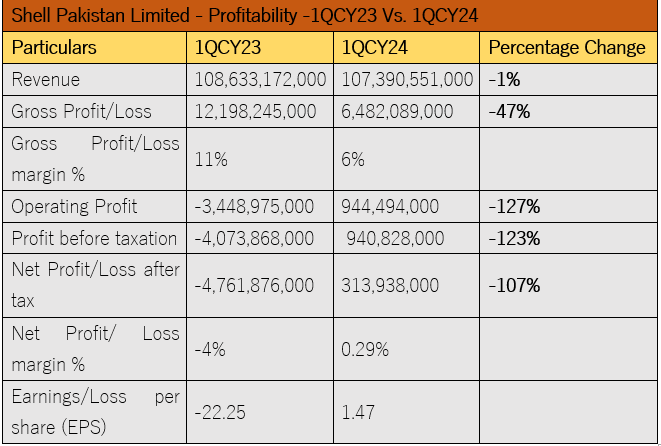

Shell Pakistan Limited's financial performance for the first quarter

shows a notable shift to a net profit of Rs313.9 million ending March 2024 from a net loss of Rs4.76 billion compared to 1QCY23, up by around 107%, reports WealthPK. The period was relatively stable, with a slight recovery of the rupee against the US dollar, although inflation remained high. However, the company experienced a slight decline in revenue by 1%, dropping to Rs107.39 billion in 1QCY24. Likewise, the gross profit decreased significantly by 47%, leading to a lower gross profit margin of 6% compared to 11% in 1QCY23. As a result of slowdown in economic activity, decreased fuel demand persisted in the first quarter of 2024.

Despite these challenges, the company achieved a remarkable turnaround in the operating profit, improving from a loss of Rs3.45 billion in 1QCY23 to a profit of Rs944.4 million in 1QCY24, driven by cost control and operational efficiency. The net profit before tax also shifted from a loss of Rs4.07 billion to a modest profit of Rs940.8 million, with the net profit margin improving to 0.29%. At the end of the quarter, the earnings per share witnessed a substantial recovery from a loss per share of Rs22.25 to an EPS of Rs1.47.

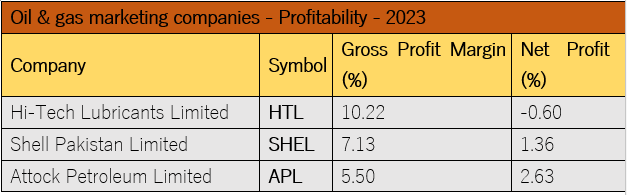

Oil & gas marketing companies

In 2023, the profitability of oil and gas marketing companies in Pakistan varied significantly, with Shell Pakistan and Attock Petroleum showing stronger profitability, while PSO and others faced more significant hurdles. Despite a net loss margin of Rs0.60%, Hi-Tech Lubricants Limited reported a gross profit margin of 10.22%. However, Shell Pakistan Limited demonstrated an efficient cost control with a 7.13% gross margin and a net profit margin of 1.36%. Strong operational efficiency allowed Attock Petroleum Limited to achieve the highest net profit margin of 2.63% despite maintaining a lower gross margin of 5.50%.

Owing to regulatory constraints, Sui Northern Gas Pipelines Limited reported a net margin of 0.72% and a gross margin of 8.74%. In the sector, Pakistan State Oil Company Limited reported a net margin of 0.17% and the lowest gross margin of 2.21%.

Financial statistical summary

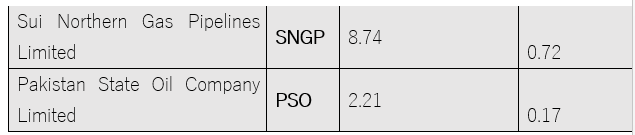

Over the past six years, Shell Pakistan Limited has experienced significant volatility, driven by market

fluctuations, economic uncertainties, and operational challenges. In 2017, the company generated a revenue of Rs9.12 billion, but it dropped sharply to a negative Rs1.7 billion by 2020. Despite this downturn, the company rebounded in 2021, reaching a six-year high of Rs13.18 billion, before slightly declining to Rs12.45 billion in 2022. However, it surged to Rs17.5 billion in 2023. Shareholder equity followed a similar trend over the six years, reaching a high of Rs15.32 billion in 2021 and dipping to a negative Rs651 million in 2020. The company recorded net losses of Rs1.1 billion in 2018, Rs1.48 billion in 2019, Rs4.8 billion in 2020, and Rs72 million in 2022, highlighting issues with financial management, increasing operating costs, and declining revenue. It gained momentum and reached its highest of Rs19.7 billion in 2023. Despite these challenges, Shell Pakistan Limited achieved profits of Rs3.18 billion in 2017 and Rs4.46 billion in 2021. The cost of sales as a percentage of revenue fluctuated over the six years, from 90.5% in 2020 to 95.4% in 2021. Initially, it rose from 91.2% in 2017 to 95.4% in 2020, then decreased to 90.5% in 2021, before climbing again to 91.9% in 2022 and 92.9% billion in 2023.

Future outlook

The company, along with the energy sector, is grappling with considerable challenges, such as rising global oil prices driven by supply concerns and geopolitical issues, coupled with uncertainty surrounding future oil demand and economic recovery. Despite these hurdles, the company's management and Board of Directors remain dedicated to preserving a strong financial standing, adhering to safety standards, and fulfilling their role as a responsible societal partner. They are particularly focused on being a reliable partner in shaping a sustainable energy future for Pakistan.

Company profile

Shell Pakistan Limited is a limited liability company incorporated in Pakistan. It is a subsidiary of Shell Petroleum Company Limited, United Kingdom, which is a subsidiary of Royal Dutch Shell Plc. The company markets petroleum products and compressed natural gas. It also blends and markets various kinds of lubricating oils.

Credit: INP-WealthPk