i INP-WEALTHPK

Hifsa Raja

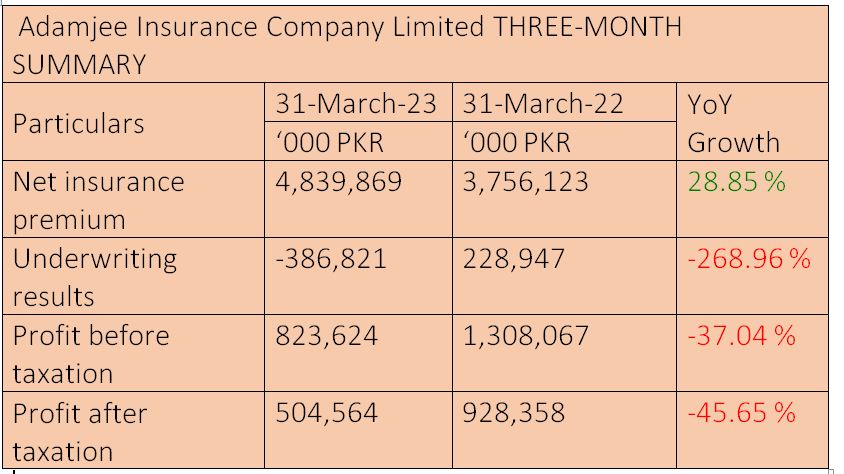

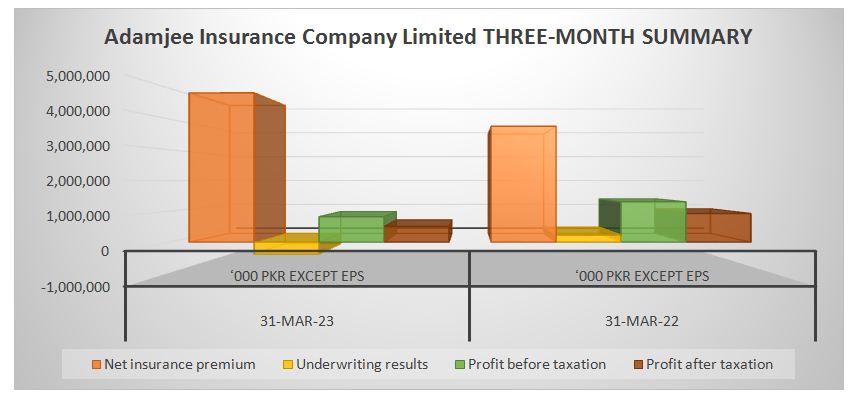

Adamjee Insurance Company Limited netted an insurance premium of Rs4.8billion in the first quarter of the ongoing calendar year 2023 (1QCY23) comparedwith Rs3.7 billion over the corresponding period of the previous year at 28.85% growth rate. However, the loss in underwriting results during the three-month period of CY23 was Rs386 million from a profit of Rs228 million over the correspondingperiod of CY22. Due to anincrease in expenses, the profit-before-taxation decreasedby 37% in 1QCY23 to Rs823million from Rs1.30 billion overthe corresponding period of CY22.

The profit-after-tax decreased by 45% to Rs504 million in 1QCY23 fromRs928 million in 1QCY22.

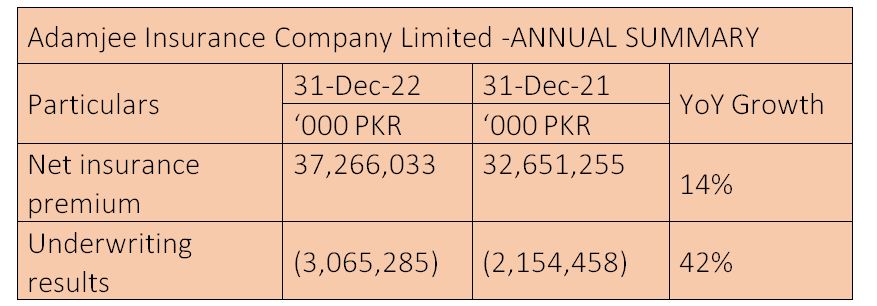

CY22 summary

During CY22, the company’s net insurance premium was up 14% toRs37 billion from Rs32 billion in CY21.

The loss in underwriting results jumped 42% to Rs3 billion in CY22 from Rs2.1billion in CY21.

The profit-before-tax in CY22 decreased by 24% to Rs3.2 billion from Rs4.2 billion in CY21.

The profit-after-tax in CY22decreased by 19% to Rs2.3 billion fromRs2.9 billion in CY21.

