آئی این پی ویلتھ پی کے

Ahmed Khan Malik

The small industrial sector in Sindh is grappling with severe challenges due to limited access to affordable financing, soaring interest rates, and inadequate government support. Industrialists warned that without urgent policy action, hundreds of small and medium enterprises (SMEs) might be forced to shut down in the coming months.

Despite being a key contributor to employment and regional economic growth, SMEs in Sindh continue to struggle with limited credit facilities and unfavorable lending conditions. Karachi Division hosts about 67 percent of the province’s manufacturing establishments, while the remaining 33 percent operate in districts such as Hyderabad, Sukkur, and Larkana, where infrastructure and utilities remain underdeveloped.

Business leaders across these districts have voiced serious concerns about the financing environment. Ahmed Ali Memon, Chairman of the Sindh Small Industries Association, said the 2025-26 federal budget had left small entrepreneurs disappointed. “We expected incentives, tax relief, and a low-mark-up financing package for struggling industrial zones. Instead, we see a budget heavily tilted towards large-scale industries,” he said.

He criticized the rising cost of doing business. “We pay high power tariffs and still suffer daily outages. How can we compete when our operational costs double every year?” he asked. Shan Elahi Sehgal, Vice President of the Hyderabad Chamber of Small Traders and Small Industry, said that while the State Bank of Pakistan’s (SBP) recent loan schemes are encouraging, many small business owners are either unaware of them or unable to meet strict bank requirements. “Without a rational mark-up rate and simplified procedures, the intended benefits will not reach the ground,” he warned.

He added that the prevailing policy rate is discouraging investment. “We need single-digit interest rates if we want industries to grow,” he stressed. Industry associations have also criticized the Sindh government for allocating insufficient funds to support small industries. The provincial budget for 2025-26 earmarked Rs500 million for SME assistance — an amount industry leaders describe as “too low to make an impact.” Many claim that even this limited allocation remains underutilized due to bureaucratic delays and weak implementation.

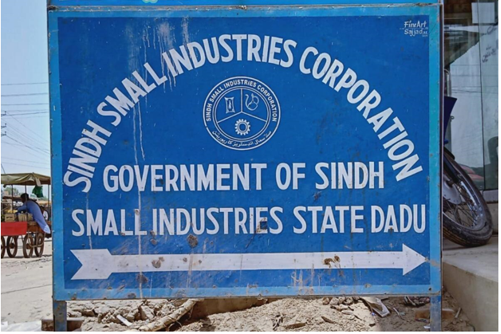

Currently, the Sindh Small Industries Corporation (SSIC) oversees 19 Small Industrial Estates (SIEs) and three Industrial Parks across the province. However, several of these remain underdeveloped, suffering from poor infrastructure, unreliable utilities, and slow financial support for operating units. Industry representatives are calling for immediate policy reforms to safeguard the sector. They recommend low-interest financing schemes, risk-sharing programs to encourage bank lending, and district-level initiatives to stimulate industrial growth in rural and semi-urban areas.

Shan Elahi Sehgal also urged the government to improve energy supply, upgrade infrastructure, and establish a one-window regulatory mechanism to cut red tape and make financing easier. “The small industrial sector is labor-intensive and crucial for job creation,” Shan said. “Without affordable credit and better infrastructure, Sindh’s economic potential will remain untapped.”

Credit: INP-WealthPk