i INP-WEALTHPK

Ayesha Mudassar

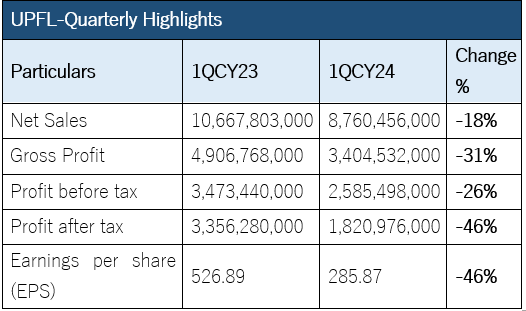

Unilever Pakistan Foods Limited (UPFL), a subsidiary of Conopco Inc. USA, reported a significant 46% decline in its net profit during the first quarter of the Calendar Year 2024 compared to the corresponding period of last year, reports WealthPK. The profit decline is largely attributed to challenging economic conditions, including inflationary pressures, increased interest rates, and higher taxation. The company earned a net profit of Rs1.8 billion in 1QCY24 compared to Rs3.3 billion registered in the corresponding quarter of 2023. This resulted in earnings per share (EPS) of Rs285.87 versus Rs526.89 in the same period of the previous year.

Sustained inflationary pressure, driven by steep increases in administered prices such as electricity tariffs and petroleum, has adversely affected consumer purchasing power, particularly impacting the sales of non-essential items like instant noodles. Consequently, net sales declined by 18%, totalling Rs8.7 billion in the first quarter of 2024. The company also reported a 31% decline in gross profit, which amounted to Rs3.4 billion in 1QCY24. In addition to the reduced gross profit, Unilever Pakistan Foods experienced a 26% decrease in profit before tax, which fell to Rs2.5 billion from Rs3.4 billion in 1QCY23.

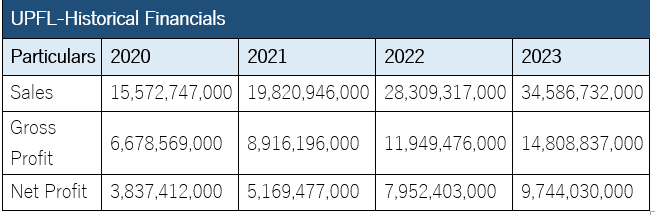

Historical financial performance (2020-2023)

The company has consistently observed a growing topline and bottom line since 2020. Furthermore, the gross profit shows a healthy upward trend. This indicates a company’s strong and improving financial position, driven by increased revenue and effective cost management strategies.

In 2021, UPFL’s sales posted a YoY growth of 27% to clock in at Rs19.8 billion. Undisrupted supply and availability of products, innovation and renovation initiatives, and numeric distribution expansion contributed to the company’s sales. The improvement in gross and net profit was facilitated through numerous cost-saving initiatives, optimization projects, and prudent pricing strategies. In the subsequent years (2022 and 2023), the company sustained its growth trajectory, demonstrating increases in both revenue and profitability. The improved profit was supported by a favourable product mix, stringent control on fixed costs, and continued sales growth.

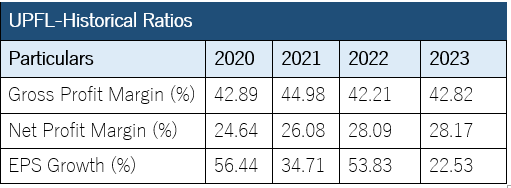

Ratio analysis (2020-2023)

The ratio analysis offers valuable insights regarding Unilever Pakistan’s financial performance over the years, highlighting key indicators such as gross profit margin, net profit margin, and earnings per share (EPS) growth ratio. The company witnessed fluctuations in its gross profit margin over four years. In CY23, the gross profit margin was 42.84% compared to the previous year’s margin of 42.21%. This rise in the gross profit margin reflects the company’s effective cost management and pricing strategies.

Concerning the net profit ratio, the company achieved its highest ratio of 28.17% in 2023. This upward trend indicates reduced operating expenses and an increase in overall profitability. Unilever Pakistan experienced significant fluctuations in EPS growth over the 2020-2023 period. In CY23, the EPS growth was 22.53%, following a growth of 53.83% in CY22, 34.71% in CY21, and 56.44% in CY20.

About the company

Listed on the Pakistan Stock Exchange, the company manufactures and sells consumer and commercial food products under the brand names Rafhan, Knorr, Energile, Glaxose-D, and Food Solutions. The company is a subsidiary of Conopco Inc. USA, whereas its ultimate parent company is Unilever PLC United Kingdom.

Future outlook

Pakistan’s economic and operating environment remains challenging. However, the management remains committed to creating long-term value for all stakeholders by leveraging global expertise and staying relevant to the consumers through a sound understanding of their needs, innovations, and new pack price architecture.

Credit: INP-WealthPk