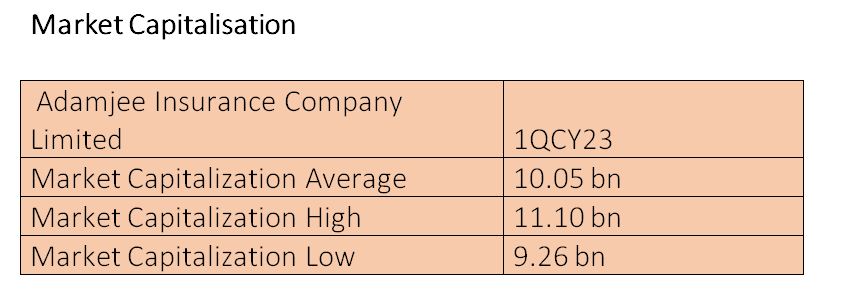

The average market cap of Adamjee Insurance Company Limited in the first quarter of CY23 was Rs10.05 billion. The peak market capitalisation stood at Rs11.10 billion, indicating a peak in investor confidence. The lowest market valuation of Rs9.26 billion during this period indicated a time of market uncertainty or waning investor interest. These changes in market capitalisation demonstrate the stock market’s volatility and the influence of several variables on a company’s perceived worth.

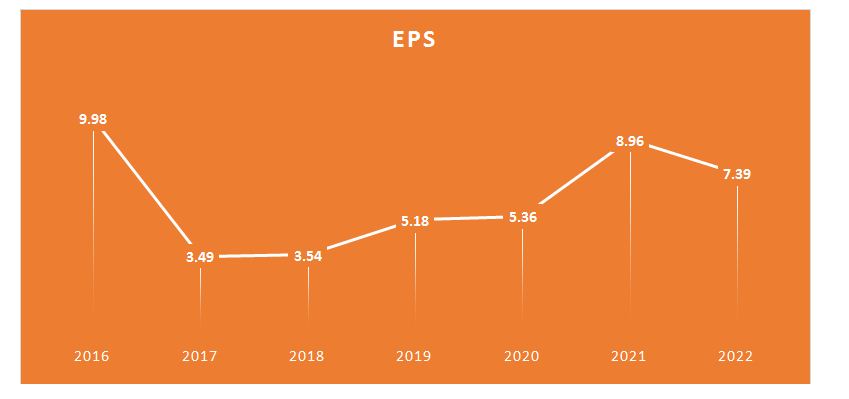

Earnings per share

The earnings per share of Adamjee Insurance Company stood at Rs9.98 in 2016, Rs3.49 in2017, Rs3.54 in 2018, Rs5.18 in 2019, Rs5.36 in 2020, Rs8.96in 2021 and Rs7.39 in 2022.

Industry comparison

Adamjee Insurance Company’scompetitors include Atlas Insurance Limited, Jubilee General Insurance Company Limited, East West Insurance Company Limited and TPL Insurance Limited.

Adamjee Insurance Company Limited has a market capitalisation of ₨8.3 billion. Atlas Insurance Limited has amarket value of Rs5.7 billion. Jubilee General Insurance Company has the market capitalisation of Rs5.6 billion. East West Insurance Company Limited has the largest market cap of Rs11.3 billion.Atlas Insurance hasthe lowest market cap of Rs3.9 billion.

Ratio analysis

The ratio analysis of Adamjee Insurance Company reveals interesting insights into the firm’s financial performance over the years. The gross profit margin, which indicates the company’s ability to generate profit from its core operations, has shown a steady improvement. From 4.23% in 2019, it increased to 5.36% in 2021, highlighting the company’s effective cost management and revenue generation strategies. Moreover, the net profit margin, a key indicator of the company’s profitability after considering all expenses and taxes, exhibited significant growth.

In 2021, the net profit margin soared to 24.99%, demonstrating the company’s successful efforts in maximising its bottom line and delivering value to its shareholders. However, it is worth noting that in 2022, the gross profit margin experienced a decline, dipping to (1.23%). This decrease may indicate challenges or factors that impacted the company’s profitability during that period. It is crucial for Adamjee Insurance Company to analyse and address these issues to sustain its financial performance.

Overall, the analysis suggests that Adamjee Insurance Company has made commendable progress in enhancing its profitability, as reflected in the improving gross profit margin and the substantial growth in net profit margin. These findings indicate the company’s effective management of costs, efficient operations, and successful revenue generation strategies. It is interesting to observe how the company adapts to market conditions and leverages its strengths to maintain its financial growth trajectory in the future.

Future prospects

Over the years, the company has made sizeable investment in its information technology infrastructure and through its experience of operations spread over 60 years has also refined, standardised and documented its operating procedures. The procedures are flexible and adaptive to absorb innovations necessary to respond to changes caused by external factors.

About the company

Adamjee Insurance Company Limited operates through five segments: fire & property, marine, aviation & transport, motor, accident & health and miscellaneous. The company’s fire and property insurance contractsgenerally cover the assets of the policyholders against damages by fire, earthquakes, riots and strikes, explosions, atmospheric disturbance, flood, and electric fluctuation. Marine, aviation and transport insurance contracts generally provide cover against damage by cargo risk and damage.

Motor insurance contracts provide indemnity for accidental damage to or total loss of an insured vehicle. Accident and health insurance contracts mainly compensate for hospitalisation and outpatient medical coverage. Miscellaneous insurance contracts provide a variety of coverage, including cover against burglary, loss of cash in safe, cash in transit and cash on the counter, fidelity guarantee, and personal accident.

Credit: INP-WealthPk