i INP-WEALTHPK

Shams ul Nisa

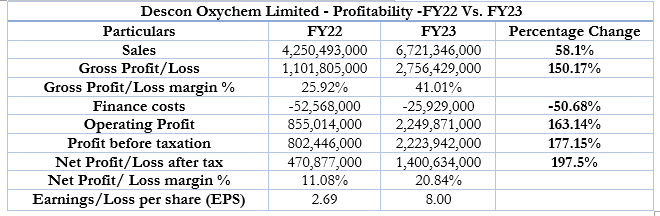

Descon Oxychem Limited (DOL) has recorded a substantial profit after tax of Rs1.4 billion in the fiscal year 2023, compared to a net profit of Rs470.87 million in the same period last year, constituting a significant rise by 197.5%. The net profit margin jumped to 20.84% in FY23 from 11.08% in FY22. The company's capacity expansion strategy of sustainable operations of plants and better product placement has helped to improve margins and increase sales during the period under discussion. The chemical manufacturing company’s net sales grew by 58.15% to Rs6.72 billion from Rs4.25 billion in FY22. As a result of the increased volume, the company exports its products to the international market.

DOL also witnessed a major increase in gross profit, as it grew by 150.17% to Rs2.75 in FY23 from Rs1.1 billion in FY22. Resultantly, the gross profit margin stood at 41.02% in FY23 against 25.92% in FY22. The company’s better cost management has resulted in a reduction of finance costs by 50.68% down to Rs25.9 million in FY23 from Rs52.56 million in FY22. The operational profit of the company jumped by 163.14% from Rs855.01 million in FY22 to Rs2.249 billion in FY23. Additionally, the profit before tax rose to Rs2.22 billion in FY23, 163.14% higher than Rs802.4 million in the same period last year. The company reported earnings per share (ESP) of Rs8.00 in FY23 compared to Rs2.69 in the previous year.

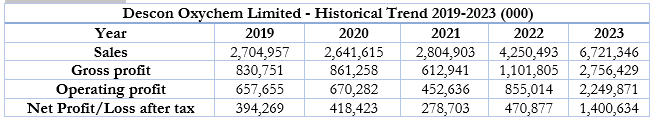

Historical Trend

DOL sales have increased from Rs2.7 billion in 2019 to Rs6.7 billion in 2023, with only one dip of Rs2.6 in 2020. Starting from Rs830.7 million recorded in 2019, the gross profit has followed an upward trajectory, reaching its highest of Rs2.756 billion in 2023 during the period. However, the operating profit rose to Rs670.28 million in 2020 from Rs657.65 million in 2019 but reduced to the lowest of Rs452.6 million in 2021. In later years, it increased to Rs855.01 million in 2022 and jumped to Rs2.249 billion in 2023. This significant jump is the result of improvement in the operational activities of the company during the period. Similarly, the company recorded the highest of Rs1.4 billion net profit after tax in 2023 and the lowest of Rs278.7 million in 2021.

Profitability Ratios analysis

DOL’s gross margin varied over the years, as it increased from 2019 to 2020, but fell in 2021 and again rose in the following years 2022 and 2023. The lowest of 21.85% was observed in 2021 and the highest gross margin of 41.01% was registered in 2023. This increase in gross profit margin is attributed to the rise in sales, reduced costs, and improved production efficiency by the company. Similarly, the maximum net margin of 20.84% was recorded in 2023 and a minimum of 9.94% was observed in 2019. The chemical manufacturing company’s return on equity has followed a fluctuating trend over the past five years as it reduced to 45.78% in 2023 from 50.32% in 2019. On the other hand, the company’s return on capital employed has shown major improvement over the years from 36.65% in 2019 to 66.78% in 2023. In 2020, 2021, and 2022, it stood at 28.35%, 13.51%, and 19.96% respectively.

Liquidity Ratios analysis

![]()

The current ratio assesses how effectively the company can cover its short-term liabilities with its current assets. DOL’s current ratio remained above 1.2, which indicated that the company has a strong liquidity position to finance its current obligations. The maximum current ratio of 2.22 was registered in 2021 and the minimum of 1.34 in 2022. However, the quick ratio remained below 1 in 2019, 2020, 2022 and 2023. In 2019, it stood at 0.82, which means the company can repay its 82% of obligation using its assets. In 2021, it remained above 1.44, which means that the company has enough liquid assets to cover its obligations.

Credit: INP-WealthPk