i INP-WEALTHPK

Hifsa Raja

Ghani Global Holdings Limited’s (GGL) latest financial report shows that it recovered from the losses in the first two quarters of the ongoing financial year 2022-23 and posted substantial increases in both gross and net profits in the third quarter (January-March) compared to the corresponding period of the last fiscal. In the third quarter, GGL managed to produce gross revenues of Rs1.89 billion with 50% growth compared to Rs1.26 billion in 3QFY22.

GGL’s gross profit increased 35% to Rs541 million in 3QFY23 from Rs402 million over the same period the previous year. The company’s operating profit increased 64% to Rs 453 million in this quarter from Rs275 million over the same quarter of last year.

The company posted a growth of 35% in net profit, which jumped to Rs207 million in 3QFY23 from Rs153 million in 3QFY22.

The earnings per share (EPS) grew by 21% in 3QFY23.

GGL- Nine-Month Performance

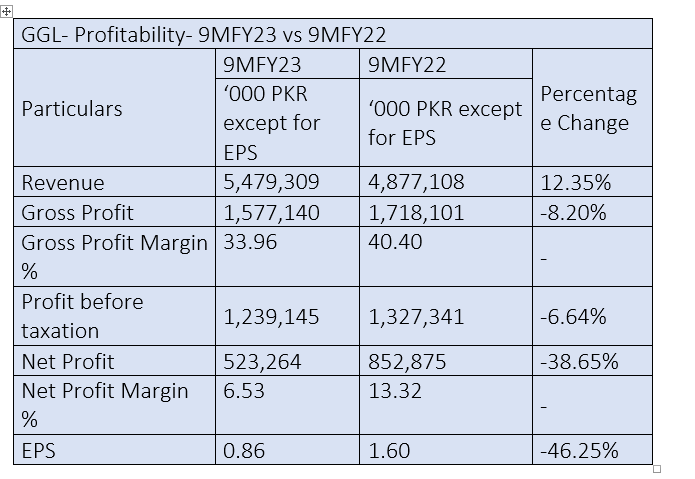

GGL recorded a 12.35% increase in revenue, which clocked in at Rs5.4 billion in 9MFY23 compared to Rs4.8 billion in 9MFY22. However, the company’s gross profit decreased 8.2% to Rs1.57 billion in 9MFY23 from Rs1.71 billion in 9MFY22. Therefore, the gross profit margin was calculated at 33.96% compared to 40.40% over the same period last year.

This decline in gross profit margin suggests the company faced challenges in managing its production costs and pricing strategies during the nine months of FY23. The company's profit-before-tax also experienced a slight decline, going down to Rs1.23 billion in 9MFY23 from Rs1.32 billion in 9MFY22. Likewise, the net profit decreased 38.65% to Rs523 million in 9MFY23 from Rs852 million in 9MFY22. Thus, the net profit margin stood at 6.53% in 9MFY23 compared to 13.32% in 9MFY22.

The EPS also declined by 46.25%.

This negative trend in 9MFY23 was due to global macro-economic instability, which also took its toll on the Pakistani economy. Continued surge in global food and fuel prices, the rupee devaluation and energy pass-through also played their part in decreasing the profitability of the companies.

Price prediction using Artificial Intelligence (AI)

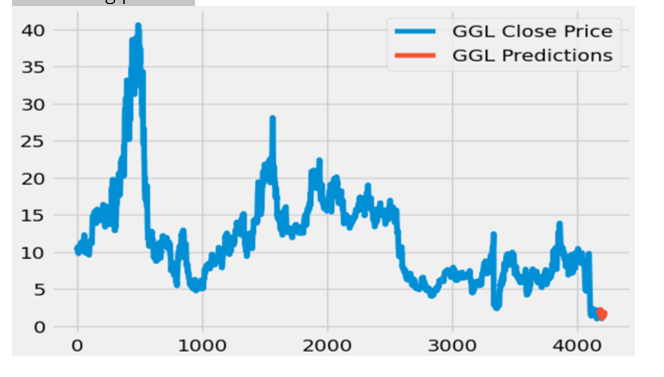

For the purpose of making extremely precise forecasts, the Long Short-Term Memory (LSTM) model employed historical data for GGL from 2003 to 2023. The red line in the graph below displays the stock price predictions for GGL, while the blue line displays the closing price.

Notably, the predictions regularly show that the price of GGL stock would stay below Rs5 for the foreseeable future.

GGL stock vs Index movement

The black line in the graph represents the Index value, while the blue line represents the share value of GGL.

Prior to the start of the current year, the index value and the stock value of GGL demonstrated a close relationship, indicating a strong correlation between them. However, as the year commenced, a noticeable change occurred in the stock price of GGL. It began to decline, deviating from the trend observed in previous periods. This downward shift in stock price persisted consistently throughout the first six months of 2023, suggesting a divergence from the overall market performance.

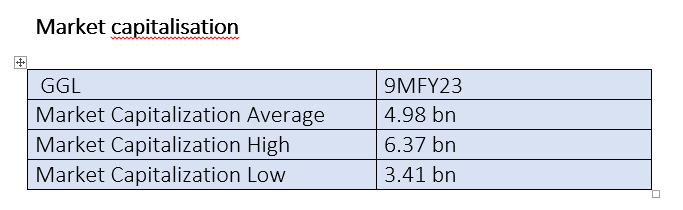

The average market capitalisation of GGL during the nine months of FY23 stood at Rs4.98 billion. This number reflects the typical value that the market gave to the company's shares throughout the time period.

