i INP-WEALTHPK

Shams ul Nisa

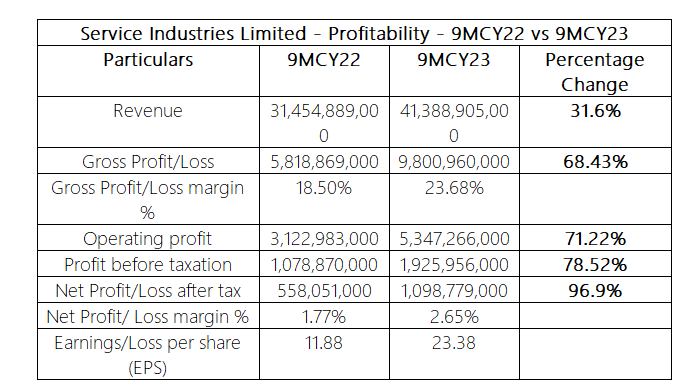

Service Industries Limited (SIL) declared a robust financial performance, with a revenue of Rs41.38 billion in the first nine months of Calendar Year 2023. This shows a significant surge of 31.6% from a revenue of Rs31.45 billion in the same period last year, mainly because of an increase in export sales, and effective cost management to increase revenue, reports WealthPK. During 9MCY23, the gross profit climbed to Rs9.8 billion from Rs5.8 billion in 9MCY22, representing a notable hike of 68.43%. The factor behind this rise in gross profit is a slight improvement in the footwear and tyre segments.

Hence, the gross margin increased to 23.68% in 9MCY23 from 18.50% in 9MCY22. The company reported an operating profit of Rs5.34 billion for the nine months ending 30th September 2023, up by 71.22% compared to the same period last year. The company's profit before tax surged to Rs1.9 billion during 9MCY23 compared to Rs1.07 billion in 9MCY22.

The company posted an unconsolidated profit after tax of Rs1.098 billion during 9MCY23, up by 96.9% from Rs558.05 million in the same period last year. Therefore, a net profit margin of 2.65% was recorded in 9MCY23 against 1.77% in 9MCY22. The earnings per share of the company clocked in at Rs23.38 during 9MCY23 compared to Rs11.88 in 9MCY22.

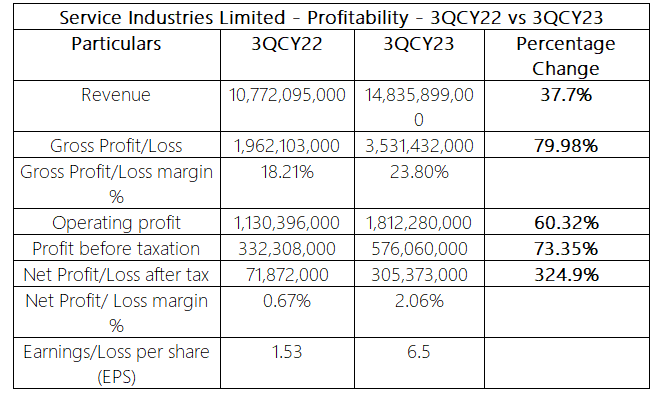

3QCY22 vs 3QCY23

A quarterly analysis reveals that in the third quarter of CY23, revenue grew by 37.7%, operating profit by 60.32%, and profit after tax by 324.9%. The company posted revenue of Rs14.8 billion, operating profit of Rs1.81 billion, and profit after tax of Rs305.37 million during the 3QCY23. The company registered a hike of 79.98% in gross profit to Rs3.53 billion in 3QCY23.

The gross profit margins improved to 23.80% during the period under review from 18.21% in 3QCY22. Similarly, the net profit margin stood at 2.06% in 3QCY23 compared to 0.67% in the same period last year. At the end of 3QCY23, the company reported earnings per share of Rs6.5 against Rs1.53 in 3QCY22.

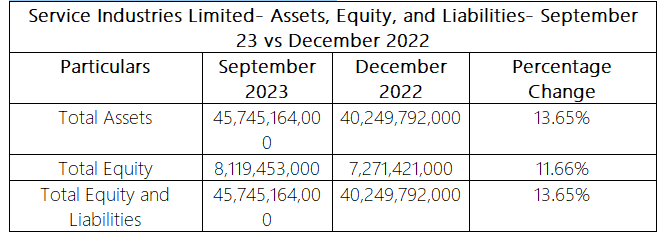

Assets, equity, and liabilities analysis

The company's assets, equity, and liabilities analysis reflect a healthy financial position during the period under review. The total assets grew 13.65% to Rs45.7 billion in September 2023 from Rs40.2 billion in December 2022. This indicates that the company has significantly invested in widening its assets. Similarly, a growth of 11.66% was observed in the total equity of the company which stood at Rs8.1 billion in September 2023 compared to Rs7.2 billion in December 2022. At the end of September 2023, total equity and liabilities reached Rs45.7 billion, a 13.65% increase from Rs40.24 billion in December 2022.

Company profile

Service Industries Limited was established on March 20, 1957, under the private limited company status. The company's main business ventures are the acquisition, production, and retailing of technical rubber goods, tyres, and tubes.

Credit: INP-WealthPk