i INP-WEALTHPK

Fakiha Tariq

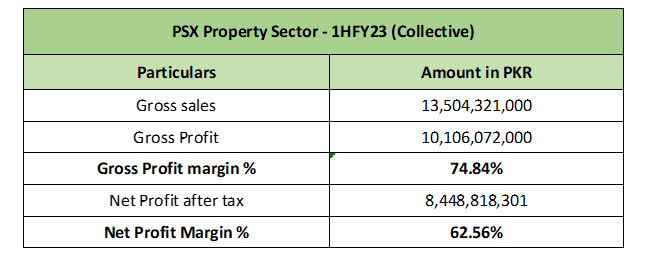

The property sector, which was recently listed on the Pakistan Stock Exchange (PSX), posted sky-scrapping gross and net profit margins of 74.84% and 62.56%, respectively, in the first six months (July-December) of the ongoing fiscal year 2022-23, WealthPK reports. The PSX officially launched the property sector for the listing of non-REIT real estate companies on August 10, 2022. The property sector on the PSX comprises three companies in total with a collective market cap of Rs27.43 billion.

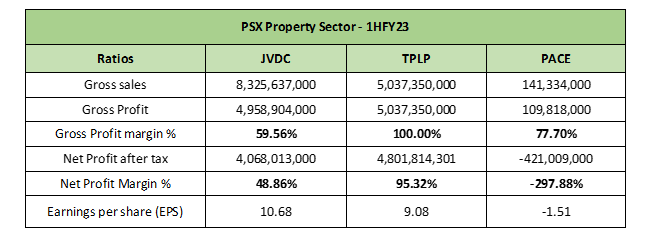

With a market cap of Rs17.9 billion, Javedan Corporation Limited (JVDC) is the largest company in the property sector, followed by TLP Properties Limited (TPLP) with a market cap of Rs8.8 billion. The third and the last publicly-listed property firm is Pace (Pakistan) Limited (PACE) holding the market capitalisation of Rs725.1 million In the first half FY23, the property sector as a whole posted revenue of Rs13 billion. The sector reported a gross profit of Rs10 billion and net profit of Rs8.44 billion in 1HFY23.

In 1HFY23, JDVC posted the highest sales of Rs8.3 billion, and earned gross and net profits of Rs4.9 billion and Rs4 billion, respectively. JDVC posted gross profit and net profit margins of 59.56% and 48.86%, respectively. JDVC’s earnings per share value remained Rs10.68 in 1HFY23.

TPLP posted the highest profits in the property sector in 1HFY23 as it recorded the gross sales of Rs5.03 billion, and with zero cost of sales value, TPLP gross profit was reported to be Rs5.03 billion. Thus, TPLP’s gross profit ratio for 1HFY23 remained at 100%. TPLP posted net profit of Rs4.8 billion and net profit ratio of 95.32%.

TPLP EPS value in 1HFY23 stood at Rs9.08 per share. PACE posted the lowest sales and gross profit in the property sector. However, it bore a net loss in 1HFY23. The firm earned gross profit of Rs109 million, but suffered heavy net loss of Rs421 million on the sales of Rs141 million in 1HFY23. Thus, PACE reported loss per share of Rs1.51. In 1HFY23, PACE posted gross profit margin of 77.70% and huge net loss ratio of 297.88%.

Credit: Independent News Pakistan-WealthPk