i INP-WEALTHPK

Hifsa Raja

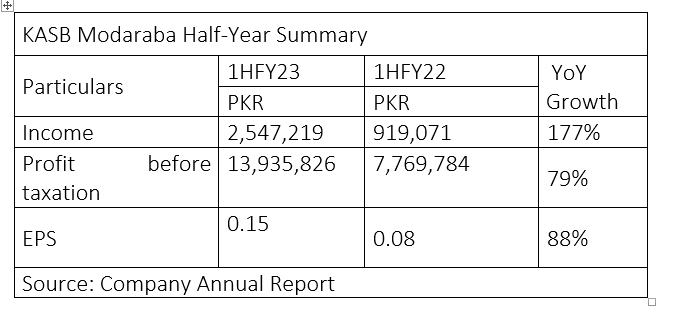

The income of KASB Modaraba jumped to Rs2.5 million in the first half of the ongoing fiscal year 2022-23, posting a staggering increase of 177% over the paltry Rs919,071 income made in the same period of the previous fiscal, reports WealthPK. The before-tax profit in 1HFY23 also jumped to Rs13.9 million from Rs7.7 million in 1HFY22, posting an increase of 79%. The earnings per share in 1HFY23 stood at Rs0.15 compared to Rs0.08 in 1HFY22, showing an increase of 88%.

It is to mention here that the process of merger of First Pak Modaraba, First Prudential Modaraba and KASB Modaraba is underway and expected to conclude soon. The merger is expected to positively impact the bottom line by reducing costs of operations and mitigating the negative impact of taxation applicable on the modaraba sector since the last fiscal year. The modaraba’s economic size will also enable it to increase its transaction exposure size and leverage its operations in order to expand its portfolio.

Earnings per share and EPS growth

The company reported a loss per share in 2019 and 2020 at -Rs0.71 and -Rs2.14, but managed to improve its performance, resulting in earnings per share of Rs0.61 and Rs0.13 in 2021 and 2022. EPS growth has been quite volatile over the past four years, with high positive growth rates in 2019 and 2021, but high negative growth rates in 2020 and 2022, as is shown in the above graph. The EPS growth rates in percentage points in 2019, 2020, 2021 and 2022 were 70.17%, -201.41%, 128.5% and -78.69%, respectively. A negative EPS growth rate denotes a decrease in EPS from the prior year.

Industry comparison

KASB Modaraba’s competitors include SME Leasing Limited, First Prudential Modaraba, Pak-Gulf Leasing Company Limited and OLP Modaraba.

As compared to its rivals, SME Leasing Limited is the lowest cap firm with a Rs51.5m market capitalisation, followed by KASB Modaraba with a market capitalisation of Rs52.4 million, while OLP Modaraba has the greatest market capitalisation at Rs558.2 million. The next highest market capitalisation is Rs157.3 million of Pak-Gulf Leasing Company Limited, followed by First Prudential Modaraba with Rs139.5 million. Higher market capitalisation indicates a firm is more established, having greater financial stability, profitability and growth potential than its rivals. A company’s lower market capitalisation does not, however, imply it is operating poorly.

Company profile

KASB Modaraba was formed under the Modaraba Companies and Modaraba (Floatation and Control) Ordinance, 1980. The Modaraba is a multipurpose entity engaged in Ijarah financing, musharaka financing, modaraba financing, diminishing musharaka, and investments in sukuk bonds, mutual funds and listed securities.

Credit : Independent News Pakistan-WealthPk