INP-WealthPk

Shams ul Nisa

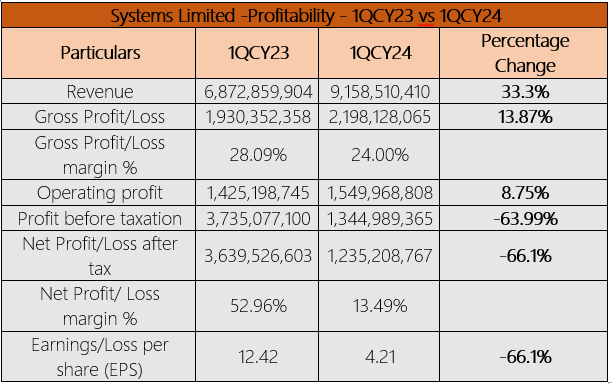

Systems Limited's revenue grew by 33.3% but the net profit shrank by 66.1% at the end of the first quarter of calendar year 2024, reports WealthPK. The company posted a revenue of Rs9.15 billion and net profit of Rs1.23 billion in 1QCY24. The decline in net profit was attributed to the exchange loss of Rs207.64 million compared to Rs2.24 billion exchange gain in March 2023, due to the currency appreciation during the review period. The company's gross profit increased by 13.87%, suggesting growing costs compared to revenue growth. Thus, the gross margin slipped to 24.00% in 1QCY24 from 28.09% in the same period last year.

Furthermore, the operating profit rose by 8.75% to Rs1.54 billion in 1QCY24. However, the profit before taxes declined by 63.99% to Rs1.34 billion in 1QCY24 from Rs3.73 billion in 1QCY23. The decreased profitability was reflected in the massive contraction in net profit margin from 52.96% in 1QCY23 to 13.49% in 1QCY24. Likewise, returns to shareholders declined from an EPS of Rs12.42 to an EPS of Rs4.21 in 1QCY24.

Assets analysis

Systems Limited's asset performance from December 2023 to March 2024 revealed a minor decrease of 0.24% in non-current assets. This decline can be driven by asset depreciation or revaluation during the period. However, the current assets rose 7.38% from Rs23.36 billion to Rs25.09 billion, suggesting a better liquidity position.

The total assets increased by 4.66% from Rs36.32 billion to Rs38.01 billion, demonstrating a favorable growth trajectory. This rise is attributed to the expansion of current assets, indicating improved operational and financial position.

Equity and liabilities analysis

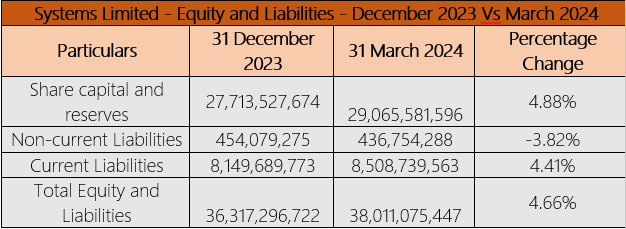

Systems Limited's share capital and reserves increased by 4.88%, indicating a healthy accumulation of retained earnings. The company reduced non-current liabilities by 3.82%, indicating effective debt management. This decrease improves the company's long-term solvency and reduces future interest obligations.

However, the current liabilities rose by 4.41% from Rs8.15 billion in December 2023 to Rs8.51 billion in March 2024, suggesting an increase in short-term borrowings. At the end of the quarter, the total equity and liabilities increased by 4.66%, mirroring the growth in total assets. This implies the company opts for a balanced approach to enhancing shareholder value.

Technology and communication companies

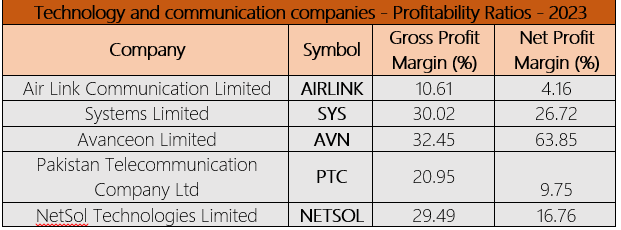

In 2023, the profitability ratios of the technology and communication sector revealed different operational efficiencies and profit generation capabilities of the companies. Among the five companies in the sector, Avanceon Limited has a gross profit margin of 32.45% and a net profit margin of 63.85%, indicating robust operational efficiency and effective cost management. Avanceon is followed by Systems Limited with a gross profit margin of 30.02% and a net profit margin of 26.72%. NetSol Technologies Limited has a gross profit margin of 29.49% and a net profit margin of 16.76%, indicating solid profitability.

The Pakistan Telecommunication Company Ltd has a gross profit margin of 20.95% and a net profit margin of 9.75%, indicating decent profitability. Air Link Communication Limited has the lowest gross profit margin at 10.61% and a net profit margin of 4.16%, indicating significant cost pressures.

Future outlook

The company faced inflationary pressures in 2023 and 2024, particularly wage inflation. Additionally, the rupee's appreciation against the dollar in 2024 worsened margins. The company is implementing cost-effective measures and developing revenue growth strategies to tackle these challenges. The company has secured numerous new contracts and is developing a robust pipeline for future growth. The company is investing in AI technology and workforce upskilling, addressing high demand for AI by ensuring adequate resource training. Furthermore, it is also developing assets, products, and solutions in the banking AI sector. The company is lobbying the government to allow investment in new markets and acquisitions, hoping the new government's focus on the IT sector will open new doors for business. The company plans to pursue inorganic growth opportunities both within Pakistan and globally.

Company profile

Systems Limited is a public limited company incorporated in Pakistan under the Companies Act, 2017. The company is principally engaged in the business of software development, trading of software, and business process outsourcing services.

Credit: INP-WealthPk