INP-WealthPk

Moaaz Manzoor

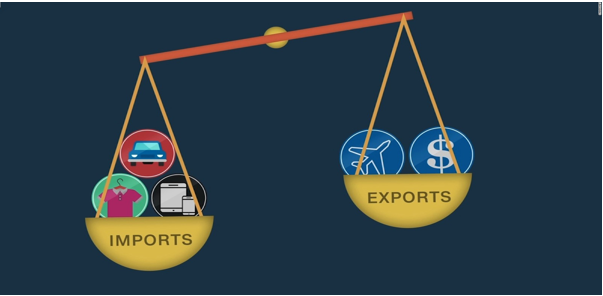

Pakistan’s widening trade deficit is intensifying pressure on the country’s external financing position, as declining export earnings and rising imports deepen imbalances in the trade account and increase reliance on external sources of foreign exchange. The latest trade figures highlight a growing gap between inflows and outflows, posing challenges for external sector management.

Data released by the Pakistan Textile Exporters Association (PTEA), based on official trade statistics, show that the trade deficit widened by 23.79 percent year on year to $3.7 billion in December 2025, compared with $2.99 billion in the same month last year. The increase reflects a combination of sharply lower exports and higher imports during the month, reinforcing pressure on the balance of payments.

In December, exports declined by 20.41 percent year on year to $2.31 billion, while imports rose by 2 percent to $6.02 billion. This divergence widened the monthly trade gap and underscored the challenges facing the external sector. With export inflows weakening, the economy has fewer foreign exchange earnings available to offset import payments, increasing dependence on external financing to bridge the deficit.

The strain is more pronounced when viewed over the first half of the fiscal year. During July–December, the trade deficit surged by 34.57 percent to $19.2 billion, up from $14.27 billion in the corresponding period of the previous year. Over the same period, exports declined by 8.70 percent to $15.18 billion, while imports increased by 11.28 percent to $34.38 billion. The scale of the half-year deficit highlights the cumulative impact of persistent trade imbalances on external financing needs.

A widening trade deficit has direct implications for Pakistan’s ability to meet its external obligations. Lower export earnings reduce the availability of foreign exchange required for external debt servicing, payments for essential imports, and other international commitments. As the deficit expands, maintaining adequate foreign exchange buffers becomes more challenging, particularly in an environment of subdued export growth.

The document flags concerns that declining exports weaken the country’s capacity to meet external debt obligations, signalling heightened pressure on external financing channels. Sustained trade deficits often necessitate increased borrowing or greater reliance on capital inflows to stabilise the external account. Over time, this can increase vulnerabilities by heightening exposure to external financing conditions and global market sentiment.

The pressure from the trade deficit is compounded by the persistence of export weakness. Export earnings have declined for five consecutive months, indicating that the shortfall in foreign exchange inflows is not temporary. Without a recovery in exports, the external financing gap risks remaining elevated, limiting policy flexibility and constraining the management of the external sector.

At the same time, rising imports add to the financing challenge. Import growth during the first half of the fiscal year reflects continued demand for goods and inputs, but without commensurate export growth, the imbalance places sustained pressure on external resources. Managing this gap becomes increasingly complex as trade deficits accumulate over successive months.

Overall, the latest data underscore growing external financing pressures linked to Pakistan’s widening trade deficit. The combination of declining exports and rising imports has expanded the trade gap to levels that intensify reliance on external financing. Unless export performance improves and the trade balance stabilises, pressures on external financing are likely to persist, shaping the external sector outlook for the remainder of the fiscal year.

Credit: INP-WealthPk