i INP-WEALTHPK

Hifsa Raja

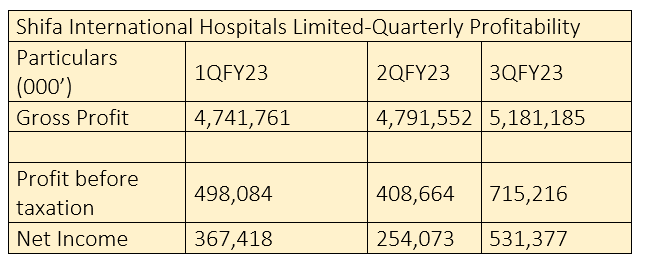

Shifa International Hospitals Limited has released its financial report for the first three quarters of the fiscal year ending on June 30, 2023, showcasing a positive trend in profitability. The company’s gross profit jumped to Rs8.1 billion in the third quarter (Jan-March) of FY23 from Rs4.7 billion each in the first two quarters. The profit-before-tax also soared to Rs715 million in 3QFY23 from Rs408 million in the 2QFY23 and Rs498 million in 1QFY23, indicating pretty good performance across this metric.

The 3QFY23 also proved good for the company as far as its net income was concerned as the profit jumped to Rs531 million from Rs254 million in 2QFY23 and Rs367 million in 1QFY23. Shifa International Hospitals’ quarterly performance underscores the volatility and complexities inherent in the healthcare industry. However, the company's ability to manage costs, navigate industry dynamics and provide quality healthcare services played a critical role in sustaining growth.

Performance in FY22

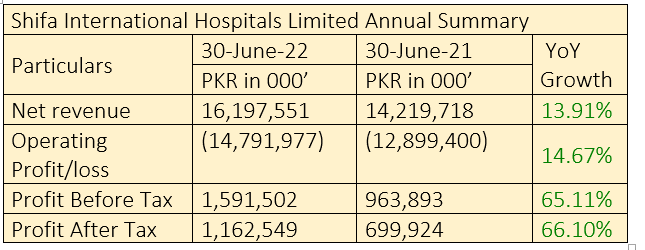

In the fiscal year 2021-2022, the company posted a modest increase in net revenue, which rose to Rs16 billion from Rs14 billion in FY21, indicating a growth of 13%. However, the operating loss further increased by 14% to Rs14 billion from the previous year's Rs12 billion.

Despite the operating loss, the company’s profit-before-tax increased by 65% to Rs1.5 billion in FY22 from Rs963 million in FY21. Likewise, the company’s profit-after-tax jumped by 66% to Rs1.1 billion in FY22 from Rs699 million in FY21.

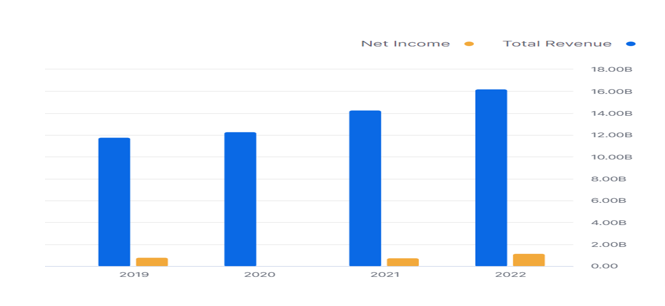

Shifa International Hospitals’ financial performance over the past four years reveals a consistent growth trajectory, indicating its resilience and strategic acumen in navigating the evolving healthcare landscape. The company’s consistent growth in both sales and profitability suggests a well-executed business strategy. The healthcare sector's demand for quality medical services and the company's ability to provide these services efficiently are evident in the increasing patient base and revenue.

However, this growth is also accompanied by the need to manage operational costs, maintain service quality, and uphold financial sustainability. As the hospital continues to expand its operations, maintaining this positive trajectory will depend on its ability to adapt to changing healthcare dynamics and maintain a patient-centric approach while ensuring strong financial foundations. It will be interesting as to how the company navigates future challenges and opportunities in the healthcare sector to ensure sustained growth and positive contributions to patient care and financial success.

Earnings per share

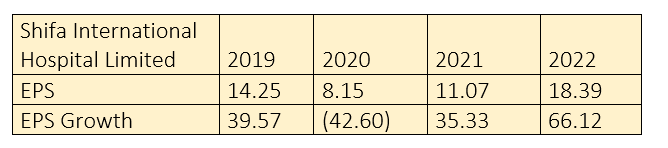

Shifa International Hospitals Limited has showcased varying trends in its earnings per share (EPS) and growth rates over the past four years, reflecting a complex interplay of factors shaping the company's financial performance. The EPS exhibited a generally upward trajectory during these years. Starting at Rs14.25 in 2019, it dipped to Rs8.15 in 2020. However, the subsequent years witnessed consistent growth of the EPS, which reached Rs11.07 in 2021 and jumped to Rs18.39 in 2022. This growth indicates improved profitability overtime, potentially influenced by enhanced revenue generation, cost management or expansion strategies.

The EPS growth rates, however, present a more nuanced story. A striking feature is the considerable volatility in EPS growth percentages. In 2019, the EPS growth was a substantial 39.57%, signifying a robust year for the company. However, this trend reversed dramatically in 2020 with a negative growth rate of 42.60%. This significant decline could be attributed to various factors such as unexpected expenses, economic fluctuations, or other industry-specific dynamics, potentially intensified by the global Covid-19 pandemic. The subsequent years, 2021 and 2022, marked a return to positive growth with rates of 35.33% and 66.12%, respectively. This rebound might suggest strategic adjustments, recovery from adverse impacts, or successful implementation of growth strategies.

Shifa International Hospitals' EPS and growth patterns indicate the company's resilience and adaptability amidst varying market conditions. The stark shifts in EPS growth rates underscore the volatility inherent in the healthcare sector, which can be influenced by regulatory changes, patient volumes, cost management, and external events. The strong positive growth rates in 2021 and 2022 show the company's ability to rebound and leverage opportunities, potentially guided by effective strategic decisions.

Company profile

Shifa International Hospitals Limited operates medical centres and hospitals across Pakistan, offering diagnostic facilities, outpatient clinics and inpatient services. It offers a range of multi-specialty organ transplant services, such as liver, kidney, bone marrow and cornea. The company offers its healthcare and surgical services in various specialties, which include gastroenterology, dermatology, endocrinology, nephrology, neurology, radiation oncology, medical oncology, psychiatry, pulmonology and critical care, rheumatology, neonatology, cardiology, urology, gynecology and ophthalmology.

Its diagnostic services include the clinical services of pathology and laboratory medicine and radiology. It also runs pharmacies and lab collection points in different cities of Pakistan. Its pharmacy services include inpatient pharmacy service, ambulatory care pharmacy services, chemo admixture service, clinical pharmacy service and surgical supplies distribution.

Credit: INP-WealthPk