INP-WealthPk

Moaaz Manzoor

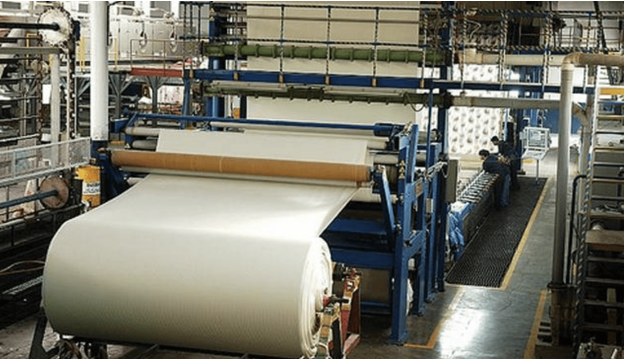

Pakistan’s textile industry is pushing for urgent reforms to tap into fresh export opportunities in Europe and the United States, with energy tariffs, taxation, and compliance challenges topping the list of barriers.

Speaking to Wealth Pakistan, Shahid Sattar, Secretary General of the All-Pakistan Textile Mills Association (APTMA), said that Pakistan has a strong textile base, but urgent corrective measures are required to compete with regional peers.

“Expanding textile exports, particularly home goods and apparel, to Europe and the US will require a mix of structural reforms, market facilitation, and targeted support. Pakistan has a strong textile base but continues to face critical constraints,” he noted.

According to APTMA’s analysis, the most immediate challenge lies in uncompetitive energy pricing. Industrial tariffs, originally promised at nine cents per unit, have instead risen to about 12 cents in FY26, compared to five to nine cents in competitor countries. A cross-subsidy of Rs131 billion inflates tariffs by Rs6.5/kWh, which discourages grid usage and erodes competitiveness.

Sattar said that removing these subsidies in the December rebasing would reduce tariffs to nine cents, stimulate demand, and restore export competitiveness. APTMA data further shows that the Competitive Trading Bilateral Contract Market (CTBCM) remains unviable due to inflated wheeling charges, penalties on hybrid consumption, and a restrictive 800MW cap.

Meaningful industrial participation requires removing legacy costs from the wheeling charges, allowing hybrid consumption at regular grid tariffs, and increasing the CTBCM cap to 1,500MW , Sattar proposed. Beyond tariffs, textile units continue to experience operational disruptions from frequent outages, voltage fluctuations, and tripping on the grid.

Liquidity stress has also intensified following retroactive RLNG billing by SNGPL for the 2015-2022 period, with charges running into hundreds of millions per unit. “This creates severe liquidity stress and risks shutdown of operations across industrial sectors,” Sattar said, urging a transparent mechanism for reconciliation.

Sustainability-linked production is also at risk. Combined Heat and Power (CHP) plants, which reach efficiency levels of up to 60-85%, face penalties under the current levy structure. APTMA has recommended reclassifying them under the industrial gas tariff category, subject to efficiency audits.

Taxation is another key barrier. Exporters currently face both fixed and normal regimes, leading to effective tax rates as high as 135% of profits. “Exporters face over 18 different federal and provincial taxes and levies, amounting to 7-11% of turnover on profit margins of 6-15%,” Sattar pointed out.

APTMA suggested abolishing the fixed regime and refunding non-export-related levies through a DLTL-style mechanism. Looking ahead, compliance with global regulations is equally crucial. The EU’s Digital Product Passport, which becomes mandatory in 2027, requires full traceability across the textile value chain. APTMA has called for a unified traceability platform under the National Compliance Centre to safeguard market access.

Sattar concluded that addressing these hurdles through timely policy actions would give Pakistan’s textiles the competitive edge they need to expand in western markets and strengthen the economy’s industrial base.

Credit: INP-WealthPk