i INP-WEALTHPK

Hifsa Raja

The gross loss of First Capital Securities Corporation (FCSC) decreased 17% to Rs4.2 million in the third quarter of the previous fiscal year 2022-23 from Rs5.1 million over the corresponding period of the fiscal 2021-22. Similarly, its operating loss decreased 13% to Rs6.1 million in 3QFY23 from Rs7 million during the corresponding period of FY22. However, the loss-before-tax increased by 1.55% to Rs74.9 million in 3QFY23 from Rs73.7 million in 3QFY22. The company’s net loss also increased by the same percentage point during the period under review.

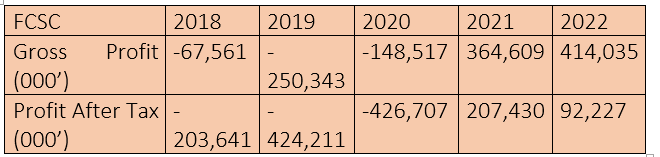

Annual comparison

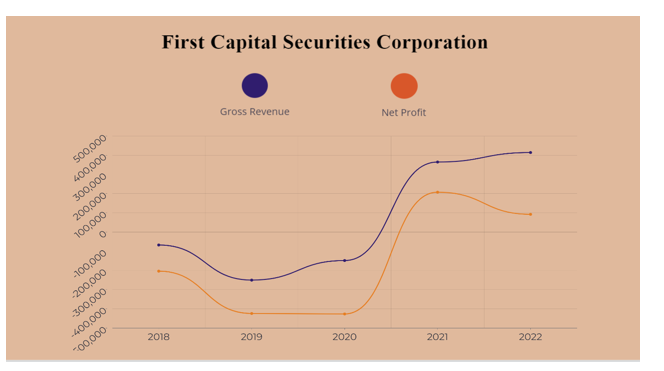

From 2018 to 2020, FCSC faced substantial financial difficulties as it continued to sustain gross losses, with 2019 marking a particularly difficult period with a gross loss of Rs250 million. Similarly, the company reported net losses during these three years with 2020 seeing a significant loss of Rs426 million.

The trend shifted in 2021 and 2022, as the company experienced a remarkable turnaround in its financial performance. The company earned a gross profit of Rs364 million in 2021, which further increased to Rs414 million in 2022. This substantial growth indicates successful efforts to manage costs, increase revenue, or potentially diversify business operations. The profit-after-tax also displayed a substantial turnaround, with the company reporting a profit of Rs207 million in 2021 and Rs92 million in 2022. This shift from consecutive years of losses to profits within a short span signifies the efficacy of strategic measures taken by the company.

Strategic resilience and adaptation

The impressive recovery seen in the years (2021-2022) reflects the company's ability to adapt, make necessary changes and implement effective strategies. The rebound in profitability suggests that FCSC not only weathered the challenges but also emerged stronger, indicating successful restructuring, improved market positioning, or other strategic initiatives. For stakeholders and investors, this transformation serves as an indicator of the company's resilience and its potential to navigate adversity.

It underscores the importance of comprehensive financial planning, adaptability and proactive measures in an ever-evolving business landscape. While the early years (2018-2020) highlighted struggles, the subsequent years' success story demonstrates the potential for recovery and growth when effective strategies are executed. As the company's fortunes have shifted, stakeholders will likely be keen to understand the specifics of the strategies employed during the recovery years, and how these strategies have positioned the company for sustainable success in the future.

Earnings per share

Like the gross and net losses, the earnings per share also witnessed a negative trend from 2018 to 2020. However, in 2021 the trend changed and the company posted EPS of Rs0.66. However, in 2022, the EPS dipped to Rs0.29, but stayed in the positive territory.

Share acquisition

Beijing State-owned Capital Operation and Management Company Limited agreed to acquire a 11.0576% stake in FCSC for CNY (Chinese Yuan) 3.8 billion on September 8, 2022. Under the terms, the company had to pay CNY 8.02 per share to acquire 464.6864 million shares of FCSC. As of September 19, 2022, the transaction was approved by the Assets Supervision and Administration Commission of the Beijing Municipal People's Government.

The company completed the acquisition of 11.0576% stake in FCSC on May 31, 2023.

Ratio analysis

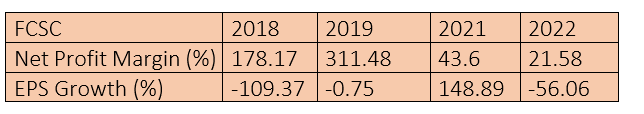

The net profit margin, which indicates the proportion of profit to total revenue, demonstrated a remarkable ascent from 178.17% in 2018 to 311.48% in 2019, suggesting exceptional profitability relative to revenue. However, a significant decline to 43.6% in 2021 and further to 21.58% in 2022 hints at changes in the company's cost structure or other factors impacting its bottom line. These fluctuations warrant a deeper exploration of the company's expense management strategies and revenue drivers in the corresponding years.

The EPS growth percentage highlights the fluctuating trajectory of earnings per share over the years. An initial steep decline of -109.37% in 2018 followed by a minor decrease of -0.75% in 2019 signals a period of challenges. However, a substantial recovery of 148.89% in 2021 showcases the company's resilience and strategic rebound. The subsequent decline of -56.06% in 2022 may indicate operational or market factors that affected earnings. This pattern prompts the inquiry into the company's actions and market conditions during these crucial periods. The fluctuating net profit margin and EPS growth figures reflect the dynamic nature of FCSC's journey.

The company experienced challenges, evident in the initial decline and subsequent recovery. The noteworthy decline in net profit margin in 2021 and 2022 could be attributed to factors like increased expenses, changing market dynamics, or shifts in the business model. The recovery in EPS growth in 2021 underlines the company's adaptability and strategic decisions. However, the subsequent decline in 2022 indicates the need for a closer examination of the underlying causes, which could range from internal operational changes to external market challenges. The ratio analysis highlights the company's resilience in the face of adversity and its ability to capitalise on opportunities.

About the company

First Capital Securities Corporation Limited is a Pakistan-based company engaged in making long and short-term investments, money market operations, and financial consultancy services. The company's segments include financial services, investment advisory services, printing and publishing, and real estate. Its financial services segment is engaged in long- and short-term investments, sale/purchase of shares, money market operations, and financial consultancy services.

Its investment advisory services segment is engaged in investment advisory services to open-end mutual funds. Its real estate segment is engaged in construction, development and other related activities of real estate properties, installation and manufacturing of water purification plants, reverse osmosis systems and water softness systems. Its subsidiaries include Ever Green Water Valley (Private) Limited, Falcon Commodities (Private) Limited and First Capital Equities Limited.

Credit: INP-WealthPk