INP-WealthPk

Fakiha Tariq

The Attock Refinery Limited (ATRL) reported healthy revenues and profits in the first quarter (July-Sept) of the ongoing fiscal year 2022-23 (1QFY23) compared to the same period of the previous fiscal, WealthPK research shows. ATRL topped market capitalisation in Pakistan’s refinery sector, as it owned market cap of Rs25 billion with recent market price circulating around at Rs171 per share. ATRL was established in 1922 and this year marks its 100th birthday.

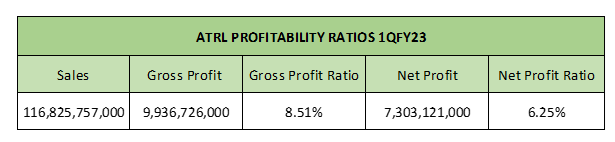

ATRL Profit Ratios in 1QFY23

During the 1QFY23, ATRL hit the gross sales of R116 billion. The company posted a gross profit ratio of 8.51%. The net profit ratio stood at 6.25%. The earnings per share (EPS) was Rs62.14 from refinery operations. However, non-refinery operations led to the gain of Rs6.36 EPS. To fuel the national demand of petroleum for smooth business, ATRL utilised 79% of its overall operating capacity.

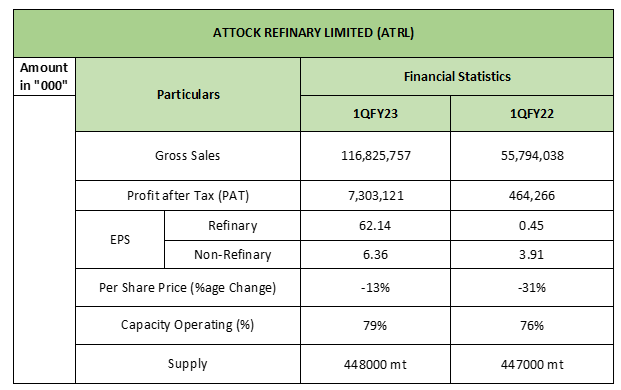

ATRL Financials – 1QFY23 VS 1QFY22

Compared to the 1QFY22, ATRL’s gross sales increased by 109% year-over-year in 1QFY23. The profit-after-tax value also showed big positive increment. During the period, the company improved its financial statements, which shows through in its stock values on the Pakistan Stock Exchange (PSX).

The increase in the EPS value in the 1QFY23 is also worth mentioning. Compared to the 1QFY22 value, the company’s EPS from refinery operations rocketed from Rs0.45 to Rs62.14 in 1QFY23. The company also managed to increase its operational capacity by 3% from the last year’s same quarter.

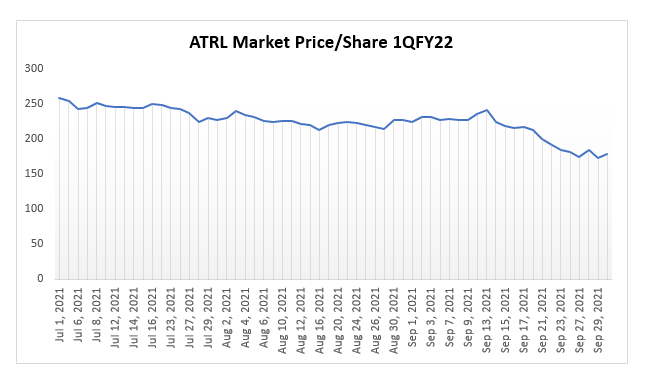

The change in the market share price over a period speaks about its market trend and stability. The ATRL market share price sustained a decline of 31% in the 1QFY22. However, during the 1QFY23, the decline was only 13%. This highlighted the serious efforts of the ATRL’s management to arrest the share price decline.

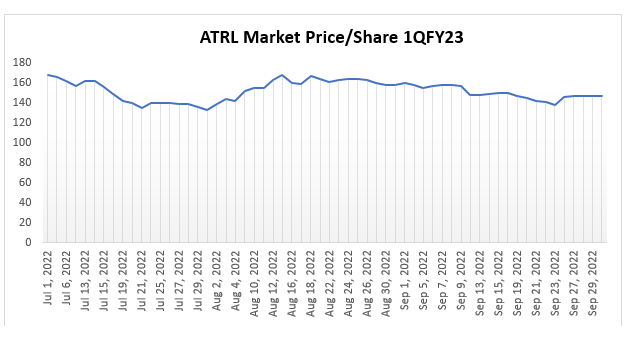

ATRL’s Market Performance – 1QFY23 VS 1QFY22

On September 30, 2022, the share price of ATRL stood at R147.22, down from R168.42 on July 1, 2022. Thus, the market price declined by R21.2 in value. The lowest and highest share value reported was Rs132.99 and Rs168.42, respectively.

It can be seen from the trend line that the ATRL’s share price did not experience any alarming fluctuation during the 1QFY23. The trend line behaved pretty straight and steady.

In comparison to 1QFY23, the 1QFY22 ended with the stock market value of Rs178.78 on September 30, 2021. However, the 1QFY22 started with the value of Rs258.81. The market price experienced loss of Rs80.03 units. Over the given period, the lowest and highest share price value reported was Rs173.59 and Rs258.81, respectively.

Although the market price declined over 1QFY22, it did not suffer any abnormal price shocks. Price trend analysis shows that ATRL’s stocks remained steady, and showed no hyperactivity and decrease in value year-on-year.

Credit : Independent News Pakistan-WealthPk