i INP-WEALTHPK

Shams ul Nisa

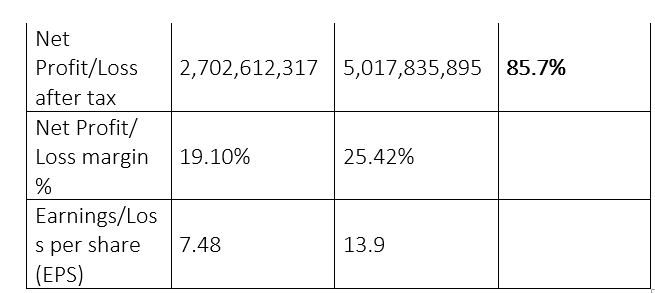

Pakistan Aluminium Beverage Cans Limited’s sales soared by 39.4% and net profit by 85.7% in the calendar year 2023 compared to the year earlier, reports WealthPK. In CY23, the company reported sales of Rs19.7 billion and net profit of Rs5.01 billion. The rise in cans sales, favourable exchange rate, and improved pricing drove the increase in sales despite a decline in domestic sales due to high inflation.

According to the financial results, the gross profit grew by 61.70%, pushing the gross margin to 38.74% in CY23 from 33.41% in CY22. Other income also climbed by 106.34% to Rs460.2 million during the period. Moreover, the profit-before-tax stood at Rs5.3 billion, 69.37% higher than Rs3.13 billion in CY22. The company announced a net profit margin of 25.42% and earnings per share (EPS) of Rs13.9 at the end of the calendar year 2023.

Assets, equity and liabilities analysis

The company's current and non-current assets increased by 66.03% and 8.82%, respectively, in 2023 from the previous year. This reflects that the company invested in property to expand its capital. Another major achievement was the complete repayment of deferred tax liabilities and half of the long-term financing liabilities. This led to non-current liabilities declining to Rs2.18 billion in CY23 from Rs3.67 billion in CY22, representing a contraction of 40.40%. However, a significant spike in short-term borrowings, accrued finance costs, trade and other payables pushed current liabilities by 79.72%. At the end of CY23, the company’s total equity and liabilities expanded to Rs21.45 billion, posting 39.72% yearly increase.

Historical trends

The revenue of Pakistan Aluminium Beverage Cans Limited increased continuously from Rs4.8 billion in 2019 to a peak of Rs19.7 billion in 2023. Similarly, the company reported a net profit of Rs147.46 million in 2019, which grew to the highest of Rs5.01 billion in 2023. This indicates an increase in the company’s product demand causing healthy financial results over the years. As a result, the EPS grew to a peak of Rs13.90 in 2023, reflecting the high profitability allocated to each outstanding share.

![]()

Ratio analysis

A company's current ratio is the liquidity ratio, which measures its ability to cover its short-term liabilities with current assets. The company has witnessed an improvement in its liquidity ratio as it grew from 0.84 in 2019 to 1.73 in 2022, with a slight decline in 2023, where the current ratio stood at 1.6. Similarly, the quick ratio measures a company’s ability to finance its short-term obligations using its most liquid assets. The quick ratio remained below 1 over the years, with a decimal increment. This indicates an improvement in liquid assets. The debt-to-equity ratio is the value that measures the debt of a company as compared to the amount invested by its owners. The company’s debt-to-equity ratio contracted from 2.15% in 2018 to 0.64% in 2023.

Future outlook

Escalating fuel and energy costs and inflation caused by supply chain disruptions and geopolitical tensions are putting significant pressure on businesses operating within the country. To maintain resilience and sustain operations, the company’s management needs to remain proactive in addressing both domestic and external challenges. The company can maintain sustainable operations amidst uncertainty by monitoring geopolitical landscape, implementing measures to mitigate domestic economic challenges and growing exports.

Company profile

Pakistan Aluminium Beverage Cans Limited was established on December 4, 2014, and listed on the Pakistan Stock Exchange on July 16, 2021. Its principal activity is the manufacturing and sale of aluminium cans.

Credit: INP-WealthPk