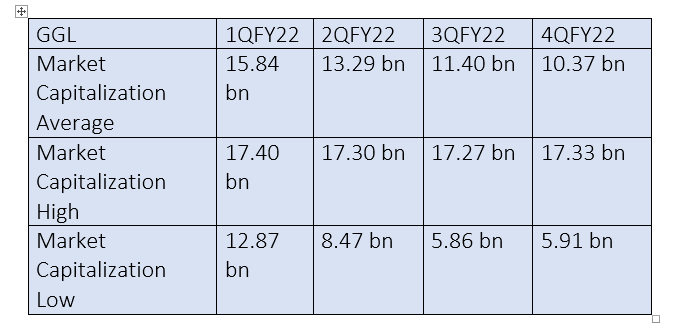

The average market capitalisation of GGL shows a gradual decline from Rs15.84 billion in 1QFY22 to Rs10.37 billion in 4QFY22. This shows that during these quarters, the market has been undervaluing GGL.

Industry comparison

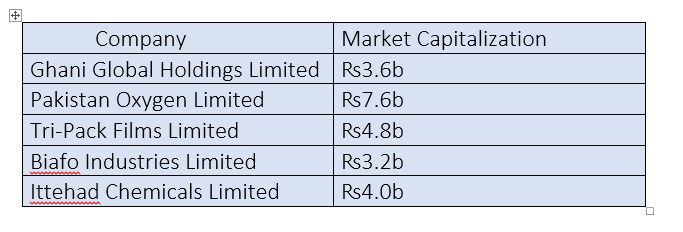

Ghani Global Holdings Limited’s competitors include Pakistan Oxygen Limited, Tri-Pack Films Limited, Biafo Industries Limited, and Ittehad Chemicals Limited.

GGL has a market capitalisation of ₨3.6 billion. Pakistan Oxygen Limited has the highest market capitalisation of ₨7.6 billion, and Biafo Industries Limited has the lowest market cap of ₨3.2 billion.

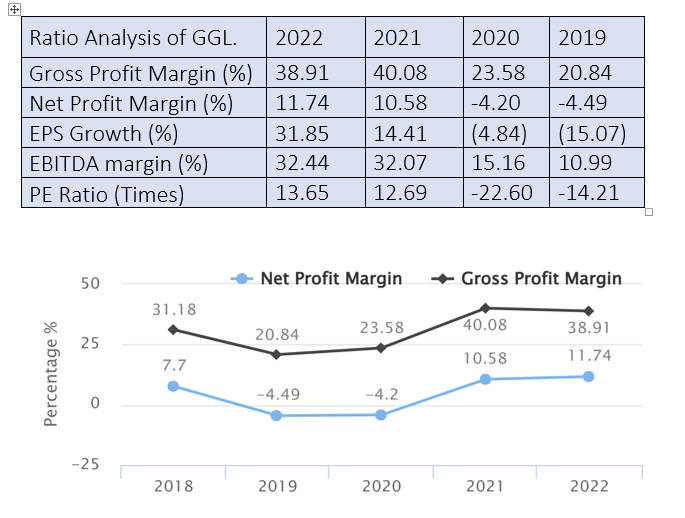

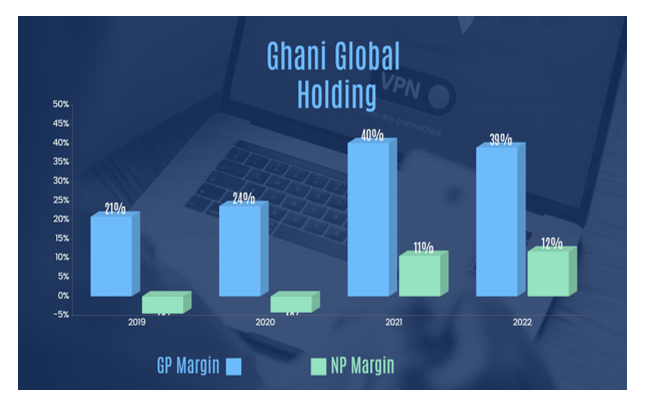

Ratio analysis

Profit or loss over the years

The gross profit margin fell from 40% in 2021 to 39% in 2022. On the other hand, the net profit margin increased from 11% in 2021 to 12% in 2022, highlighting the company's advancements in lowering operational costs and increasing operating earnings. The company's financial health is usually in line with expectations, and the rising trend in net profit margins suggests that it will eventually be able to produce bigger profits.

Company profile

Ghani Global Holdings Limited is engaged in manufacturing and sales of industrial and medical gases and chemicals. The company operates in three segments: industrial and medical gases, glass tubes and glassware and other. The industrial and medical gases segment covers business with large-scale industrial consumers, typically in the oil, chemical, food and beverage, metal, glass sectors and medical customers in healthcare sectors.

Gases and services are supplied as part of customer specific solutions. These range from supply by road tankers in liquefied form. Gases for cutting and welding, hospital, laboratory applications and a variety of medical purposes are also distributed in cylinders.

The glass tubes and glassware segment covers sales of all glass tubes, ampoules, and other glassware. The ‘other’ segment covers business of trading of chemicals.

Credit : Independent News Pakistan-WealthPk