i INP-WEALTHPK

Hifsa Raja

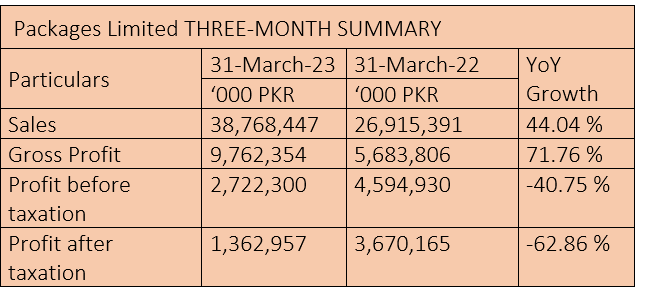

Packages Limited netted sales of Rs38 billion in the first quarter of the ongoing calendar year 2023 (1QCY23) compared with Rs26 billion over the corresponding period of the previous year, posting growth of 44%. The gross profit during the three-month period of CY23 was Rs9.7 billion compared to profit of Rs5.6 billion over the corresponding period of CY22, registering a growth of 71%. However, due to an increase in expenses, the profit-before-taxation decreased by 40% in 1QCY23 to Rs2.7 billion from Rs4.5 billion over the corresponding period of CY22. Likewise, the profit-after-tax decreased by 62% to Rs1.3 billion in 1QCY23 from Rs3.6 billion in the 1QCY22.

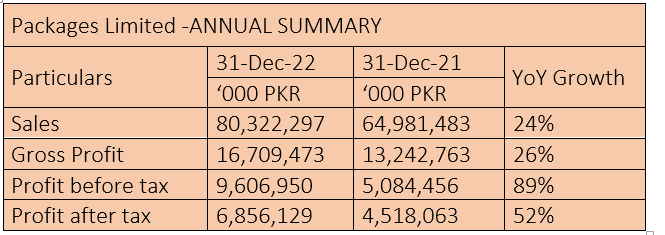

CY22 summary

During CY22, the company’s net sales went up by 24% to Rs80 billion from Rs64 billion in CY21.

The gross profit jumped 26% to Rs16 billion in CY22 from Rs13 billion in CY21.

The profit-before-tax in CY22 increased by 89% to Rs9.6 billion from Rs5 billion in CY21.

The profit-after-tax in CY22 increased by 52% to Rs6.8 billion from Rs4.5 billion in CY21.

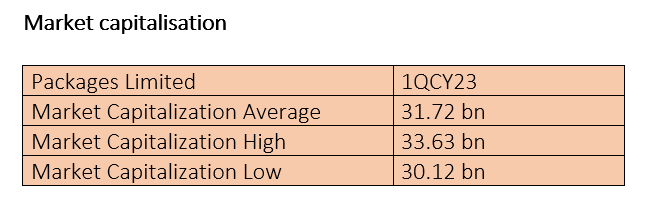

Packages Limited's average market value in the first quarter of CY23 was Rs31.72 billion. During this time period, the company's market value peaked at Rs33.63 billion, suggesting a high level of investor trust. The lowest market valuation of Rs30.12 billion reflected a period of market uncertainty or dwindling investor interest. These swings in market capitalisation reflect the volatility of the stock market and the impact of numerous variables on a company's perceived worth.

