i INP-WEALTHPK

Shams ul Nisa

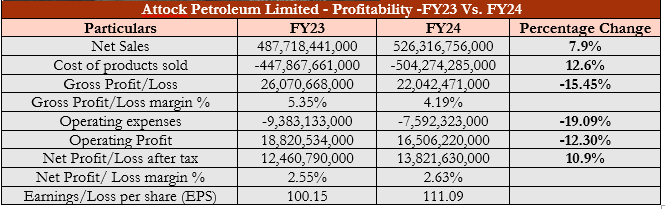

Attock Petroleum Limited’s net sales increased 7.9% from Rs487.72 billion in FY23 to Rs526.32 billion in FY24, primarily due to higher average selling prices, reports WealthPK.The cost of goods sold grew by 12.6%, leading to a 15.45% reduction in the gross profit, which totaled Rs22.04 billion for the period.

Furthermore, the company successfully reduced its operating expenses by 19.09%, demonstrating effective cost management. Despite the decline in its operating expenses, the company’s operating profit still declined by 12.3% to Rs16.51 billion in FY24, reflecting challenges within core operations that impacted overall profitability. Despite this, the net profit rose by 10.9% to Rs13.82 billion, with the net profit margin improving slightly to 2.63% for FY24. This increase was attributed to improved product margins, lower exchange losses, and reduced operating expenses, along with higher investment returns that bolstered other income. The earnings per share (EPS) also rose from Rs100.15 in FY23 to Rs111.09 in FY24, showcasing the company’s capacity to enhance shareholder value.

Profitability Ratios

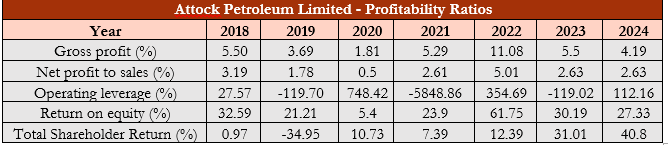

Attock Petroleum Limited's profitability ratios from 2018 to 2024 reflect a varied financial performance, marked by fluctuating profitability and shifts in operational efficiency. The gross profit margin experienced volatility, reaching a high of 11.08% in 2022 but dropping sharply to 4.19% in 2024, primarily due to rising costs alongside increased selling prices. The net profit margin held steady at 2.63% in both 2023 and 2024, aided by controlled other expenses and a boost in other income. The operating leverage ratio demonstrated instability, with extreme values pointing to operational hurdles. However, it improved to 112.16% in 2024, indicating that increased sales relative to fixed costs could support profitability gains.

The company’s return on equity (ROE) remained relatively strong due to efficient equity usage and high profitability but decreased from 61.75% in 2022 to 27.33% in 2024. This drop was primarily due to a reduction in financial leverage, despite a steady net profit margin and higher asset turnover. The total shareholder returns also showed notable swings, rising to 40.8% in 2024, likely driven by favorable market conditions and strategic actions that bolstered investor confidence

Liquidity Ratios

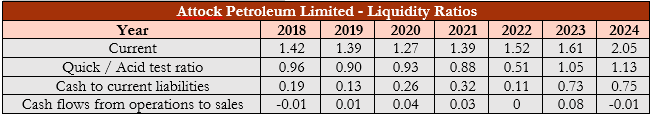

Attock Petroleum Limited's liquidity ratios from 2018 to 2024 indicate a positive trend in its ability to meet short-term obligations. The current ratio has consistently stayed above 1, reflecting effective management of working capital. The quick ratio, which assesses liquidity excluding inventory, has risen slightly from 0.96 in 2018 to 1.13 in 2024, suggesting an improved capacity to meet short-term liabilities even without relying on inventory.

The cash-to-current-liabilities ratio has also strengthened, increasing from 0.19 in 2018 to 0.75 in 2024, showing a larger proportion of cash available to cover current liabilities. However, the cash flow from operations to sales ratio has been inconsistent, fluctuating from a negative figure in 2018 to slightly positive levels in the following years, before falling to -0.01 in 2024. This variability suggests difficulties in effectively converting sales into operating cash flow, raising potential concerns about operational sustainability and the company’s reliance on internally generated cash for funding activities.

Future Outlook

APL, a prominent oil marketing company in Pakistan, is dedicated to providing high-quality petroleum and energy products and services. The company is currently managing legal issues associated with constructing a Bulk Oil Terminal at Tarujabba and is expanding its retail network across the northern region. APL aims to increase storage capacity with an additional 10,000 metric tons for PMG at the Rawalpindi Bulk Oil Terminal and 18,700 metric tons at the Port Qasim Terminal in Karachi. Furthermore, the company is establishing new retail locations in Rawalpindi, Lahore, and Karachi to enhance its brand presence. APL is also investing in sustainable energy initiatives, including the installation of Electric Vehicle (EV) charging stations and transitioning to On-Grid Solar Systems. The plan includes converting selected retail outlets and storage terminals to On-Grid Solar Systems.

Company profile

Attock Petroleum Limited was established in Pakistan as a public limited company on December 3, 1995. The principal activity of the Company is the procurement, storage, and marketing of petroleum and related products.

Credit: INP-WealthPk