i INP-WEALTHPK

By Qudsia Bano

Amid global challenges and domestic economic uncertainties, Pakistan's equity market, represented by the KSE-100 index, demonstrated remarkable resilience in the first half of 2023 (1HCY23). The index recorded an impressive overall growth of 2.6% during this period, marking a significant turnaround from the 6.9% decline witnessed in the same period last year. The upward movement of the KSE-100 index was primarily attributed to mounting expectations of the revival of the International Monetary Fund’s loan programme, which is anticipated to come to fruition by the end of June 2023. This positive sentiment injected optimism into the market, prompting investors to reposition their portfolios.

One notable characteristic of 1HCY23 was the subdued trading activity in the equity market, resulting in a lower level of volatility compared to the same period the previous year. This relative stability provided investors with some assurance during a time of economic flux.

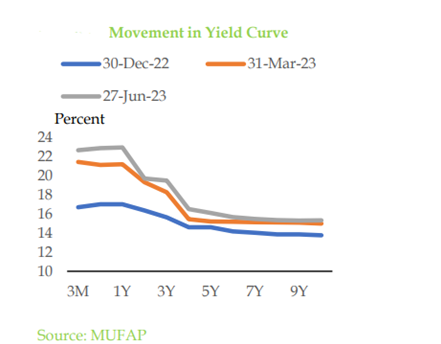

Several key factors influenced the overall trend of the KSE-100 index in 1HCY23. Firstly, the monetary policy took a tightening stance to address economic challenges, which had an impact on investor sentiment. Secondly, Pakistan faced elevated inflation rates and a slowdown in economic activity, contributing to the cautious approach adopted by investors. Lastly, political developments and uncertainties surrounding the IMF programme added to the complexity of the investment landscape.

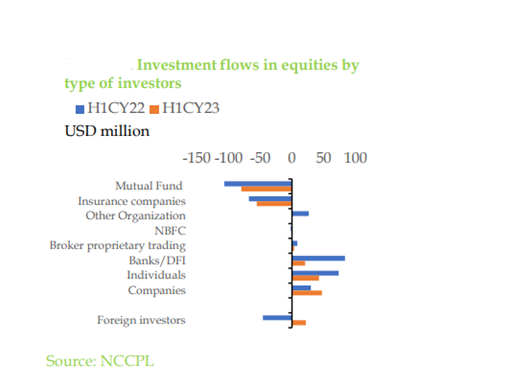

An interesting aspect of 1HCY23 was the breach of the KSE-100 index returns beyond the 100-day rolling Value at Risk (VaR) on four occasions. While breaches occurred, their magnitude was notably lower on average compared to the eight breaches witnessed in the same period the previous year. This suggests that investors, although cautious, were better prepared for market fluctuations. Mutual funds and insurance companies exhibited risk aversion during 1HCY23, resulting in the net selling of equities. In contrast, other investors, including companies, individuals, and banks/DFIs (Development Finance Institutions), remained net buyers in 1HCY23, showcasing their confidence in the domestic equity market's potential.

As Pakistan continues to navigate economic challenges and geopolitical uncertainties, the resilience displayed by the KSE-100 index in 1HCY23 serves as a testament to the confidence of various investor segments and the anticipation of positive economic developments after the IMF programme revival. While risks persist, this resilience suggests that the Pakistani equity market remains an attractive option for both domestic and international investors.

Hamza Anwar, equity manager at Zahid Latif Khan Securities, said, "In today's dynamic economic environment, it's crucial for investors to strike a balance between risk and opportunity. The resilience demonstrated by the KSE-100 index in 1HCY23 is indeed noteworthy, reflecting the adaptability of the market to evolving conditions. While economic uncertainties persist, the revival the IMF programme offers a glimmer of hope.”

He said the investors should remain vigilant and diversify their portfolios to mitigate potential risks. “As we navigate the impact of tightened monetary policies, elevated inflation, and political developments, it's essential to stay informed and agile in our investment strategies.” “Furthermore, recognising the preferences of different investor segments is crucial,” Anwar stressed. While mutual funds and insurance companies might adopt a more risk-averse stance, individual investors and institutions appeared to see long-term value in the Pakistani equity market, he added.

Credit: INP-WealthPk