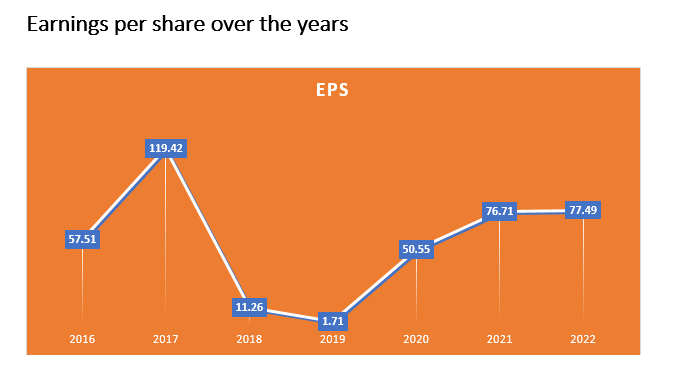

The earnings per share of Packages Limited stood at Rs57.51 in 2016, Rs119.42 in 2017, Rs11.26 in 2018, Rs1.71 in 2019, Rs50.55 in 2020, Rs76.71 in 2021 and Rs77.49 in 2022. The EPS trend showcases the company's ability to navigate through challenges, capitalise on opportunities and adapt to changing circumstances. The significant fluctuations observed over the years suggest that the company operates in a dynamic environment. The rebound from the decline in 2018 and 2019, along with the continued growth in later years, implies that the company's strategies and actions have contributed to its recovery and sustained profitability.

Industry comparison

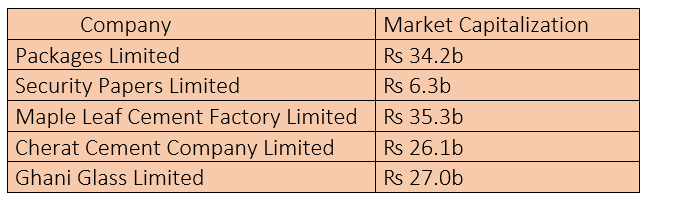

Packages Limited’s competitors include Security Papers Limited, Maple Leaf Cement Factory Limited, Cherat Cement Company Limited and Ghani Glass Limited.

Packages Limited has a market cap of ₨34.2 billion. Maple Leaf Cement Factory Limited has the highest market capitalisation of Rs35.3 billion and Security Papers Limited has the lowest market value of Rs6.3 billion.

Ratio analysis

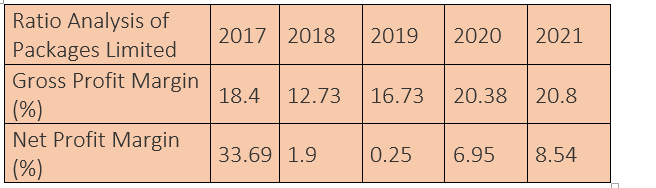

The gross profit margin, which indicates the efficiency of the company in generating profits from its production and sales operations, has shown fluctuations. Starting at 18.4% in 2017, it dipped to 12.73% in 2018, reflecting challenges in cost management. However, Packages Limited improved its gross profit margin in subsequent years, reaching 20.38% in 2020 and 20.8% in 2021. This consistent upward trend suggests the company's success in optimising its production processes and controlling costs to enhance profitability.

The net profit margin, which represents the portion of revenue that translates into net profit, had a noteworthy journey. Beginning strong at 33.69% in 2017, it experienced a significant drop to 1.9% in 2018. This dip could be attributed to various factors, including increased expenses and market dynamics. However, Packages Limited exhibited a remarkable turnaround, gradually recovering its net profit margin to 6.95% in 2020 and 8.54% in 2021, respectively. This recovery indicates effective strategic adjustments and cost-containment efforts, allowing the company to regain profitability.

The fluctuations in both gross and net profit margins reveal Packages Limited's ability to adapt and navigate challenges in a dynamic business landscape. The steady growth in gross profit margin signifies the company's efficient management of its production and operational costs, contributing to higher profitability. The recovery of the net profit margin over the years underscores Packages Limited's resilience and strategic decisions to address financial setbacks and enhance overall profitability. As the company continues to innovate and adapt to market changes, maintaining a balance between revenue growth and cost control will remain crucial for sustaining and further improving its profitability ratios.

About the company

Packages Limited is a Pakistan-based company that provides packaging solutions. The company also manufactures tissue paper products, invests in companies, which are engaged in the manufacture and sale of inks, flexible packaging material, paper, paperboard and corrugated boxes, biaxially oriented polypropylene and cast polypropylene films; and companies, which are engaged in insurance and real estate businesses. Its subsidiaries include Bulleh Shah Packaging (Private) Limited and Anemone Holdings Limited.

Credit: INP-WealthPk