i INP-WEALTHPK

Hifsa Raja

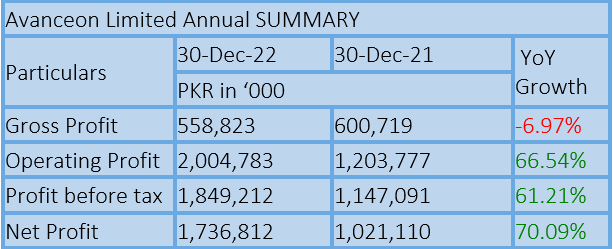

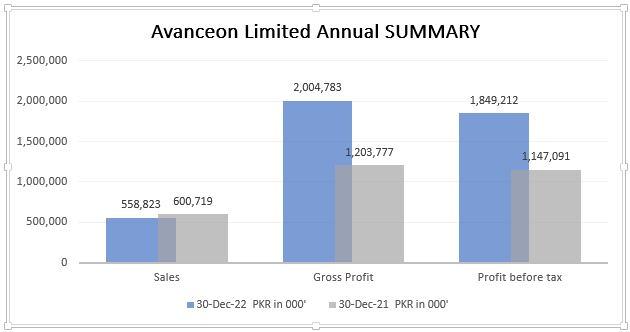

Avanceon Limited’s profit-after-taxation jumped 70.09% to Rs1.73 billion in the calendar year 2022 from Rs1.02 billion in the previous year, suggesting the company was able to generate more income after accounting for all expenses, including taxes. However, the gross profit decreased 6.97% to Rs558 million in CY22 from Rs600 million the previous year, suggesting the company needs to manage its costs and profitability in the face of various challenges.

The company’s operating profit increased 66.54% to Rs2 billion in CY22 from Rs1.20 billion in CY21. This indicates the company was able to generate more revenue from its operations while keeping expenses under control. The profit-before-taxation jumped 61.21% to Rs1.84 billion in CY22 from Rs1.14 billion in CY21.

Industry comparison

Avanceon Limited’s competitors include NetSol Technologies Limited, Octopus Digital Limited, Systems Limited and ORBIS AG.

Avanceon Limited has a market capitalisation of ₨20 billion, which is the second-highest among its competitors. Systems Limited has the highest market capitalisation of ₨113 billion and ORBIS AG has the lowest market cap at Rs5.9 billion.

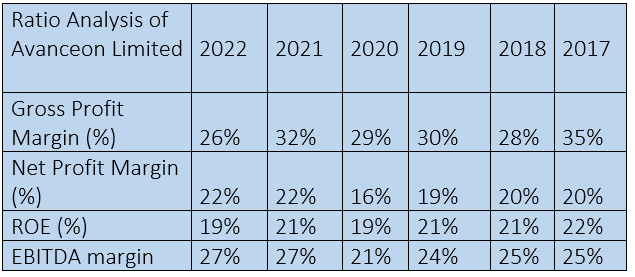

Ratio analysis

Financial ratios show that Avanceon Limited has maintained a reasonable level of profitability, with stable net profit margins and return on equity (RoE). However, there has been a decline in gross profit margin in recent years, which indicates challenges in managing production costs and pricing strategies. The slight increase in EBITDA margin suggests improved operational efficiency.

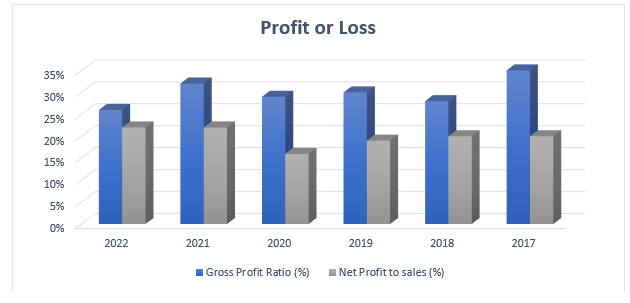

Profit or loss

Avanceon Limited witnessed a notable increase in gross profit in 2017. However, in 2018, the company experienced a decline in profitability.

In 2019, Avanceon's profitability showed signs of improvement, reflecting the company's efforts to enhance its performance. Unfortunately, in 2020, there was a decline in profitability once again. Nevertheless, the year 2021 proved to be a positive turning point for the company, as profitability experienced a notable increase. However, in 2022, there was a subsequent decrease in profitability. Despite these fluctuations, Avanceon Limited continues to strive for sustainable growth and aims to enhance its profitability in the future.

About the company

Avanceon Limited provides industrial automation, process control and system integration, energy management solutions and support services. The company offers control valves, programmable logic controllers and distributed control systems, building management systems, fire and gas detection solutions and human machine interface products, variable frequency drives, and low and medium voltage motors. It also provides plant information management systems, process loop tuning products and distributed control and building management systems. The company serves oil and gas, water and wastewater, food and beverages, infrastructure and transportation, sugar and ethanol, and cooling industries. It operates in Pakistan, Qatar, the United Arab Emirates and the Kingdom of Saudi Arabia. The company was founded in 1984 and is headquartered in Lahore.

Credit: Independent News Pakistan-WealthPk