i INP-WEALTHPK

Shams ul Nisa

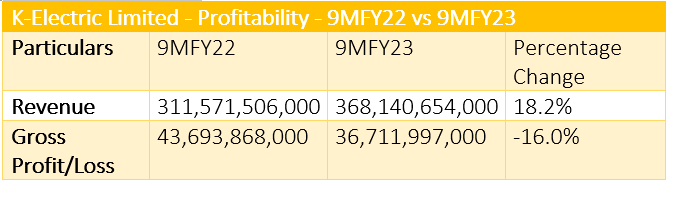

Though the revenue of Karachi-Electric Limited, also known as K-Electric, posted a notable growth of 18.2%, it suffered huge net loss in the first nine months of the previous financial year 2022-23 compared to the same period of the earlier fiscal. The company’s sales increased 18.2% to Rs368.14 billion in 9MFY23 from Rs311.57 billion in 9MFY22. This shows the company increased its business operations mainly because of rise in customer base, increased energy usage and changes in tariff.

Despite the increase in sales, the company’s gross profit declined by 16% from Rs43.69 billion in 9MFY22 to Rs36.71 billion in 9MFY23. This decline indicates that the company’s cost of core operations increased more than the revenue it generated during the period. Thus, the gross profit margin dropped to 9.97% in 9MFY23 from 14.02% in 9MFY22.

The company’s major concern during this period was the phenomenal net loss. It suffered a net loss of Rs39.38 billion in 9MFY23 against a net profit of Rs1.49 billion in 9MFY22, showcasing a huge 2742.8% decline. This sharp decrease can be attributed to a number of factors, such as surging inflation, high policy rate, increased expenditures and a decline in financial activities. In 9MFY23, the company witnessed a net loss margin of -10.70%, in contrast to a net profit margin of 0.48% in 9MFY22.

The company’s shareholders faced loss during the 9MFY23 as the earning per share plunged to a negative Rs1.43 in 9MFY23 from an EPS of Rs0.05 in 9MFY22. The decline in gross profitability, high net loss and lower EPS indicate the financial challenges faced by the company. The company needs a strategic intervention to achieve stability.

3QFY23 compared with 3QFY22

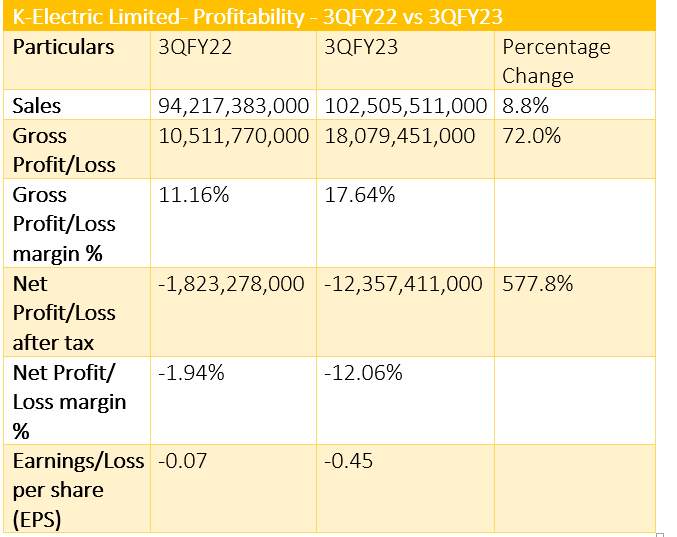

During 3QFY23, K-Electric sales grew 8.8% to Rs102.51 billion from Rs94.22 billion in 3QFY22. The gross profit improved remarkably to Rs18.08 billion in 3QFY23 from Rs10.51 billion in 3QFY22, reflecting a growth of a healthy 72%. Similarly, the gross profit margin rose from 11.16% in 3QFY22 to 17.64% in 3QFY23, indicating a marked improvement in managing costs.

However, the company’s net loss further increased to Rs12.23 billion in 3QFY23 from net loss of Rs1.82 billion in 3QFY22, showing a gigantic negative growth of 577.8%. The company attributed this drastic decline to increased exchange rate, high inflation, increase in consumer tariffs and deteriorating economic conditions. Additionally, the EPS declined further to minus Rs0.45 in 3QFY23 from minus Rs0.07 in 3QFY22.

Assets analysis

The company’s non-current assets include long-term investments in property, plant and equipment, intangible assets, long-term loans and deposits. Such assets showed a positive trend in March 2023 from June 2022, showing that the company has invested in long-term assets to improve its activities and enhance the company’s infrastructure. The non-current assets increased 5.38% to Rs536.69 billion in March 2023 from Rs509.31 billion in June 2022.

The company’s current assets include short-term assets such as inventories, trade debts, loans and advances, deposits and short-term prepayments etc. These rose by 3.14% to Rs568.80 billion in March 2023 from Rs550.81 billion in June 2022. This shows the company has efficiently managed its short-term liquidity position by covering its expenditures and paying its financial obligations. The total assets grew by 4.21% to Rs1.10 trillion in March 2023 from Rs1.06 trillion in June 2022.

Equity and liabilities analysis

The company’s non-current liabilities, including long-term financing, lease liabilities, long-term deposits, deferred revenue valuable etc., increased by 11.85% to Rs225.86 billion in March 2023 from Rs201.94 billion in June 2022. This shows the company took up more long-term obligations during this period.

The current liabilities expanded by 9.87% to Rs668.14 billion in March 2023 from Rs608.09 billion in June 2022. This expansion shows the company had high obligations because of higher expenses and short-term borrowings in March 2023 than in June 2022. Total equity and liabilities experienced a growth of 4.21% to Rs1.10 trillion in March 2023 from Rs1.06 trillion in June 2022. This shows the company took higher short and long-term obligations to finance its operations.

Company profile

K-Electric Limited is engaged in the generation, transmission and distribution of electric energy for industrial and other consumers. It serves over 3.4 million customers across Karachi, Dhabeji and Gharo in Sindh, and Uthal, Vinder and Bela in Balochistan.

Credit: INP-WealthPk